Economics

White House Delays Refill Of Strategic Oil Reserve, Balks At “Too Expensive” Offers

White House Delays Refill Of Strategic Oil Reserve, Balks At "Too Expensive" Offers

The Biden administration had no problems aggressively…

White House Delays Refill Of Strategic Oil Reserve, Balks At “Too Expensive” Offers

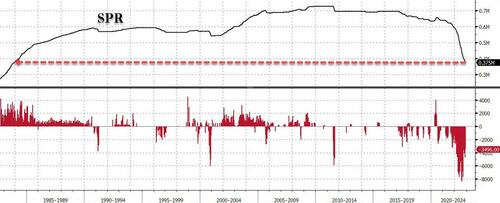

The Biden administration had no problems aggressively draining the SPR by 1mmb/d at market prices in the immediate aftermath of the Ukraine war, in hopes of lowering the price of gasoline ahead of November’s elections and avoiding an inflationary midterm rout. However, when it comes to refilling the SPR, now that US emergency inventories are down to the lowest level since November 1983 and not too far from an all time low which threatens the structural integrity of the salt caverns the oil is deposited in…

… the White House has “unexpectedly” gotten cold feet.

One month after the White House said it will start refilling the Strategic Petroleum Reserve, and made an initial order of 3mm barrels of sour crude (a tiny fraction of the 200 million released in 2022), in what it said was a clear message to oil companies that they can freely invest capital in boosting output cause, well, Biden’s got their backs, overnight we learned that there was a rather sizable caveat in the White House’s brilliant plan.

According to Bloomberg, the Biden administration has delayed the replenishment of the nation’s emergency oil reserve after deciding the offers it received were either too expensive or didn’t meet the required specifications. Citing “people familiar” the report adds that “the Department of Energy rejected the several offers it got for a potential purchase in February.” In other words, absent a brutal US or global recession which drags oil far lower – courtesy of the Fed which is doing Biden’s bidding of containing inflation by crushing the US economy with the highest interest rates in a generation – the SPR won’t get any more oil.

While the DOE will put off the purchase it had originally planned for next month, the proposed program, which used a new approach that accepts fixed-price offers, will continue, one of the people said. Of course, it will “continue” only as long as oil is below a certain White House mandated threshold, anything above that – as we now can see – means no refills. As a reminder, last year there were reports that the Biden administration had planned to start buying crude when it dropped around $70 a barrel; and while oil fell during the fourth quarter and US benchmark prices fell close to those levels last month, they have since rebounded, with the SPR refill price serving as a market support level.

“DOE has put forth a long term plan to transition from release to replenishment, and we’re committed to doing so in a manner that provides a fair deal for taxpayers,” the department said in a statement Friday.

“DOE will only select bids that meet the required crude specifications and that are at a price that is a good deal for taxpayers,” it said. “Following review of the initial submission, DOE will not be making any award selections for the February delivery window.”

What this means is that, as we noted yesterday, either the White House – in all its infinite wisdom – will start having to chase the price of oil even higher in hopes of catching up to the offer now that it has set a firm floor for oil prices thereby shooting itself in the foot…

The Department of Energy rejected the several offers it got for a potential SPR purchase in February: BBG

Well it will just have to raise its bid then

— zerohedge (@zerohedge) January 7, 2023

… or the SPR will not see even one more drop of new oil, and the 372 million barrels currently there, just under 20 days of dometic consumption, will be the total SPR inventory at the time when China inevitably invades Taiwan – a far bigger emergency than a democrat loss in the elections. At that point only that legendary energy guru, Hunter Biden, who was paid so handsomely for his energy insight by Ukraine’s energy giant Burisma…

… will be able to save the US.

Tyler Durden

Sat, 01/07/2023 – 14:00

inflation

reserve

interest rates

fed

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…