Economics

What the CPI Number Means

A drop in the Consumer Price Index … consumers are slowing their spending … why oil prices are headed higher … how Eric Fry is playing the oil trade

There’s…

A drop in the Consumer Price Index … consumers are slowing their spending … why oil prices are headed higher … how Eric Fry is playing the oil trade

There’s plenty in the headlines. Let’s cover a handful of the top stories that are most likely impacting your portfolio.

Inflation keeps dropping

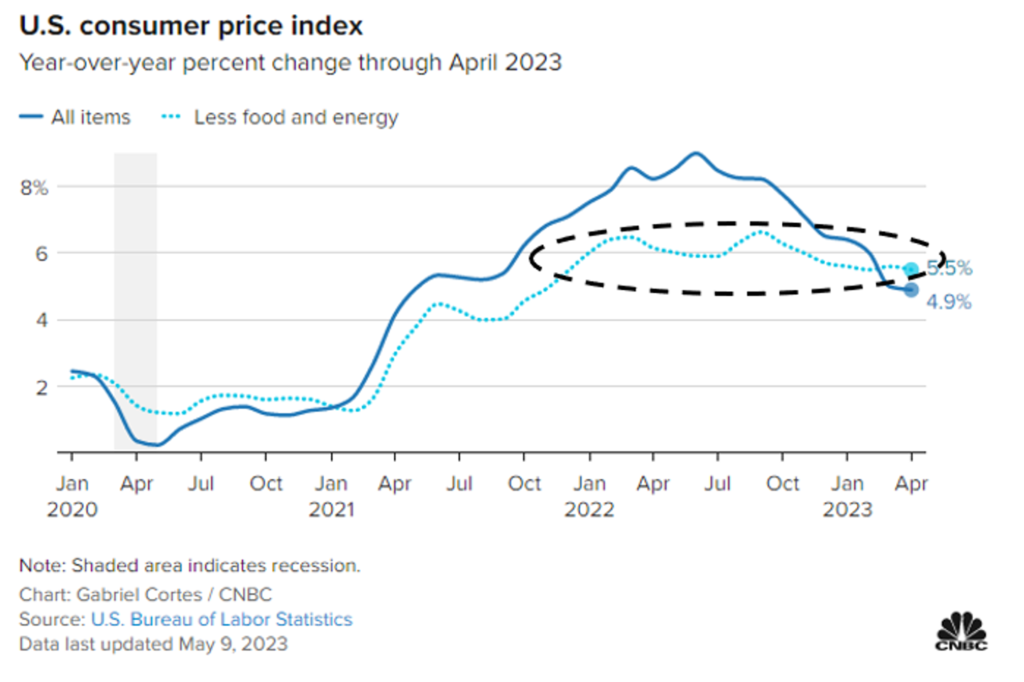

This morning, the latest Consumer Price Index number showed that headline inflation eased to a 4.9% increase in April on an annual basis. That was slightly less than the expectation of 5.0%.

Month-over-month, the index was in line with expectations, climbing 0.4%.

Shelter costs saw the biggest jump in inflation at a monthly increase of 0.4% and a yearly gain of 8.1%. That said, they’re still falling.

Now, for months, you’ve been reading how inflation is moving in the right direction. So, why is the Fed still so aggressive?

Because while the headline CPI numbers have fallen substantially, the core CPI (which doesn’t include food and energy) is more stubborn. And the Fed focuses more on this core CPI.

You can see this stubbornness in the chart below from CNBC.

The dotted light blue line is core CPI (I’ve circled it in dotted black). While falling from its September high, it remains elevated at 5.5% which isn’t tremendously lower than its peak level of 6.6% last fall.

Source: Bureau of Labor Statistics/CNBC

Source: Bureau of Labor Statistics/CNBC

But overall, today’s report is good news. And for Fed members who lean dovish, this should increase their comfort in pausing rates next month.

