Economics

Vertiv: Cash Don’t Lie; Likely Insolvent in 2023

Vertiv Holdings Co (NYSE:VRT): Cash Don’t Lie[1] VRT Likely Insolvent in 2023 Rating UNDERPERFORM Price (14 February-23): $15.22 Target price: $0.00…

Vertiv Holdings Co (NYSE:VRT): Cash Don’t Lie[1]

VRT Likely Insolvent in 2023

Rating UNDERPERFORM

Price (14 February-23): $15.22

Target price: $0.00

52-week price range: $7.76 – $27.97

Market capitalization: $5.46B

Enterprise value: $8.49B

Summary:

Cash don’t lie. Vertiv’s low margins have been obfuscated by the build-up of inventory and contribution from E&I’s more profitable products. Management has focused investor attention on the growing backlog (of questionable profitability) and repeated promises of margins in the future.

Get The Full Henry Singleton Series in PDF

Get the entire 4-part series on Henry Singleton in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q4 2022 hedge fund letters, conferences and more

Current adjusted operating profit (AOP) margins are inflated, but cash isn’t. The -59% collapse in adjusted cash flow margins since 2020 shows a company in increasing distress.

Despite the best industry conditions in years, VRT narrowly avoided insolvency in 2022 by borrowing heavily. When credit runs dry in 2H23, the company may face insolvency again, absent an equity offering in the interim.

Glassdoor Review

Current Employee, more than 3 years

Worst corporate culture I have ever experienced

Dec 20, 2022 – Engineer in Columbus, OH

Pros

Direct deposit shows up like clockwork, co-workers and direct managers are skilled, kind and supportive

Cons

Upper management, compensation, salary, terrible benefits, work/life balance, being told there is a hiring freeze while they spend money on more unneeded office space… The entire company appears to be beholden to the whims of Dave Cote.

Advice to Management

I have never worked for a company where upper management appears to have outright contempt for the employees. Typically you get at least some lip service to the concept that “our people are our greatest asset”. Not at Vertiv. Here we get “If you don’t like it, leave.” Im watching every skilled coworker leave one after the other due to nonsense RTO policies.

The brain drain is ridiculous. Our systems are screwed up top to bottom so the new CEO has an all employee call to tell us not to blame the systems, blame ourselves. Rob Johnson seemed like his hands were tied by the board, the new CEO feels more like a henchman. Employees are demotivated, demoralized, and angry.

I can’t fathom what the end game is aside from a buyout offer from a competitor. We could be a serious force in the industry and instead we will be a case study in terrible management. It’s just all so depressing. I had hoped to have a long career here.

The Path to Zero

Investor focus on the AOP metric is mis-guided and will eventually prove costly. Accounting measures can improve AOP while obscuring real economic performance. For example, in 2022, AOP margins are expected to stabilize at 8% – the same as 2020.

Cash flow measures, however, have eroded. Our adjusted free cash flow (FCF) margins have declined to only 4% from 9.8% in 2020. The mid-point of the repeatedly lowered guidance for 2022 is for negative free cash flow of ($125M). We think it will be a stretch for the company to meet it.

AOP margins will prove irrelevant when the company runs out of cash.

By using adjusted FCF margins as an anchor, we estimate VRT’s true AOP margin to be 2.2%, not the 8% expected to be reported to investors in 2022. A margin of 2.2% warrants a 50% discount on the total valuation, in our view, implying a stock price of $3.22, 77% below current levels.

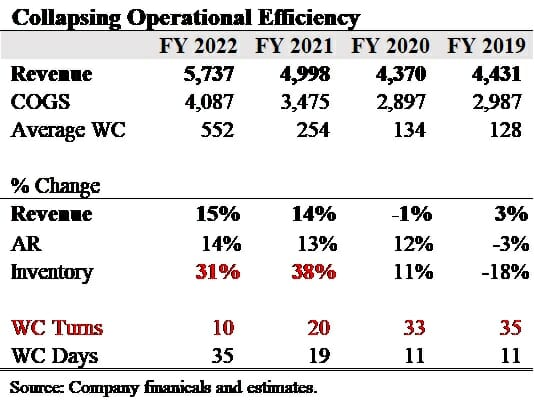

We believe the presentation of AOP has been stabilized at the expense of working capital (WC), which has increased nearly 300% since 2020. Other companies in the industry have also experienced WC pressures due to supply chain challenges.

The adjusted FCF margins of competitors have declined between -6% and -12% since 2020; VRT’s -59% collapse is an industry anomaly signaling a systemic problem. VRT burned $334M in cash flow from operations (CFO) in the first 9-months of 2022, due to large, unprofitable contracts. Working capital accounts used $448M of cash in the period.

