Economics

Why the right investment framework is important

We recently published a blog post I wrote entitled, ‘Why I think tech and small caps could rally this year’. In that post I explained the unreasonableness…

We recently published a blog post I wrote entitled, ‘Why I think tech and small caps could rally this year’. In that post I explained the unreasonableness of the interest rate market’s expectations of more than three rate cuts by the end of January 2024.

Citing the U.S. Federal Reserve Chairman Jerome Powell’s own comments that he is not forecasting recession, as well as the improbability the U.S. inflation rate will plunge far enough, or unemployment will rise fast enough to prompt the Fed to cut rates, I concluded the equity market, and in particular technology and small-cap stocks, could rally on the back of a combination of economic growth and disinflation.

In this blog we pour more coals on the head of rate cut expectations noting the Fed has been extremely ineffective at slowing employment growth with the blunt hammer of monetary policy and rate hikes.

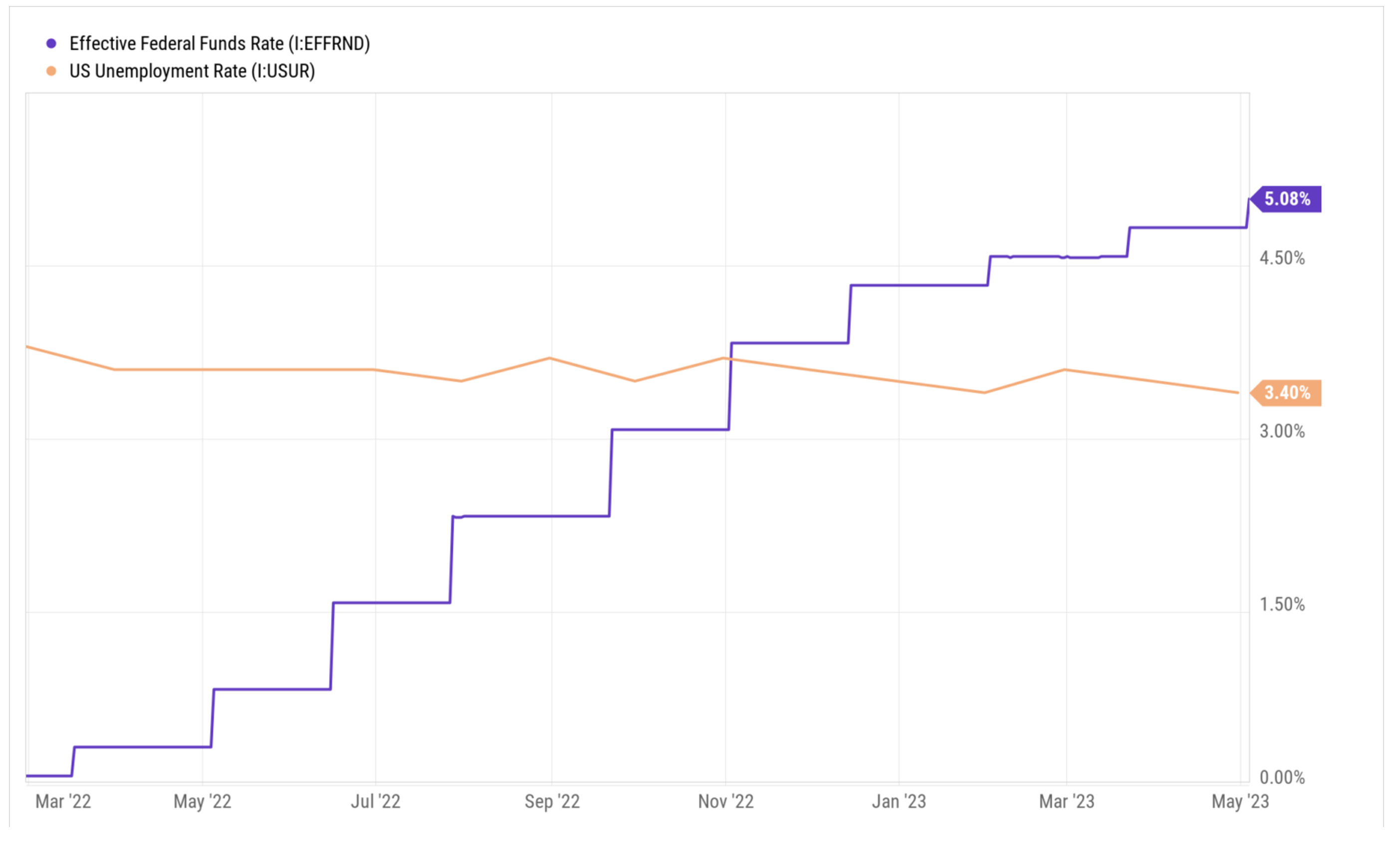

Figure 1. U.S. Federal Reserve rate hikes alongside unemployment

Figure 1. reveals the U.S. Federal Reserve’s rate hikes have been ineffective at quelling demand for labour. For the economy to ease enough for inflation to slow, a higher unemployment rate is at least one of the necessary requirements. It certainly seems to be one of the aims of the Fed.

But it’s not working. In the period the U.S. central bank raised rates from its target range of 0-0.25 per cent as recently as February 2022, to its current target of 4.75-5.25 per cent, the unemployment rate has fallen from four per cent to 3.4 per cent.

Think about that. Despite the Fed raising rates at its fastest rate in history, unemployment has fallen. A cynic might suggest that when inflation was declining, rate cuts did nothing to stop the decline, and now rate hikes are contributing relatively little to the quest to bring inflation down.

It seems to me however, the COVID pandemic justified a cut in the Fed Funds target from 1.50-1.75 per cent to 0-0.25 per cent because unemployment jumped from just 3.5 per cent in February prior to the outbreak of the virus, to a peak of 14.7 per cent just two months later. But that lower bound interest rate target remained in place for just a month shy of two full years.

As one commentator pointed out the U.S. economy added almost five million jobs last year and has added more than a million jobs thus far in calendar 2023 and that’s alongside the prime-age labour force growing to an all-time high of 106.5 million people.

Perhaps the point of all this is that as investors, there are only a few things we can control. We can control our temperament, the framework we adopt for our investing and the discipline with which we invest. We have written extensively about all of those requirements on our blog. We cannot however control whether interest rates rise or fall, whether a recession is around the corner, what the government will do in its annual budget, or the direction of markets.

The uncontrollable however probably matter far less. Your long term returns will be sound if you have the right framework and temperament, irrespective of whether the Fed is successful in fighting inflation and employment.

inflation

monetary

markets

reserve

policy

interest rates

fed

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…