Disclaimer: the opinions in this article are personal to the writer and do not reflect those of Exness or LeapRate.

Economics

Weekly data: Focus on the NFP for currencies this week

Dollar-loonie is likely to be highly active later this week because of the respective countries’ job reports on Thursday and Friday. Since the NFP has…

Dollar-loonie is likely to be highly active later this week because of the respective countries’ job reports on Thursday and Friday. Since the NFP has consistently been higher than expected in 2023 so far, it wouldn’t be very surprising to see a stronger result on Friday with a kneejerk higher for USDCAD. That could provide an opportunity for sellers to enter at a more favourable price, but depending on sentiment on the US dollar and oil’s movements it’d be possible to see the price continue to bounce. Gauging the strength of the reaction to Friday’s data for at least a few minutes might be wise before committing.

Key data this week

Bold indicates the most important releases for this symbol.

Tuesday 4 April

- 14:00 GMT: JOLTs job openings (February) – consensus 10.4 million, previous 10.82 million

Wednesday 5 April

- 12:30 GMT: Canadian balance of trade (February) – consensus C$1.7 billion, previous C$1.92 billion

- 12:30 GMT: American balance of trade (February) – consensus negative $69 billion, previous negative $68.3 billion

- 14:00 GMT: ISM non-manufacturing PMI (March) – consensus 54.5, previous 55.1

Thursday 6 April

- 12:30 GMT: Canadian employment change (March) – consensus 14,900, previous 21,800

- 12:30 GMT: Canadian unemployment rate (March) – consensus 5.1%, previous 5%

- 12:30 GMT: Canadian annual average hourly wages (March) – consensus 5.5%, previous 5.4%

- 14:00 GMT: Ivey PMI (March) – consensus 49, previous 51.6)

Friday 7 April

- 12:30 GMT: non-farm payrolls (March) – consensus 238,000, previous 311,000

- 12:30 GMT: American unemployment rate (March) – consensus 3.6%, previous 3.6%

- 12:30 GMT: American annual average hourly earnings (March) – consensus 4.3%, previous 4.6%

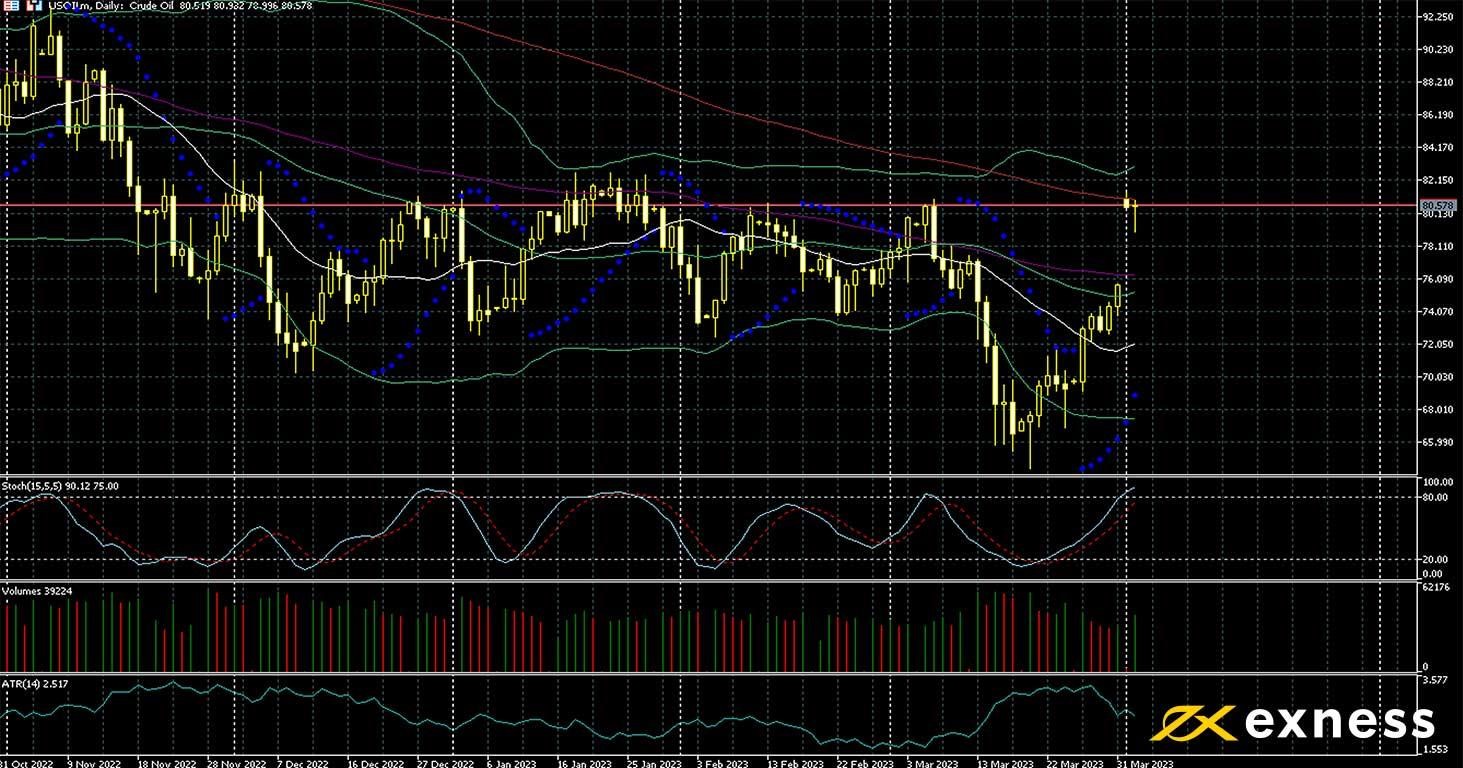

American light oil, daily

USOIL gapped up more than $5 over the weekend after OPEC+ announced a surprise cut to production of more than a million barrels daily from May to the end of 2023. In practice, it’s likely that the total cuts will be significantly higher than this, with Russia in particular eager to cut more. While markets seemed to have been pricing in some sort of further action from the group and its allies, few had expected a sudden move like this. Meanwhile the outlook for demand from China still seems to be positive. On the other hand, the dispute over exports of oil from Iraqi Kurdistan through Turkish ports seems more likely to be resolved within weeks rather than many months.

It’s challenging to apply TA after a gap this large. There seems to be some reluctance to push above the 200 SMA, but this is partially because a gap of more than 5% for crude oil would usually close within a few days before a possible resumption of the movement. That might seem especially relevant now that the price is overbought based on the stochastic and there hasn’t been clear support from buying volume.

This week’s stocks from the USA might give traders more useful information and possibly drive further movement. Equally, traders of oil should monitor the job report from the USA because most markets price oil in dollars: commentary about the rise of the ‘petroyuan’ seems to be overblown for now.

Key data this week

Bold indicates the most important release for this symbol.

Tuesday 4 April

- 20:30 GMT: API crude oil stock change (31 March) – previous negative 6.08 million

Wednesday 5 April

- 14:30 GMT: EIA crude oil stock change (31 March) – previous negative 7.49 million

Thursday 6 April

- 17:00 GMT: Baker Hughes oil rig count (6 April) – consensus 592

The post Weekly data: Focus on the NFP for currencies this week appeared first on LeapRate.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…