We think investors expecting higher margins going forward will be disappointed. VRT stocked-up on inventory at peak prices in 1Q and 2Q22. Current margins are inflated by older purchases.

Going forward, the high-priced inventory will flow through the cost of goods. At the same time, materials prices are declining and some customers likely expect, or are contracted via pricing bands, to get lower prices.

Margins were pressured in 2021 and 2022 as the company mishandled pricing in the inflationary environment; margins will be pressured going forward as the cost side was mishandled. Materials deflation should devalue both stock and work-in-progress inventory.

The margin picture is further clouded by the E&I acquisition. Management failed to disclose that VRT had a reseller relationship with E&I prior to the acquisition. Rather than E&I underperforming original expectations, we hypothesize that the relationship may have been concealed to facilitate internal sales/profit transfer from E&I to VRT.

Allocating the shortfall to E&I, would obscure continued margin erosion at the company’s much larger core business and support management’s margin improvement narrative.

Cash flow performance has been terrible even inclusive of E&I, which had margins of ~2.5x VRT’s. Liquidity ceased to be a topic of discussion on conference calls, likely because the company is in crisis. VRT narrowly avoided insolvency in 2022 only by borrowing heavily from its ABL facility, despite the damage it does to the already slim margins.

We estimate the ABL facility will run dry in 2H23, potentially pushing VRT into insolvency. A prudent step would be an equity offering before then to avoid the catastrophe.

Management has used unrealistic financial promises, debt and an acquisition to avoid permanent impairment to the equity. However, the low-margin business is too overlevered to be bought and does not have the pricing power or cost discipline to thrive, even at the cyclical peak. In the end, we expect VRT’s equity to be worthless, like almost every other SPAC of its vintage.

I. Adjusted AOP Margin is 2% Not the Reported 8%

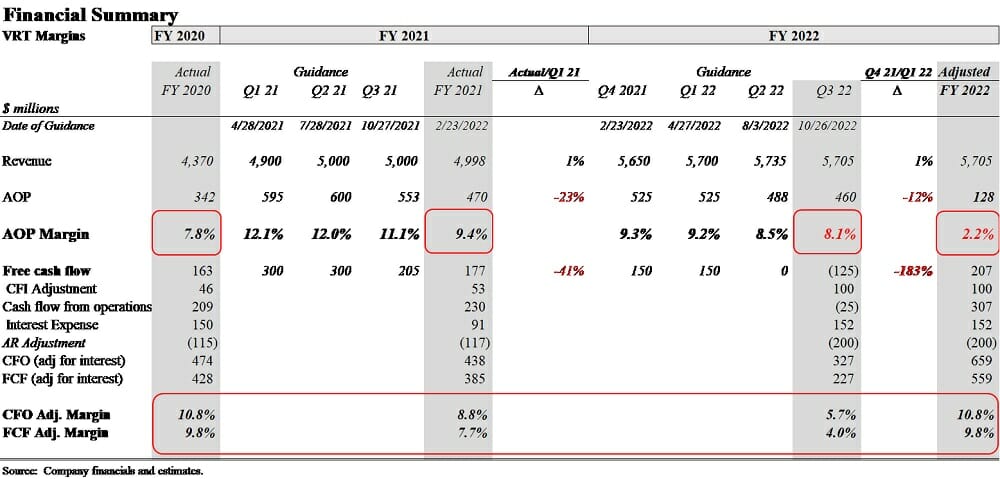

VRT focuses investor attention on AOP, a metric akin to EBITDA. Guidance on AOP has been repeatedly revised downward in the last two years – a total negative adjustment of -23% for 2021 and -12% for 2022. As poor as AOP performance has been, reliance on the metric leads investors to overestimate financial performance and overlook the more important problematic cash flow results.

Cash flow performance has been a disaster. In 2021, annual FCF was 47% below original guidance. If 4Q22 guidance is met, FCF will come in 183% below original guidance for the year.

Our credibility matters greatly to us. And we don’t want to guide to numbers we may not be able to deliver even in the face of strong orders.

David Cote, Q1 2020

In the table below, we provide a summary of guidance to actual results, cash flow statistics, and an adjusted AOP estimate for 2022. Reported AOP margins increased from 2020 to 2021 and are expected to stabilize at 8% in 2022. The critical figures here are in the cash flow.

We adjusted the cash flow margin by adding back both the interest expense and the negative impact of accounts receivable to mitigate the impact of leverage and increased sales. The adjusted metric shows the cash generating power of the underlying business. The results are telling.

