Economics

Wall Street Reacts To Today’s “Hotter Than Expected” CPI Report

Wall Street Reacts To Today’s "Hotter Than Expected" CPI Report

There was something for both the hawks and doves in today’s CPI report.

On…

Wall Street Reacts To Today’s “Hotter Than Expected” CPI Report

There was something for both the hawks and doves in today’s CPI report.

On one hand, the YoY measures came in (just slightly) hotter than expected, rising 6.4% for headline (vs exp. 6.2%) and 5.6% for core (vs exp. 5.5%), suggesting the Fed is once again behind the curve. Additionally, some components – such as used car prices – indicated continued price drops even though we know that this lags the recent real-world rebound.

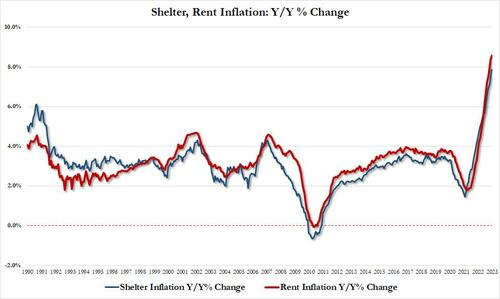

On the other hand, more than half of the core monthly increase was due to shelter…

… which however lags the market by 12 months, so second-half inflation numbers should come down rapidly. Also adding to the dovish picture was that core CPI services ex-shelter (one of Powell’s preferred supercore inflation measures) rose just 0.27% in Jan, down from 0.37% in Dec and the lowest since October.

Finally, even though the 6.4% year-on-year CPI increase was higher than the average estimate of economists, it’s still the lowest reading since October 2021 and a tick down from the prior month.

So what is one to make with this data? Below is a snapshot of several kneejerk reactions from Wall Street strategists and economists which confirms that everyone is just seeing whatever they wants to see in today’s report.

Dennis DeBusschere, founder of 22V Research, had to say:

“Looks like OER is a driver of the slight headline beat .7 vs .8 last. Recall, OER weight increased in the latest revision. That is why people thought upside risk to the number. Used auto weight decreased. Since private market rent data has collapsed, we know that OER is moving even lower over time. That is why market is taking the inline number OK.”

Infrastructure Capital Advisors: CIO Jay Hatfield:

“we continue to forecast inflation will rapidly decline as the BLS slowly reflects the reality of housing deflation in their estimate of shelter inflation. This lag is approximately 12 months, so second-half inflation numbers should come down rapidly.”

Mohamed El-Erian, strategist at Allianz

“It is less hard for policymakers than market participants. Policymakers have to think about ‘What mistakes can I afford to make?’ The mistake you can afford to make right now given the underlying strength of the labor market is how the economy is paying too much attention to persistent inflation. It is better to get the inflation genie back in the bottle than to relax too early.”

BMO Capital economist Ben Jeffery

“The kneejerk rally was a result of the unrounded core figure, and we’ve seen 10s selloff back to effectively unchanged with 2s/10s similarly back to -84 bp. From here, there is today’s Fedspeak with which to contend, and we don’t think there is anything contained within this read to call into question the FOMC’s hawkish commitment.”

Interactive Brokers chief strategist Steve Sosnick

“As expected, core revised up slightly. Cue the narrative from markets that inflation is higher (month-over-month) and from politicians that it’s lower (year-over-year). Stock market doesn’t care. If traders were really worried about CPI, we wouldn’t have gotten a big rally yesterday and a lift in the futures pre-number. The in-line number was a mere speed bump in the stocks’ advance. Certainly the rally in bonds gives a further excuse for stocks to rally.”

Morgan Stanley chief economist Ellen Zentner

“We expect the Fed tightening path to be largely set through the May FOMC, with a 25 basis-point hike at each of the upcoming meetings. Beyond May, however, a slowing labor market and more moderate inflation outcomes should set the stage for a stop in the tightening cycle and an eventual first rate cut in December.”

Bloomberg Econ chief US economist Anna Wong

“January’s CPI blunted the trend of declining inflation over the past few months. The report showed an increase in energy prices, slowing momentum in goods disinflation, and still-robust gains in service prices. That should help move the market in the direction wanted by the Fed, which aims to keep rates higher for longer to rein in price pressures.”

Santander economist Stephern Stanley

“It was largely as expected, but it could have been worse. As long as shelter costs are going up as rapidly as they have been, it’s going to be tough to get inflation down to where the Fed wants to see it…. both the used-car price decline and the drop in airfares embedded in this report aren’t likely to continue.”

Columbia Threadneedle rates strategist Ed Al-Hussainy

“Core data right on top of expectations, but markets were positioned for an upside surprise. The guts of the data look quite good; the disinflationary passthrough to PCE from housing and medical services is strong… Real weekly earnings are rapidly improving -1.5% y/y vs a low of -3.8% last summer. I think this pattern raises the possibility that inflation declines without the consumer and employment getting thrown overboard.””

Goldman Sachs Asset Management strategist Maria Vassalou

“The strength of core inflation suggests that the Fed has a lot more work to do to bring inflation back to 2%. If retail sales also show strength tomorrow, the Fed may have to increase their funds rate target to 5.5% in order to tame inflation.”

Cornerstone Wealth CIO Cliff Hodge

“There may be a little volatility this morning but markets are taking it in stride but that won’t likely derail the positive momentum in equities. Month-on-month numbers right in line while year-on-year with a slight miss. The more volatile goods component continues to provide a tailwind via a break in used cars and airline tickets which are unlikely to continue, while services remains sticky.”

Vanguard economist Andrew Patterson

“This report does not change our expectations for macro fundamentals or Fed policy, but highlights the need to remain data dependent and focused on the nuance in data releases as well as the headline numbers.”

Source: Bloomberg

Tyler Durden

Tue, 02/14/2023 – 09:50

inflation

deflation

markets

policy

fed

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…