Economics

What’s Wrong With Macroeconomic Uncertainty Indexes

I love FRED — I am a big user of their charts and data (and even their swag). Where I depart from the heterodox are in things like the Macroeconomic…

I love FRED — I am a big user of their charts and data (and even their swag).

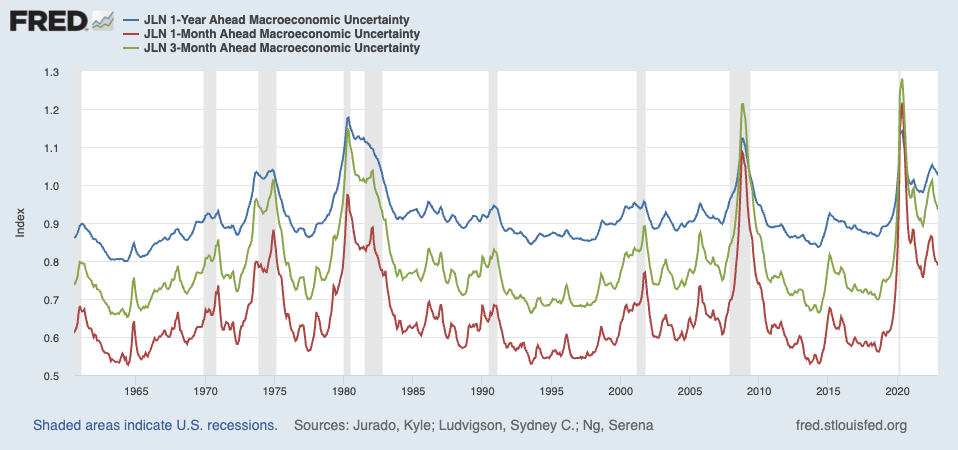

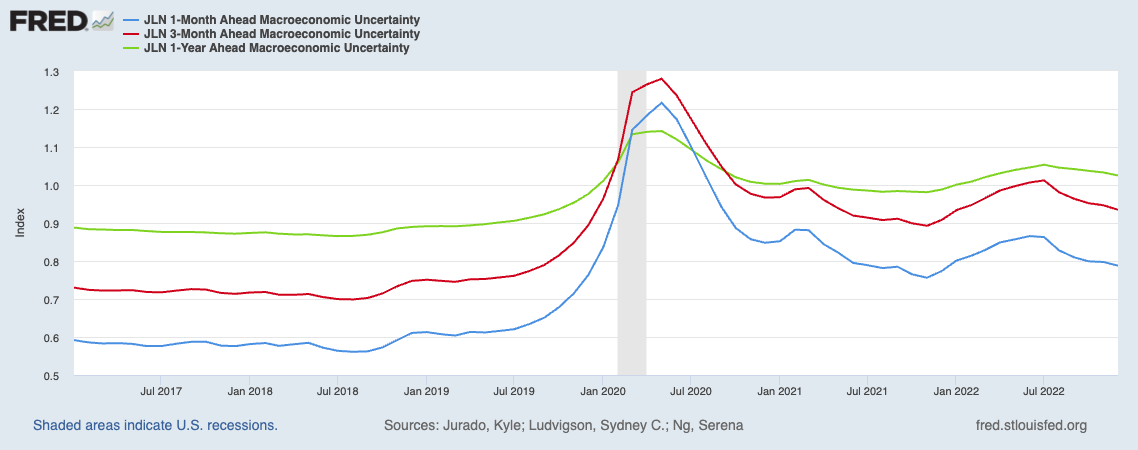

Where I depart from the heterodox are in things like the Macroeconomic Uncertainty Index, which is a recent addition to FRED’s awesome database. It is a “monthly measure of how unpredictable overall economic conditions are 1 month, 3 months, and 1 year ahead.” FRED’s post on it observed that “Economists Kyle Jurado, Sydney Ludvigson, and Serena Ng use a set of 132 individual macroeconomic time series to calculate forecasting factors and estimate period-specific measures of uncertainty.”

I don’t buy into it because, for the most part, the world is simply too random for most forecasts to be reliable or even useful. Sure, you can extrapolate out a few weeks or months, but that’s not really forecasting, it’s more trend-following than anything else.

And I am okay with that.

But “uncertainty” as that word is commonly used on Wall Street seems to be correlated with concerns about faltering economic conditions and/or rising market volatility. At best, it’s coincidental, although the chart above suggests it actually lags quite a bit. That is before we consider the false positives in years like 1965, ’68, ’78, ’86, ’96, ’98, 2003, ’05, ’15, and ’22. Those are merely the largest peaks and do not include myriad other feints and false starts.