Included 2022 expectations is an adjusted FCF margin of only 4%, down from 7.7% and 9.8% in 2021 and 2020, respectively. So, while AOP margins have stabilized at comparable levels with 2020, cash flow margins collapsed by 60%. The fall came despite the contribution of the acquired high-margin E&I business; VRT as a stand-alone entity would have been worse.

In the right-most column, we adjust 2022 AOP to reflect expected free cash flow margins. We back into AOP by using 2020’s FCF margin with 2022 revenue expectations.

If VRT’s expected 8% AOP margin was real, it should generate $207M in FCF versus current estimates of ($125M). We subtract the negative $332M FCF delta from the expected $460M of AOP to get an adjusted figure of $128M.

Our analysis shows the real AOP margin is only 2.2%.

The year-to-date cash burn has led to a liquidity crisis, although it has not been acknowledged by the company. In fact, discussion of cash levels ceased as liquidity evaporated. When asked about cash on the 4Q21 call, CFO Dave Fallon stated that liquidity would bottom in 2Q22 and improve thereafter. On the 1Q22 call, management said “liquidity was strong at $720M”.

There was no mention of cash or liquidity on the 2Q22 call when the company drew-down $175M from the ABL facility for the first time in years, nor on the 3Q22 call when they drew-down another ~$105M.

As of 3Q22, VRT had negative FCF of ($408M); the latest FCF guidance is for a midpoint of ($125M). Yet, on the 1Q22 call, Mr. Fallon said “we are still comfortable with the $150M positive guide. If you look at that from a quarterly perspective, we do anticipate another cash burn in Q2. It should not be as high as what we saw in Q1 ($150M) , but we do anticipate significantly positive free cash flow in Q3 and Q4.”

Contrary to Mr. Fallon’s April 27, 2022 projections, 2Q22 FCF was much less than 1Q at ($232M) and 3Q was ($20M). Almost one-third through the quarter, Mr. Fallon did not know that VRT’s 2Q cash burn would vastly exceed Q1, and he thought 3Q would be significantly positive and it was negative. In our view it is deeply problematic that VRT’s CFO appears to have zero visibility into cash flow, even in current quarters.

VRT ended 3Q22 with $258M in cash after drawing $280M from the ABL facility. Absent the ABL funding, VRT would have been insolvent. The cash bridge comes at a cost of 3 to 4% for a company with a reported AOP margin of 7% to 8%. Thus approximately 13% of the AOP margin on factored receivables is given up in interest cost.

The ABL facility was increased by $115M to $570M in September 2022. There is $215M available if the company is to remain with the 10% limit. We forecast the capacity will be exhausted in 2H23. We expect management will take the opportunity afforded by the current strength in the stock to conduct an equity offering.

Pricing and Inventory

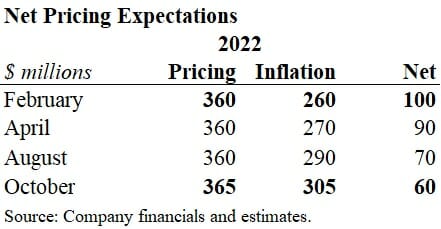

Poor real margins are illustrated by both the lack of pricing power and the inability to manage working capital. The table below shows the evolution of pricing expectations in 2022.

Management put out the initial estimate for net pricing on the 4Q21 conference call on February 23, 2022 when David Cote stated “Generating $100M of favorable price/costs for the full-year ’22, because much of that price is in the backlog…”

Net pricing expectations for the year have collapsed 40% to $60M from $100M. Either the company did not have price in excess of inflation built into the backlog as Mr. Cote said, or it cannot control the cost side of the equation.

In any case, VRT has not been able to obtain price in excess of inflation. For the first 9-months of the year, net pricing was ($20M); $80M of net price increases are expected in 4Q22. Even if accomplished, $60M in annual net pricing is a miniscule 1.2% on $5B in sales.

Management is aware working capital accounts are critical for “engineered to order” manufacturers like VRT. As part of its efforts to become public in 2019 the company linked 20% of its executive compensation plans (and 33.33% of its Transformation Bonus plans) (including R. Johnson and D. Fallon, current CFO) to “Controllable cash” defined as reduction in past due accounts receivable (AR) aged 30 days or greater plus reduction in GAAP inventory and other adjustments in order to “increase utilization of working capital”.

The focus on working capital efficiency appears to have been abandoned after going public. As shown in the table below, 2019 represents peak efficiency in our data set.

Working capital has deteriorated rapidly since 2019, declining from 35 turns annually to only 10. Part of the reason for the deterioration is the focus on AOP. We believe, the current year’s AOP margins have been “maintained” at the expense of WC accounts.