We can see this by looking at CME Group’s FedWatch Tool. Yesterday, traders put the odds of another quarter-point hike in June at 22%. As I write Wednesday in the wake of the CPI release, that number has virtually dropped in half, down to 13.1%.

But what today’s CPI data don’t do is make the case for rate cuts. Inflation remains far too high for that.

It will be interesting to hear commentary from the various Fed members in the coming days as they balance last Friday’s red hot labor report numbers with today’s cooler inflation data.

We’ll keep you updated.

Meanwhile, the latest data on the U.S. consumer shows that the Fed’s interest rates are slowing down spending

A survey from the New York Federal Reserve finds that the outlook for spending fell by half a percentage point to an annual rate of 5.2%. That’s the lowest level since September 2021.

If you’re curious why consumers are spending less, famous investor Warren Buffett has an answer…

They’ve run out of pandemic dollars.

From CNBC:

The “Oracle of Omaha” believes that the “extraordinary period” of excessive spending on the back of Covid pandemic stimulus is over, and now many of his businesses are faced with an inventory build-up that they’ll need to get rid of by having sales…

Buffett said his businesses had experienced an “extreme” period where consumers splurged, which led to many managers at his subsidiaries overestimating demand for certain products…

“It is a different climate than it was six months ago. And a number of our managers were surprised,” Buffett said Saturday. “Some of them had too much inventory on order, and then all of a sudden it got delivered, and people weren’t in the same frame of mind as earlier. Now we will start having sales when we didn’t need to have sales before.”

“In the general economy, the feedback we get is that, I would say, perhaps the majority of our businesses will actually report lower earnings this year than last year,” he said.

Now, this is both good and bad news.

On one hand, companies that are forced to mark down prices to get rid of old inventory is inherently deflationary. This is welcomed news to a Federal Reserve and its ongoing inflation fight.

On the other hand, inventory that consumers don’t want (or no longer have the money to afford), which forces sale prices, means lower profits, as Buffett pointed out.

Which one will have the greater impact on the economy/stock market as we move deeper into the back half of 2023?

Well, when it comes to reduced earnings, Wall Street is inherently forgiving if the link can be made to something short-term and fixable in nature, like inventory problems related to supply chains. That’s a reason to be optimistic.

But how much of what we’re seeing can be attributed to inventory issues rather than to an increasingly-strained consumer that would have a much longer-lasting impact on the economy?

There’s a magical trump card that can help both issues…

A more accommodative Federal Reserve.

And that brings us back to this morning’s CPI data. We’re interpreting it as mostly good news. Let’s see what the Fed does with it.

Switching gears to the energy markets, what’s the latest with the oil trade?

As I write, the price of the U.S. crude benchmark, West Texas Intermediate (WTI) sits at about $72. This isn’t far above its 52-week low of about $65.

While many oil companies can still make profits at this price, $72 is much cheaper than $120 that we saw last summer.

Meanwhile, as these lower prices have eaten profit margins, the prices of many oil stocks have taken a hit.

To illustrate, look at the SPDR S&P Oil & Gas Exploration and Production ETF, XOP. It holds energy heavyweights including Valero, Marathon, Occidental, and Chevron. It’s down more than 27% from last June’s high.

Source: StockCharts.com

Source: StockCharts.com

So, what happens now? Will we enter a recession that further kneecaps demand?

Or will the summer driving season result in a surge in prices? (Which would be challenging for the Fed and its inflation fight.)

For the latest analysis, let’s turn to our macro expert, Eric Fry, editor of The Speculator, and why he’s bullish on certain energy plays today:

Like a group of partying college kids at midnight, oil stocks may have just gotten a “second wind…” and a major rally could be imminent.

Here’s why I think it still belongs in your portfolio.

[Last] Tuesday, Bloomberg reported that oil production for the Organization of Petroleum Exporting Countries (OPEC) fell in April due to an Iraqi pipeline suspension and Nigerian labor strike. In fact, its output was the lowest in almost a year, declining by 310,000 barrels a day.

