Economics

Wall Street Bulls Forget One Thing

“Surprise” inflation isn’t a surprise … January’s hot market start takes it on the chin …the case for the Fed Funds rate above 6% … blue…

“Surprise” inflation isn’t a surprise … January’s hot market start takes it on the chin …the case for the Fed Funds rate above 6% … blue skies aren’t here yet

As I scanned the headlines in the wake of last Friday’s hotter-than-forecasted PCE inflation data, I noticed a theme of head-scratching surprise.

Here are a few examples…

“Big Upside Surprise”

“…PCE Inflation Unexpectedly Re-accelerates”

“Bad Surprise”

“Inflation Surprisingly Rose in January…”

Frankly, I’m surprised by this degree of surprise.

History has shown that inflation can be incredibly challenging to beat, and that U-turn resurgences are common

It was last May, that we featured a Barron’s opinion piece from Richard Curtin, the University of Michigan professor who has directed the widely-referenced Consumer Sentiment surveys since 1976.

From Curtin, comparing inflation in the 70s and early 80s to that of the last 18 months:

Another critical characteristic of the earlier inflation era was frequent temporary reversals in inflation, only to be followed by new peaks.

That same pattern should be expected in the months ahead.

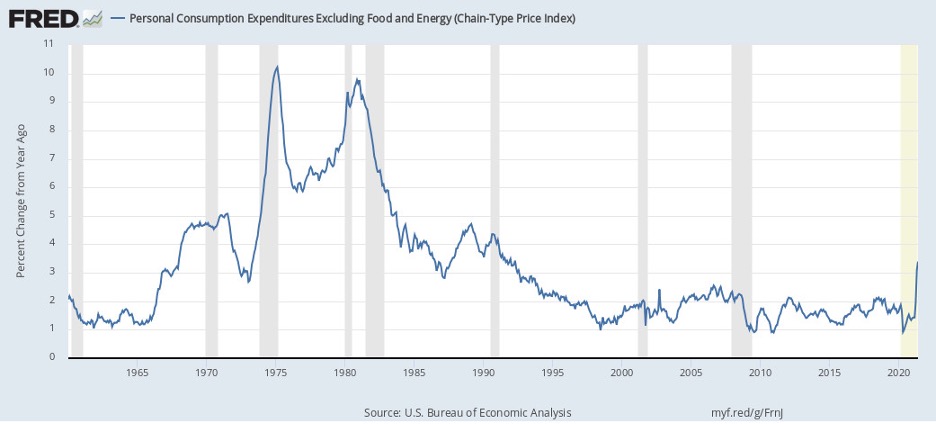

It remains to be seen whether we’ll see a new peak in inflation (it’s unlikely). But a reversal of inflation declines shouldn’t raise an eyebrow. All you have to do is look at a long-term chart of inflation in the 70s and early 80s to see this clearly illustrated.

Source: Federal Reserve Data

Source: Federal Reserve Data

Let’s jump back to Curtin’s opinion piece from last spring:

Prices and wages will continue to spiral upward until the cumulative erosion in inflation-adjusted incomes causes the economy to collapse in recession…

This situation has been termed “inflationary psychology.”

Consumers purposely advance their purchases in order to beat anticipated future price increases. Firms readily pass along higher costs to consumers, including the future cost increases that they anticipate.

That’s what happened in the last inflationary age, which started in 1965 and ended in 1982: Expected inflation became a self-fulfilling prophecy.

Last Friday, the University of Michigan released its latest Consumer Sentiment survey that reported on inflation expectations

While the data revealed a more optimistic consumer, in large part due to the stock market run-up in January, expectations for inflation remain elevated – echoing Curtin’s prediction of a “self-fulfilling prophecy.”

From MarketWatch:

Inflation expectations, meanwhile, remained fairly high…

Americans think inflation will persist for some time. They expect the inflation rate in the next year to average about 4.1%.

In the longer run, consumers believe inflation will increase about 2.9% a year, well above the Federal Reserve’s 2% target.

Fed officials pay close attention to inflation expectations because they could be a harbinger of future price trends.

Now, a resurgence of monster inflation is unlikely to happen. I’m not suggesting we’ll see that.

What I’m pointing out is that the ebullient market explosion in January was based on Goldilocks wishful thinking that inflation has been conquered, the Fed is about to transform into a dove, and happy days are here again.

The market declines in February show what happens when bullish expectations outpace economic realities.

To see this visually, below, we look at the three major indexes as of last Friday (before the bounce we’re seeing today, as I write Monday morning).

