Economics

Will This Year’s Recovery In US Bonds Continue?

After taking a beating last year, US fixed income securities have clawed back some of the losses so far in 2023, based on a set of ETFs through yesterday’s…

After taking a beating last year, US fixed income securities have clawed back some of the losses so far in 2023, based on a set of ETFs through yesterday’s close (Feb. 9). But with the Federal Reserve still intent on lifting interest rates to tame inflation, the outlook for bonds is still murky.

For the moment, however, a broad review of US fixed income is showing gains across the board this year. Leading the recovery: iShares 20+ Year Treasury Bond ETF (TLT), which has popped 5.3% since 2022’s close.

Deciding if TLT and bonds generally can continue to recover is tricky in the wake of renewed comments from Fed officials, who advise that more rate hikes are coming. Fed Governor Christopher Waller, for example, said this week that while tighter monetary policy has contributed to trimming inflation, “we have farther to go.” He added: “It might be a long fight, with interest rates higher for longer than some are currently expecting. But I will not hesitate to do what is needed to get my job done.”

Higher rates imply lower bond prices because the two sides of this coin generally move inversely to one another. The optimistic view is that the bond market has priced in most (all?) of the Fed’s policy-tightening plans at this point and so the downside risk for fixed income is minimal at this late date. Maybe, but some analysts say that the crowd remains overly optimistic on where the Fed’s terminal rate lies and how long that peak will last.

As for the immediate future, Fed funds futures are currently pricing in a 90% probability that the central bank will lift its target rate by 25 basis points again at the next FOMC meeting on March 22, according to CME FedWatch Tool. Another ¼-point hike is estimated at a 70%-plus probability for May meeting.

Goldman Sachs is looking for higher rates too. “We expect the Fed to deliver 25-basis-points hikes in March and May for a peak funds rate of 5.00-5.25%, although more hikes may be needed if the economy reaccelerates as the drag on growth from past policy tightening fades,” analysts at the investment bank advise.

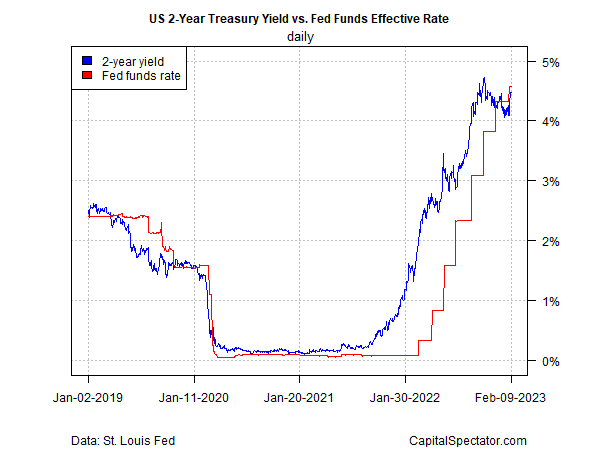

The Treasury market has adjusted its recent dovish pivot by lifting the 2-year yield, which is widely viewed as a proxy for the Fed’s near-term policy outlook. After falling toward the 4% mark earlier this year, the 2-year rate has rebounded this month, edging up on Thursday to 4.48% — the highest level since November.

The bond market, it seems, is struggling to assess the outlook for the peak in rates. The calculus looks set to remain muddled at best, based on expectations for next week’s update (Feb. 14) on consumer inflation for January. After a monthly 0.1% decline in CPI for December – the first slide in more than a year – economists are looking for a rebound in pricing pressure via a 0.5% monthly rise, according to TradingEconomics.com. If correct, the news may strengthen the Fed’s resolve to lift rates further and postpone cuts for longer.

The main takeaway: it’s premature to read this year’s rally in the bond market as a signal that it’s clear sailing from here on out for fixed-income securities.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

inflation

monetary

reserve

policy

interest rates

fed

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…