Those geopolitical issues and continuing sanctions against Russia continue to limit supply, along with weak economic data coming out of China and banking-collapse fears.

OPEC+, which includes Russia, instituted a voluntary output cut of around 1.16 million barrels a day, beginning this month.

These supply limitations should drive the price up.

In fact, global crude oil demand will hit record levels by the end of this year, according to new estimates from the International Energy Agency (IEA).

Eric further explains that the IEA expects the oil market will fall into a 400,000-barrel-per-day (BPD) deficit soon, only to then explode to a two-million-BPD deficit in the second half of the year.

It’s hard to imagine such supply issues won’t translate to higher prices per barrel.

So, how might you play this?

Well, there’s XOP, which we profiled a moment ago.

You can also look at the specific oil plays within XOP and pick your top three favorites (we mentioned Buffett earlier – he’s a major owner of Occidental).

As for Eric, although he’s bullish on certain oil and gas stocks, he’s also bullish on the transition to green energy. Is there a way to have both?

It turns out, yes. Back to Eric:

As the world continues to invest in green energy in the quest to get to zero carbon emissions, oil and gas companies that haven’t stopped to consider this diversification will be left in the dust.

I have sung the praises of TotalEnergies SE (TTE) in one of my elite trading research services as a company that is poised for success.

It’s investing in not only traditional forms of energy, but also is expanding into wind and solar electricity, plus is developing other biofuel solutions.

Eric’s Speculator subscribers made about 22% returns on a covered-call trade on TTE last fall. Here’s how Eric described the company back then:

[TTE] is a fashion-forward, energy-transition company. The company’s management understands both what has been and what will be – and they intend to maximize profit from both.

Specifically, management is pursuing a long-term strategy to reinvest the robust cash flows from Total’s legacy oil and gas operations into renewable energy projects and technologies.

TTE is just one way that Eric is playing the energy markets and the transition to green technologies. For more of his research and specific recommendations as a Speculator subscriber, click here.

Finally, there’s more trouble brewing in commercial real estate

Regular Digest readers know that we’ve been featuring a “commercial real estate watch” segment to monitor this critically-important sector of the U.S. economy.

The same factors that just resulted in a handful of banking failures are creating cracks in the foundation of the $20-trillion commercial real estate sector. If defaults snowball, it will have an enormous impact on the U.S. economy.

Let’s turn to Reuters from Monday:

Rising interest rates, falling prices and waning demand for office space following the pandemic had strained the commercial property market. But these troubles intensified after this year’s failures of Silicon Valley Bank, Signature Bank and First Republic raised worries about other regional banks that account for the bulk of commercial real estate loans.

“The private market hasn’t started to heavily mark down real estate,” Apollo Global Management co-president Scott Kleinman told the Financial Times. “The equity will be first. That’s the next shoe to drop in the US. Like everything else, it has been priced so tightly and there hasn’t been a commercial real estate crisis in the US since the ‘90s.”

The article goes on to interview various experts who suggest we’ll see a concentration of pain in urban centers such as New York and San Francisco. And while the obvious concern is about specific, overextended real estate companies, you have to consider the domino effect.

Back to Reuters:

A wall of debt is also scheduled for repayment in the coming years. “There’s a maturity cliff for a lot of this real estate in the next few years, a significant portion of which is funded by regional banks,” said the chief executive of a large US bank.

“Commercial real estate is leverage on leverage on leverage . . . if people are forced to quickly unwind that leverage it can pop up in other places.”

We continue to urge you to be aware of the extent to which your portfolio is exposed to commercial real estate. Pain is coming for the sector – it’s just a matter of how much, and how far it spreads.

We’ll keep you updated on all of these stories here in the Digest.

Have a good evening,

Jeff Remsburg

The post What the CPI Number Means appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…