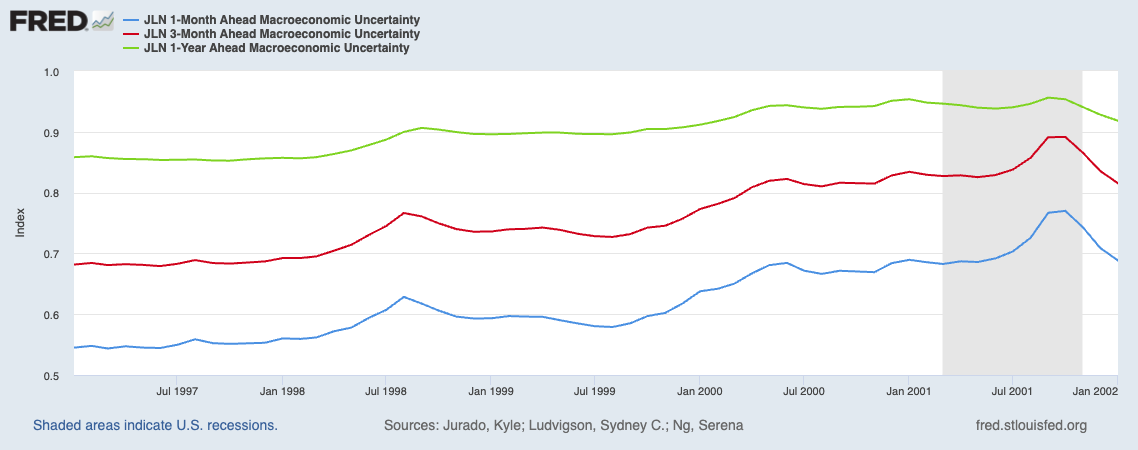

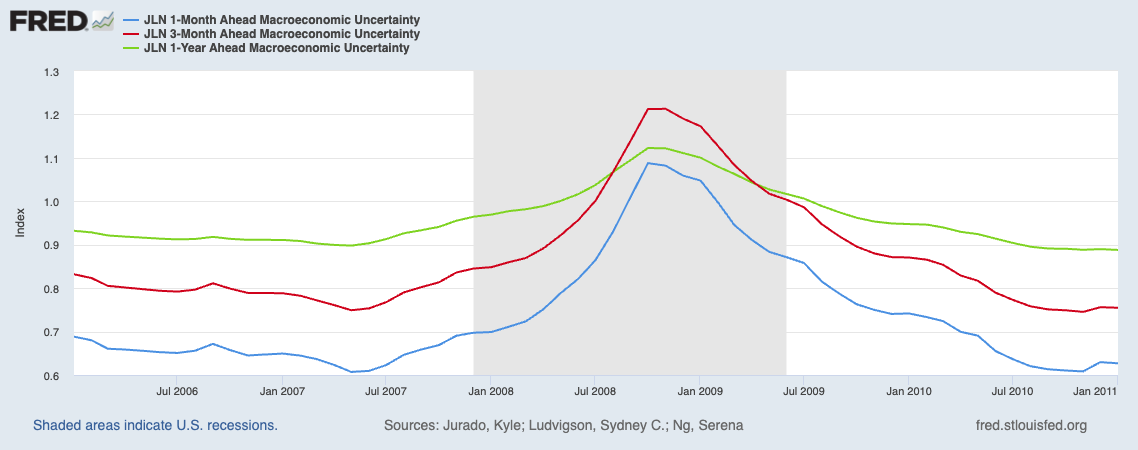

Investors want a crystal ball that can tell them what is going to happen. Here are a few charts showing 5 years around some big moves — the dotcom implosion, GFC, and Covid-19 — where prescience would have been helpful:

1997-2002 Macroeconomic Uncertainty Index

2006-2011 Macroeconomic Uncertainty Index

2017-2022 Macroeconomic Uncertainty Index

I am not sure there are a lot of reliable and confidence-inspiring signals in these zoomed-in charts. It is a heavy lift to generate something that would allow you to move to cash or bonds or otherwise hedge a downturn.

The big problem with “uncertainty” beyond lags and bad signals is the inherent assumption built into all uncertainty indexes. By definition, the future is ALWAYS unknown and unknowable; that implies uncertainty is the default setting for human understanding of what might come next year. We ignore this truism at our own peril.

As I noted a decade ago, we go about our happy little day oblivious to the future parade of horribles that the next downturn inevitably brings:

“Most of the time, Humans exist in a happy little bubble of self-created delusion. We lie to ourselves constantly. We rationalize everything we do, past and present. We engage in selective perception, seeing only the things that agree with us. Our selective retention retains the good stuff and disregards most of the rest. In the mind’s eye, we are all younger, better looking, slimmer, with more hair than the camera reveals.

