Economics

What to Expect from the Fed Tomorrow

A Fed preview … the inflation question … earnings are down, but beating expectations … two new stories for our “commercial real estate watch”…

A Fed preview … the inflation question … earnings are down, but beating expectations … two new stories for our “commercial real estate watch” segment

Tomorrow is the big day when we’ll get the latest Fed policy decision and general economic commentary from the Fed Chair Jerome Powell.

According to the CME Group’s FedWatch Tool, the probability of another 25-basis-point hike is 94.7% as I write Tuesday morning. If carried out, that will take the Fed’s target rate to 5.00% – 5.25%.

Exactly one month ago, traders held very different expectations.

At that time, odds of another rate-hike came in at just 48.4%. Traders didn’t believe the Fed would keep hiking rates in the wake of the banking turmoil.

Cut to yesterday, with First Republic Bank officially going under – and yet traders didn’t blink.

It appears that the Fed’s consistent tough talk about “more work to do” on inflation has tempered hopes that problems in the banking sector would cause the Fed to pause rate hikes tomorrow.

As to that inflation, last Friday’s data showed that the Fed has successfully pumped the brakes on many rising prices, but those prices are not yet falling at a pace that would cause a dovish policy shift.

If you missed it, last Friday’s Personal Consumption Expenditures (PCE) Index and core PCE Index showed inflation rising at 4.2% and 4.6% year-over-year, respectively.

But if you dig into the details, more than 40% of the constituent components show inflation still rising between 5% and 10%.

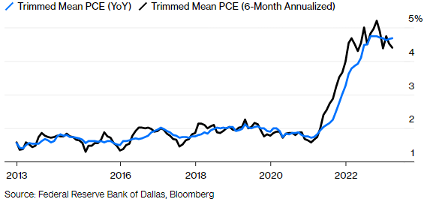

And if you strip out the outliers and look at the “trimmed mean,” it illustrates how we characterized inflation a moment ago – the Fed has successful pumped the brakes, but prices are not yet falling as the Fed wants.

Here’s how that looks. The blue line shows us the year-over-year “trimmed mean” inflation data. You can see it hovering at elevated levels.

Source: Federal Reserve data, Bloomberg

Source: Federal Reserve data, Bloomberg

While a quarter-point rate-hike is all-but-certain tomorrow, the potential for fireworks will come via Federal Reserve Chairman Jerome Powell’s commentary in his press conference.

Traders will be listening for clues about another potential hike in June… whether the Fed hints at its openness to a rate-cut later this year… and broadly-speaking, how it’s sizing up the economy today.

We’ll keep you updated.

Meanwhile, we’re about halfway done with earnings season and results are mostly a pleasant surprise

The headline takeaway from Q1 earnings so far is “not good, but better than expected.”

For these details, let’s go to FactSet, which is the go-to earnings data analytics group used by the pros:

At the mid-point of the Q1 2023 earnings season, S&P 500 companies are recording their best performance relative to analyst expectations since Q4 2021.

Both the number of companies reporting positive EPS surprises and the magnitude of these earnings surprises are above their 10-year averages.

Now, keep in mind, as of last Friday, the blended earnings (combining actual results for companies that have reported and estimated results for companies that have yet to report) decline for the first quarter was -3.7%.

So, earnings are contracting – but because they’re contracting at a slower pace than analysts were expecting, the market is pleased. And so, the overall takeaway is “good earnings season.”

As one illustration of how “bad news” can still be “good news,” take Intel.

Last week, the tech blue-chip reported a 36% drop in year-over-year revenue, as well as a staggering 133% reduction in annual earnings per share. This was the worst performance in the company’s 55-year history.

Bad new, right?

Yes, but…

The loss-per-share was slightly better than Wall Street expected, so rather than melt down, Intel’s stock exploded 12% higher in the session following the report before ending about 7% up.

Source: StockCharts.com

Source: StockCharts.com

Now, in the long-run, a stock price reflects the condition of a company’s earnings. But Intel’s results go to show that, in the short-run, what moves a stock are surprises to expectations.

So far, Q1 earnings are bad – but they’re less “bad” than what was expected…which makes them “good.”

