Economics

Will The Labor Market Inoculate The US Against Recession?

US economic activity looks strong or weak, depending on the data sets you choose to craft a narrative. That’s always true in some sense for the simple…

US economic activity looks strong or weak, depending on the data sets you choose to craft a narrative. That’s always true in some sense for the simple reason: there’s always some slice of the economy bucking the broader trend. But this time is different because the degree of the conflicting signals is so stark.

The poster boy for growth and thinking positively is the labor market, which continues to post strong gains – far stronger than suggested by other indicators that in previous decades offered relatively reliable business-cycle signals.

The debate is whether the surprisingly robust gains in payrolls of late are due to extraordinary one-time factors linked to the ongoing effects of the pandemic. So-called labor-hoarding is one theory. If there’s something different this time, can it reverse suddenly? Or is it persistent?

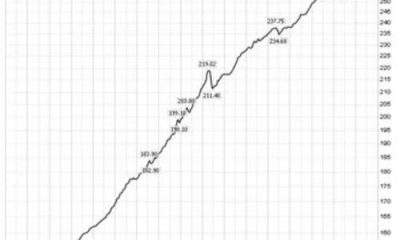

Regardless of the explanation (and the staying power, or lack thereof), there’s no denying the numbers. US unemployment remains low and payrolls are rising at a strong pace: payrolls rose 517,000 in January, the highest monthly gain since July. Meanwhile, the jobless rate ticked down to 3.4%, the lowest since the 1950s.

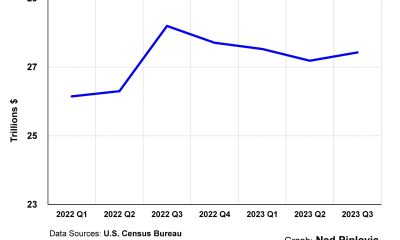

Other key areas of the economy are strong as well. Notably, consumer spending, although wobbly in recent months, shows a strong ability to bounce back. Personal consumption expenditures surged 1.8% in January, the most in nearly two years.

Definitions of recession vary, but it’s a safe assumption that the economy will almost certainly avoid contraction if payrolls and consumer spending are robust. That doesn’t change the fact that key indicators otherwise continue to flash warnings. The inverted Treasury yield curve, for example. Rising interest rates and unusually steep declines in money supply are others portents.

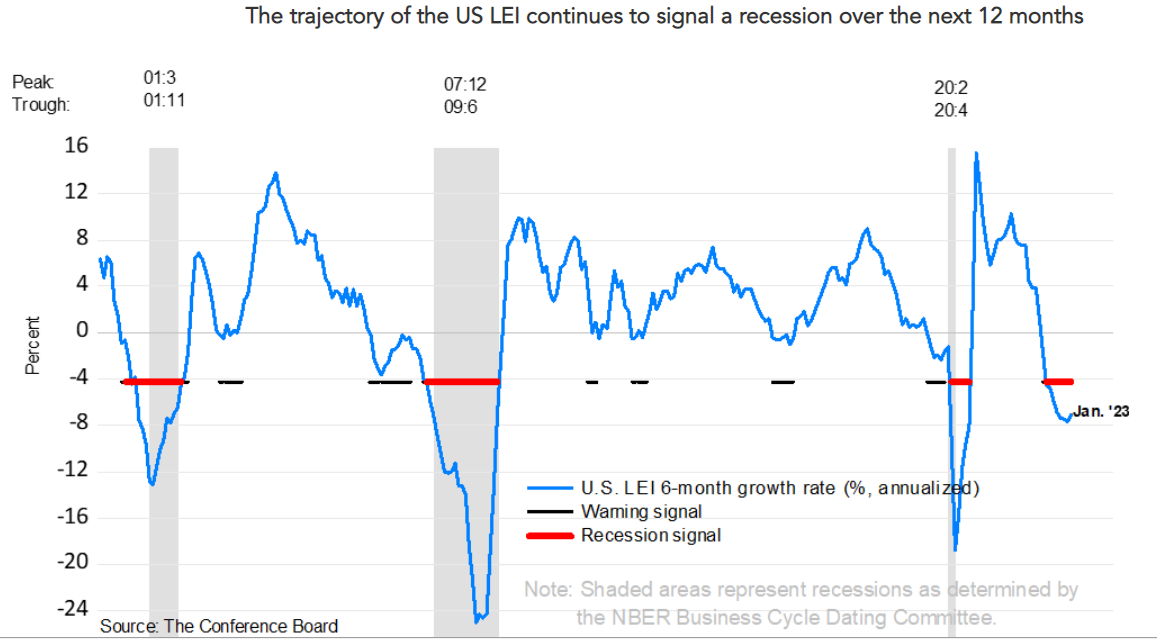

In fact, several broad-minded measures of the business-cycle look downright ominous. The Conference Board’s Leading Economic Index in January, for instance, paints a dark profile.

But the labor market suggests otherwise. The crucial question: Which side will blink first? In search of an answer, watching payrolls and related numbers will offer early clues on how this mystery resolves. On that front, keep an eye on what could be hints of weaker data for payrolls in the next round of updates.

Job postings on Indeed.com, a jobs platform, suggests that the recent strength in the labor market is reversing and that rise in job openings will continue to reverse.

Analysts at other platforms report similar results. “We haven’t seen [the slowdown] in the employment data yet, but we will see it soon,” predicts Julia Pollak, chief economist at ZipRecruiter. “We also speak to customers all of the time. We discuss with them their plans for future hiring. They are telling us they are worried about the risk of overhiring.”

The Kansas City Labor Market Conditions Index is trending lower, which implies that the strength in year-over-year payrolls will soon weaken.

The question is whether the warning signs will continue to be one more case of premature and possibly misleading indicators? This much is clear: the usual conditions for evaluating the business cycle are issuing conflicting signals. We may be in the middle of a learning experience that rewrites how analysts evaluate business-cycle risk.

Meanwhile, it’s hard to argue that a recession is near as long as the labor market remains tight and hiring is robust. Until the hard data on this front tell us otherwise, payrolls appear the only game in town for deciding if business-cycle risk is high or low.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…