Economics

What current macro puzzle?

Here’s Tyler Cowen:

One of the current macro puzzles is that we keep on receiving good labor market reports during a time of monetary and credit tightening….

Here’s Tyler Cowen:

One of the current macro puzzles is that we keep on receiving good labor market reports during a time of monetary and credit tightening. Which is the missing “dark matter” variable that helps to explain this?

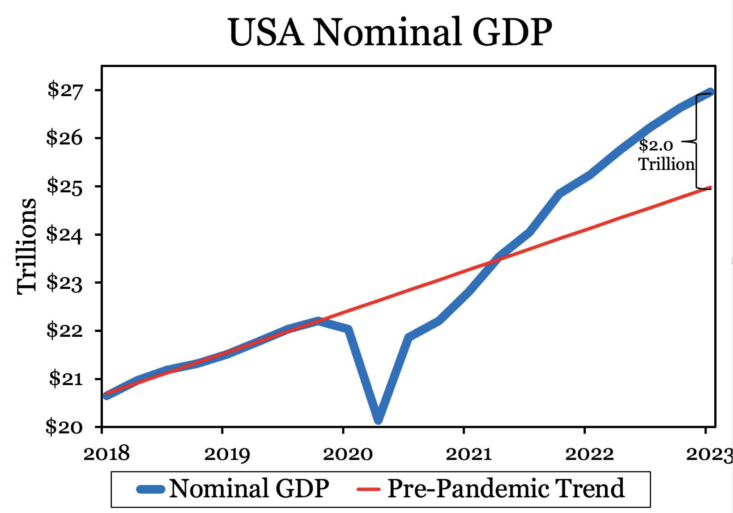

I see no “current macro puzzle” because I see no monetary tightening. NGDP growth over the past couple of years has been very rapid, and thus the strong labor market is no surprise. Perhaps Tyler would say that the strong NGDP growth is surprising. If so, why? Is he assuming that rising interest rates reflect monetary tightening? (It doesn’t.) Does he judge monetary policy by the growth rate of M2? (He shouldn’t.) What’s his metric? What causes Tyler to conclude that monetary tightening has been significant?

I am aware that the extremely rapid NGDP growth has been gradually slowing—but it’s still quite rapid. If you wish to call that “tightening”, that’s fine. But the strong labor market is no surprise given the high NGDP growth rate. I don’t see any mystery here. David Beckworth produced this graph:

Again, what macro puzzle? If Tyler insists on finding some mysterious “dark matter”, how about the following:

The unobservable natural rate of interest has risen faster than the policy rate, producing easy money. The cause of the rise in the natural rate is the monetary and fiscal stimulus of 2020-21, which generated very fast NGDP growth. Higher NGDP growth leads to a higher natural rate of interest in 2022.

If you insist on focusing on M2, then the dark matter is movements in velocity.

(1 COMMENTS)

monetary

policy

interest rates

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…