In short, we create a reality construct that bear only passing resemblance to the objective universe.

Once it gets scary, with layoffs rising and markets faltering, our ability to lie to ourselves is compromised. Fear can do that to a person. When “Uncertainty” rises, it is not because of the challenging macro conditions, but rather because the little narrator in our heads is robbed of his ability to convince us that whatever fairy tale has been operative during the prior months is still working.

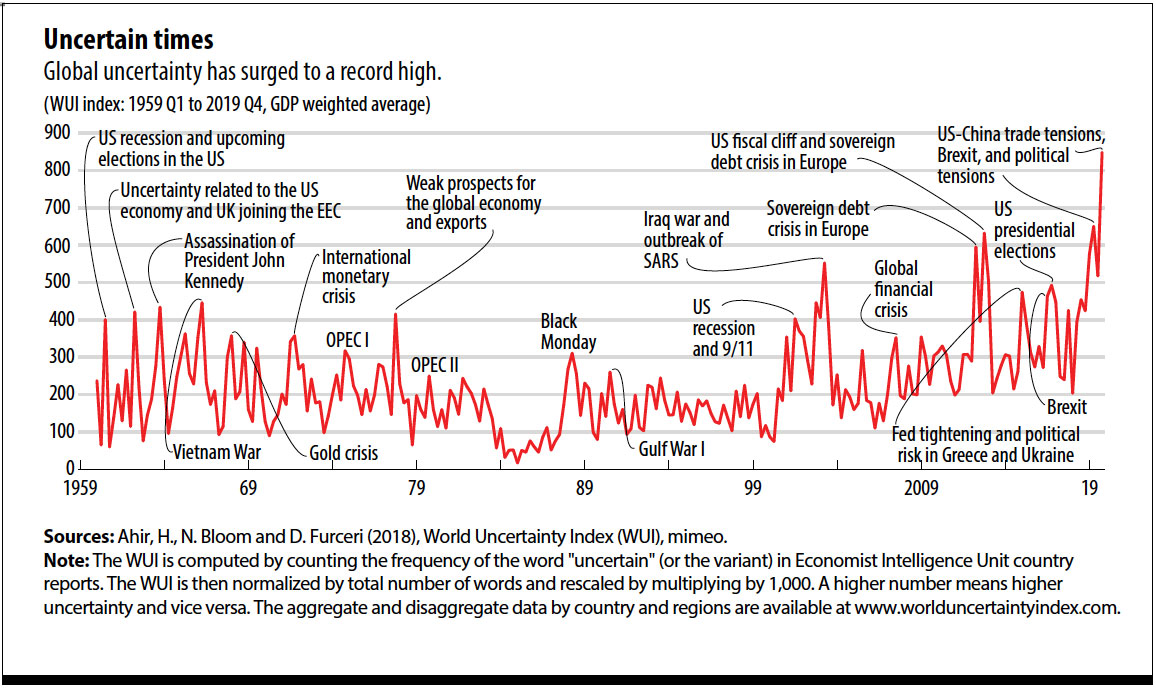

As the IMF reminded us, the world is always uncertain; but in the modern era of instant communication and social media, we seem to have a heightened sensitivity to this:

For any “Uncertainty Index” to be of value, you really must believe that you actually know less today about the future than what you knew about the future a year ago. My view is that at both junctures in time, you knew nothing. The difference is at one point you were frightened and at another you are not.

I have discussed all too frequently why sentiment is mostly useless; now apply that sentiment to future conditions and you end up with these sorts of attempts to capture uncertainty. I have yet to find one that is useful a priori.

Previously:

The Uncertainty Monster (July 21, 2022)

“Glass Half-Empty” Investors (May 8, 2023)

Sentiment LOL (May 17, 2022)

“Uncertainty” Meme Refuses to Die . . . (May 20, 2016)

Revisiting the Uncertainty Trope (June 27, 2012)

There’s nothing new about uncertainty (July 14, 2012)

Kiss Your Assets Goodbye When Certainty Reigns (November 9, 2010)

Apprenticed Investor: The Folly of Forecasting (June 7, 2005)

Sources:

FRED Adds Macroeconomic Uncertainty Index Data

Fred, July 24, 2023

Uncertainty Data

Macro and Financial Uncertainty Indexes.

60 Years of Uncertainty

Hites Ahir, Nicholas Bloom, Davide Furceri

IMF, March 2020

__________

X. I also prefer the distinction Michael Mauboussin makes between Risk (We don’t know what is going to happen next, but we do know what the distribution looks like) and Uncertainty: (We don’t know what is going to happen next, and we do not know what the possible distribution looks like) See this for more info.

The post What’s Wrong With Macroeconomic Uncertainty Indexes appeared first on The Big Picture.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…