They include FIFO accounting, cost allocation to inventory, and factoring receivables, which reduces gross margins, though the cost is allocated below the operating line.

We expect inventory to remain a problem over the next year. On the 2Q22 call, commenting on going forward pricing, Rob Johnson said he didn’t anticipate pricing to deteriorate going into 2023, “if inflationary conditions go”. “We bought inventory at higher prices, they (customers) understand that. So, it’s something that wouldn’t keep me up at night…”

It should have kept Mr. Johnson up, and apparently the management team has noticed. On the 3Q22 call, Dave Fallon, Dave Cote and the new CEO Giodarno Albertazzi all talked about how the company was improving its SIOP process – Sales Inventory Operations Planning. We think their concern comes too late.

VRT’s response to supply chain issues was to make a lot of high-priced “spot buys”, particularly in 2021. The company built inventory significantly in 1H22 when raw materials and component prices were peaking, as noted by Mr. Johnson.

We believe the company will experience the worst of all worlds. VRT did not raise prices enough to keep up with inflation and lost margin. It purchased bulk inventory at spot/peak prices with suppliers decommitting and unwilling to extend credit. Current gross margins reflect the expense of the older, cheaper inventory.

Over the next year, that the high-priced inventory will flow through the cost of goods. Unlike Mr. Johnson, we don’t think customers will “understand” and pay a higher price because VRT has expensive inventory. The company is likely to lose margin as prices decline, particularly as some contracts have pricing bands, giving customers the right to lower prices as component prices decline.

One might call VRT’s execution of its pricing/inventory a lose now lose later strategy.

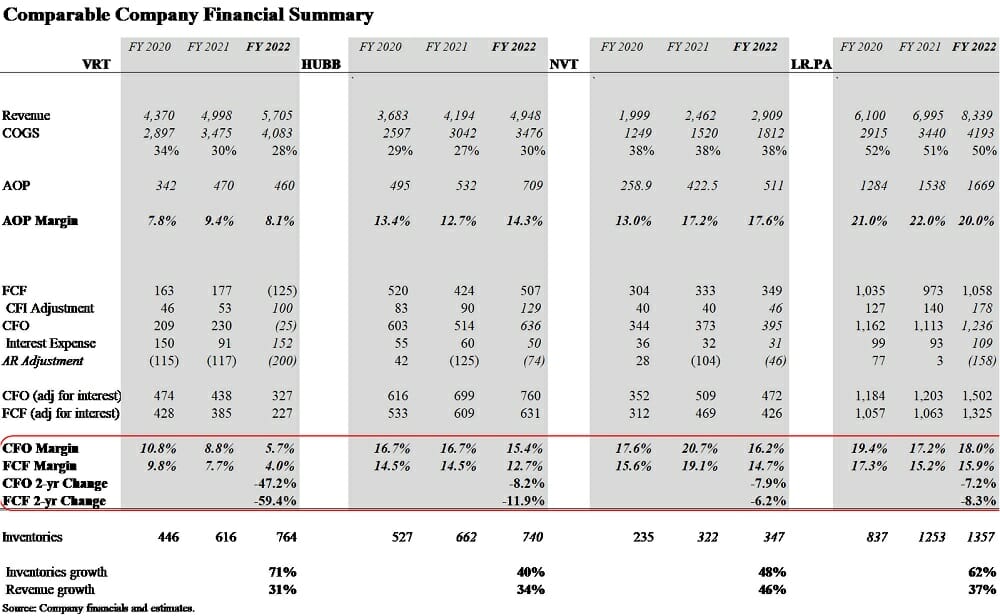

II. VRT is Worst in Class Operations

Management and some analysts attribute the working capital/inventory problems to industry dynamics. While it is true that there have been considerable supply chain disruptions, none of VRT’s competitors has experienced the magnitude of pricing pressures and free cash flow collapses that plague the company.

For most of the electrical/HVAC companies Gross/AOP margins have expanded in the last year due to rising industry sales with double digit price realizations across the board. As evident in the exhibit below, the supply chain disruptions have put some strain on the WC accounts. (Again we adjust for interest expense and AR to make comparisons meaningful).

Adjusted FCF margins in the industry declined between -6% and -12% nowhere near the -59% collapse at VRT.

VRT’s aggressive and very expensive inventory growth relative to its revenue increases points out the main culprit and the unwillingness of suppliers to fund the company’s inventory buildup. VRT’s inventory has grown 41% more than sales, which is remarkable given the acquired E&I is sales additive, but does not carry much inventory.