The Nasdaq’s peak 2023 gains have been halved… the S&P’s gains were trimmed to one-third of their prior max… and the Dow had lost all its gains and more.

Source: StockCharts.com

Source: StockCharts.com

Some painful perspective we’d be wise to remember

The Fed’s latest thinking puts its eventual “terminal rate” at a bit more than 5%. As we’ve chronicled here in the Digest, Wall Street has refused to believe the Fed would take rates this high.

However, finally, here in February, traders have begrudgingly priced in this 5%+ terminal rate (yet, many traders don’t believe it will be long before the Fed cuts rates from this level).

But what if the Fed is wrong in its guess that rates at, say, 5.3% will beat inflation?

What if they have to go much higher?

From Bloomberg, last Friday (emphasis added):

The unexpected acceleration in the personal consumption expenditures gauge underscored the risks of persistently high inflation.

Furthermore, resilient spending paired with the exceptional strength of the labor market will make it tougher for the Fed to get inflation to its 2% goal…

Officials may need to raise rates as high as 6.5% to defeat inflation, according to new research that was critical of the central bank’s initially slow response to rising prices.

In a paper presented Friday in New York, a quintet of Wall Street economists and academics argue that policymakers have an overly-optimistic outlook and will need to inflict some economic pain to get prices under control.

If this sounds outrageous to you, consider the following from Stan Druckenmiller, arguably the most successful investor in modern history:

Once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI.

As a reminder, the latest CPI report shows year-over-year inflation coming in at 6.4%.

For even more granularity on Druckenmiller’s point, let’s rewind one year

From our February 14, 2022 Digest:

I don’t know how high the Fed Funds Rate will have to go to squelch inflation.

But I do know that historical data can be used to give us an informed perspective on the answer.

Below, we’re going to look at a chart that compares the Federal Funds Effective Rate (in blue) with the Consumer Price Index (in red).

We’re taking the data all the way back to 1950.

Now, as you look at the chart, the first thing I’d ask you to notice is how the Fed Funds rate in blue tracks the inflation rate in red pretty closely.

Source: Federal Reserve Data

Source: Federal Reserve Data

Now, look at the chart again. This time, notice that when inflation (again, in red) spikes, the Fed Funds rate (in blue) has had to climb above the CPI spike in order to rein it in.

Reminder…

The current Fed Funds target range is 4.50% – 4.75% and the latest Consumer Price Index reading is 6.4%.

If Druckenmiller is right that “once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI,” then I’d ask bulls to answer why this time is different.

But let’s say “this time is different” for whatever reason

There’s still a massive difference between the Fed stopping its rate-hike campaign, yet letting rates remain high for months to make sure inflation is conquered…

Versus…

The Fed going full-dove and beginning to cut rates later this year.

And that’s what today’s bull case rests upon – a Fed that decides its job is done and begins juicing the economy with rate-cuts sometime around Q4. After all, paused rates at 5.3% aren’t going to help the economy one bit. Those rates have to come down.

But today’s labor market refuses to crack. How is it logical that a Fed – scared of losing the fight against inflation after calling it “transitory” – will be cutting rates just a handful of months from now with the labor market this strong?

The most likely path to rate-cuts is a recession, but that doesn’t fit with the bullish Goldilocks scenario that helped push January’s wild market run-up.

“We still have work to do” is a refrain from various Fed presidents that we should pay attention to. The big question is how “surprised” Wall Street will be when the Fed does what it says it will do.

If you’re wondering what this means for your portfolio, I have two words…

Fundamental strength.

This is not a “rising tide lifts all ships” market. The stocks that will best protect your wealth are those that are grounded in fundamental strength. I’m talking robust earnings, reliable cash flows, and a fortress balance sheet.

Legendary investor Louis Navellier stressed this point in last Friday’s Special Market Update podcast from Accelerated Profits:

It’s going to be slim pickings out there. It’s a top 15% market where you have to stay in the crème de la crème.

You should not be invested in the broad market, in index funds, or anything like that. That’s not going to work out too well for you right now.

It turns out, Louis recently held a special live event that details how he finds his quantitatively-strong stocks. In short, he uses high-powered computers running complex algorithms to scour the markets, looking for a small subset of stocks that have the fingerprints of fundamental superiority.

Today, is the last day we’ll make this free replay available. In it, Louis shows multiple real-life examples of his groundbreaking market approach in action. It’s a strategy that Louis says can deliver real, hold-in-your-hand income time and time again.

To watch a free replay, just click here.

Have a good evening,

Jeff Remsburg

The post Wall Street Bulls Forget One Thing appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…