Economics

When Should the Fed Stop Raising Interest Rates?

The Issue:

Since March of 2022, the Federal Reserve has raised interest rates briskly, hoping to reverse a historic rise in inflation, moving the Federal…

The Issue:

Since March of 2022, the Federal Reserve has raised interest rates briskly, hoping to reverse a historic rise in inflation, moving the Federal Funds Rate from near-zero to the current 4.75-5%. But the Fed is also facing the very real risk that its efforts to lower inflation will cause a recession. Is the Fed overreacting with ongoing rate increases?

The Facts:

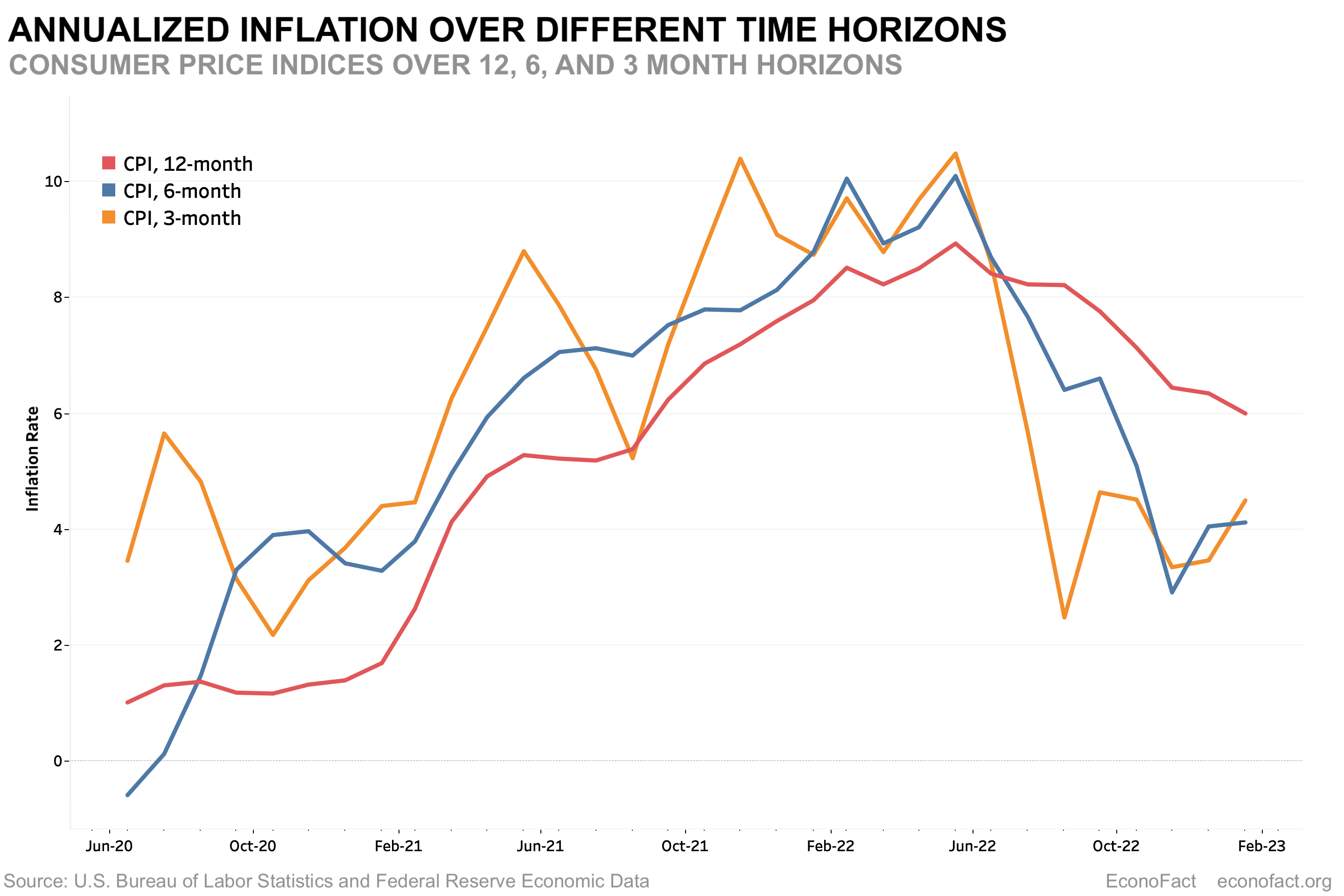

- After reaching the highest rates in decades, inflation has been on the retreat. The twelve-month inflation rates compare current prices to those from one year ago and are thus arguably too backward-looking. Inflation over the past 3 to 6 months has declined to somewhere between 2.5 and 4.5 percent (at an annual rate), depending on the month (see chart above).

- Most agree that COVID shutdowns led to transitory supply constraints. The main factors raising inflation may well have been transitory, but a cavalcade of global disruptions, including the war in Ukraine and more recent COVID responses in China, have caused more persistent increases in inflation.

- An alternative explanation is that the primary culprit behind elevated inflation is an excess of aggregate demand due to a recovered economy spurred in part by generous government support during the COVID pandemic. But we enjoyed similarly strong demand in late 2019, yet the Fed’s challenge then was to raise stubbornly low inflation to its 2 percent target. A reasonable conclusion, therefore, is that as of early 2020, strong demand had at best a very modest effect on inflation, as long as supply conditions were normal.

- To date wages have followed, not driven inflation. And measures of longer-term inflation expectations — 5 or 10 years out — have remained quite stable, suggesting that people on average see this as a transitory period of elevated inflation.

- What impact have the Fed’s actions to date had on the economy and inflation? Real interest rates were negative well into 2022. But by mid-2021, apart from inflation concerns, the economy was doing quite well and no longer needed expansionary policy to support employment and spending. At that point the Fed was still holding short-term interest rates low and continuing to purchase Treasury and mortgage securities to keep longer-term rates low.

- With most forecasters now expecting inflation to be around 3 percent or lower by later this year, current interest rates are about two percentage points above expected inflation. By this simple measure, current Fed policy is already quite restrictive, and became about one-quarter percentage point more so after their March 22nd meeting.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…