But while earnings are largely comparing well against prior expectations, keep your eye on this dynamic

Let’s go back to FactSet:

As of today, the S&P 500 is reporting a year-over-year decline in earnings of -3.7%.

Despite the overall earnings decline for the index, five sectors are reporting year-over-year earnings growth, led by the Consumer Discretionary sector at 47.8%.

However, just one company in this sector accounts for more than 70% of the net year-over-year increase in earnings for the sector: Amazon.com.

FactSet goes on to detail Amazon’s earnings, concluding that the company is the largest contributor to earnings growth for the Consumer Discretionary sector for Q1 2023.

Now, with this context, let’s go back to FactSet for the real eye-opener:

If [Amazon’s earnings] were excluded, the blended earnings growth rate for the sector would fall to 10.9% from 47.8%…

It is interesting to note that Amazon.com is also the largest contributor to earnings growth for the entire S&P 500 for Q1 and 2023.

If this company were excluded, the (blended) earning decline for the S&P 500 for Q1 2023 would increase to -5.1% from -3.7%, while the estimated earnings growth rate for the S&P 500 for CY 2023 would fall to 0.2% from 1.2%

So, while we breathe a sigh of relief that earnings haven’t fallen off a cliff, we need to be aware that a handful of companies are doing lots of the heavy lifting.

In other words, this is not a rising-tide-lift-all-ships market.

We’ve shown the following chart before here in the Digest to illustrate this point. It’s a comparison of the S&P 500 and the S&P 500 Equal Weight Index.

The Equal Weight Index shows how the S&P is doing if we weight all the stocks in the index equally, rather than giving huge companies like Amazon a massively-outsized weighting.

Over the last three months, while the S&P is down 1.7%, the average equal-weighted performance of all stocks in the S&P is down 8.2%.

This is a big performance differential.

Source: StockCharts.com

Source: StockCharts.com

Translation – if you’re not in the small group of stocks that are accounting for most of the gains this year, your portfolio is down.

Finally, we have two new stories for our “commercial real estate watch” segment

Regular Digest readers know that we’ve begun a “commercial real estate watch” segment to monitor this critically-important sector of the U.S. economy.

The same factors that just resulted in a handful of banking failures are creating cracks in the foundation of the $20-trillion commercial real estate sector. If defaults snowball, it will have an enormous impact on the U.S. economy.

Our first story comes from San Francisco. Let’s jump to The Wall Street Journal:

Before the pandemic, San Francisco’s California Street was home to some of the world’s most valuable commercial real estate. The corridor runs through the heart of the city’s financial district and is lined with offices for banks and other companies that help fuel the global tech economy.

One building, a 22-story glass and stone tower at 350 California Street, was worth around $300 million in 2019, according to office broker estimates.

That building now is for sale, with bids due soon. They are expected to come in at about $60 million, commercial real-estate brokers say. That’s an 80% decline in value in just four years.

As we’ve discussed in the Digest, “work from home” has reduced office demand… which slashes rental prices… which reduces revenues/earnings… which crushes valuations.

In the meantime, roughly $1.5 trillion in commercial real estate debt is set to mature in the next three years.

Most of this debt was financed when interest rates were near zero. When the debt rolls over, commercial real estate companies will be refinancing in a market environment characterized by three things: higher interest rates, lower property values and less liquidity.

If this sounds like trouble and a recipe for defaults, you’re of the same mindset at Charlie Munger

For readers less familiar with Munger, he’s Warren Buffett’s business partner.

And while he doesn’t believe we’ll see a repeat of the 2008 housing market implosion, he sees pain on the way.

From CNBC:

Charlie Munger believes there is trouble ahead for the U.S. commercial property market.

The 99-year-old investor told the Financial Times that U.S. banks are packed with “bad loans” that will be vulnerable as “bad times come” and property prices fall…

“A lot of real estate isn’t so good anymore,” Munger said. “We have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There’s a lot of agony out there.”

It’s in this environment of “agony” that the Fed will likely raise interest rates yet again tomorrow.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg

The post What to Expect from the Fed Tomorrow appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…