Economics

Visualized: U.S. Corporate Bankruptcies On the Rise

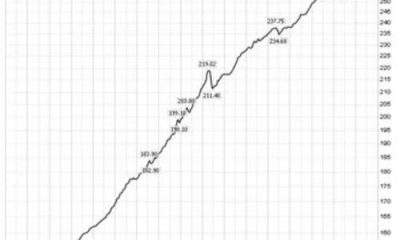

In 2023, over 400 companies have folded. This graphic shows how corporate bankruptcies are growing at the second-fastest rate since 2010.

The post Visualized:…

Visualized: U.S. Corporate Bankruptcies on the Rise

In March, Silicon Valley Bank collapsed, plunging its parent company SVB Financial Group into bankruptcy a week later.

While many expected a wave of bank failures to follow, much of this has since been averted—but cracks have begun to emerge with Moody’s recent downgrading of 10 small and mid-sized banks.

Across the wider corporate landscape, bankruptcies have begun to tick higher. Overstretched balance sheets coupled with 11 interest rate hikes since last year have added to mounting challenges for companies across many sectors.

This graphic shows the surge in corporate bankruptcies in 2023 based on data from S&P Global.

U.S. Corporate Bankruptcies Grow

So far in 2023, over 400 corporations have gone under. Corporate bankruptcies are rising at the fastest pace since 2010 (barring the pandemic), and are double the level seen this time last year.

Below, we show trends in corporate casualties with data as of July 31, 2023:

| Year of Filing | Bankruptcy Filings as of July |

Annual Total |

|---|---|---|

| 2023 | 402 | N/A |

| 2022 | 205 | 373 |

| 2021 | 256 | 408 |

| 2020 | 407 | 639 |

| 2019 | 334 | 590 |

| 2018 | 317 | 518 |

| 2017 | 305 | 520 |

| 2016 | 354 | 576 |

| 2015 | 292 | 525 |

| 2014 | 273 | 471 |

| 2013 | 349 | 558 |

| 2012 | 362 | 586 |

| 2011 | 364 | 634 |

| 2010 | 530 | 827 |

Represents public or private companies with public debt where either assets or liabilities are greater than or equal to $2 million, or private companies where assets or liabilities are greater than or equal to $10 million at time of bankruptcy.

Firms in the consumer discretionary and industrial sectors have seen the most bankruptcies, based on available data. Historically, both sectors carry significant debt on their balance sheets compared to other sectors, putting them at higher risk in a rising rate environment.

Overall, U.S. corporate interest costs have increased 22% annually compared to the first quarter of 2021. These additional costs, combined with higher wages, energy, and materials, among others, mean that companies may be under greater pressure to cut costs, restructure their debt, or in the worst case, fold.

Billion-Dollar Bankruptcies

This year, 16 companies with over $1 billion in liabilities have filed for bankruptcy. Among the most notable are retail chain Bed Bath & Beyond and the parent company of Silicon Valley Bank.

| Company | Primary Sector | Date |

|---|---|---|

| Party City | Consumer Discretionary | Jan 2023 |

| Serta Simmons Bedding | Consumer Discretionary | Jan 2023 |

| Avaya | Information Technology | Feb 2023 |

| Diamond Sports | Communication Services | Mar 2023 |

| SVB Financial | Financials | Mar 2023 |

| LTL Management | N/A | Apr 2023 |

| Bed Bath & Beyond | Consumer Discretionary | Apr 2023 |

| Whittaker, Clark & Daniels | N/A | Apr 2023 |

| Monitronics | Industrials | May 2023 |

| Kidde-Fenwal | Consumer Discretionary | May 2023 |

| Envision Healthcare | Healthcare | May 2023 |

| Diebold | N/A | Jun 2023 |

| Wesco Aircraft | Industrials | Jun 2023 |

| PGX Holdings | Industrials | Jun 2023 |

| Cyxtera | Information Technology | Jun 2023 |

| Voyager Aviation | Industrials | Jul 2023 |

Mattress giant Serta Simmons filed for bankruptcy early this year. It once made up nearly 20% of bedding sales in America. With a vast share of debt coming due this year, the company was unable to make payments due to higher borrowing costs.

What Comes Next?

In many ways, U.S. corporations have been resilient despite the sharp rise in borrowing costs and economic uncertainty.

This can be explained in part by stronger than anticipated profits seen in 2022. While some companies have cut costs, others have hiked prices in an inflationary environment, creating buffers for rising interest payments. Still, S&P 500 earnings have begun to slow this year, falling over 5% in the second quarter compared to last year.

Secondly, the structure of corporate debt is much different than before the global financial crash. Many companies locked in fixed-rate debt over longer periods after the crisis. Today, roughly 72% of rated U.S. corporate debt has fixed rates.

At the same time, banks are getting more creative with their lending structures when companies get into trouble. There has been a record “extend and amend” activity for certain types of corporate bonds. This debt restructuring is enabling companies to keep operating.

The bad news is that corporate debt swelled during the pandemic, and eventually this debt will come due likely at much higher costs and with more severe consequences.

The post Visualized: U.S. Corporate Bankruptcies On the Rise appeared first on Visual Capitalist.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…