This compares to an inventory/sales growth differential of 11% for competitors. VRT’s significant gap signals potential overbuild/overvaluation of VRT’s newer stock while the least expensive initial purchases boost gross margins in the near-term.

Despite the industry tailwind, VRT continues to struggle with gross margins, signaling lower price realizations likely due to product mix. It is unclear if the company is able to keep its competitive position within the fastest growing segments of the data center orders like liquid cooling given diminished in-house development capabilities.

III. VRT’s Undisclosed Relationship with E&I

The November 2021 acquisition of E&I Engineering further complicates VRT’s margin story. We discovered that VRT and E&I had a relationship prior to the acquisition. VRT had a product called the Vertiv Liebert MBX Busway.

The MBX was actually a re-branded E&I IMPB Powerbar. Although we have not technically verified that they are the same products, it appears to be the case. By September 2022, less than a year after the acquisition, VRT mothballed the MBX product, replacing it with the Vertiv IMPB Powerbar from E&I.

The pre-existing relationship and white-labeled products are material facts management should have disclosed. M&A transactions often involve companies with customer/supplier relationships.

Part of the transaction often settles the pre-existing relationship. Any settlement along with previous inter-company sales should be discussed in the fairness opinion as they impact valuation and the allocation of consideration.

We have to ask why management concealed the relationship, and reiterate our call for the company to file an 8-K with all fairness opinions to help answer the growing number of questions around the transaction.

Prior to the acquisition, VRT was in essence a reseller of E&I’s most profitable product line. When VRT’s sales force would sell an MBX busway system all revenue would be recorded as VRT’s. The cost paid to E&I would be reflected in the cost of goods sold and presumably lower gross margin.

Post-acquisition, it is unclear how revenue and gross margins are allocated. However, it is quite possible that transfer pricing has been used to shift revenue and margin to VRT with shortfalls assigned to E&I.

Booking E&I sales and profits at VRT would not impact the consolidated results, but it would have the optical effect of inflating gross and AOP margins at VRT in support of management’s recovery narrative.

This would partially explain why management has been non-specific and evasive when asked to explain E&I’s poor performance relative to original expectations, and why it remains enthusiastic regarding the strategic value, despite what appears to be an unmitigated failure if evaluated by the guidance/results presented to investors.

At the time of the merger in September/November 2021, management guided for $570M in sales and $150M in EBITDA for E&I. In February 2022 on the 4Q21 call, management lowered sales expectation 18%, but EBITDA was down approximately 40%.

Management simply noted that E&I faced the same issues VRT was facing. It is unclear why management didn’t figure that out by the announcement date or closing, when VRT along with the entire industry were in the thick of the pricing/inflation problems.

Current guidance for E&I has increased sales to ~$500M, but lowered AOP to $67M, down approximately 52% from original guidance, implying margins roughly half of what was expected. It was a massive downgrade of expectations with almost no explanation.

What if E&I is actually performing inline or close to original guidance?

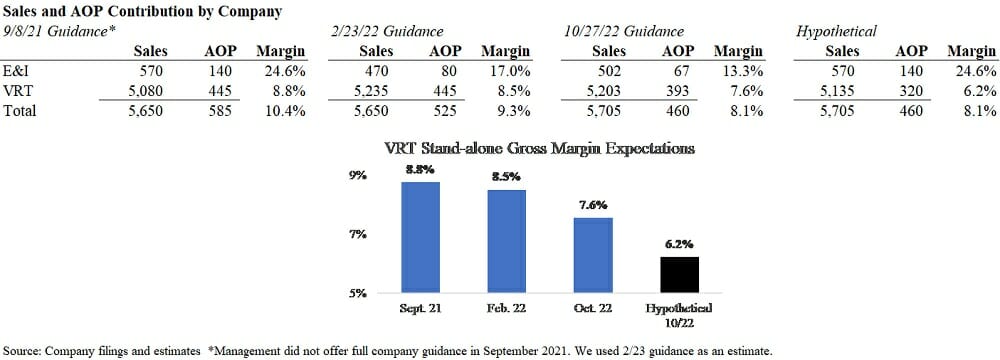

In the table below, we show the evolution of guidance for E&I and VRT to our hypothetical scenario where E&I 2022 results are inline with original expectations. We estimate original E&I guidance of $150M in EBITDA is ~$140M in AOP.

VRT did not offer full-company guidance in September/October 2021; we backfilled the results with expectations set in February 2022.

If E&I is performing as expected, it is generating closer to ~30% of AOP with only 10% of the revenue, implying that margins at VRT as a stand-alone entity have eroded to 6.2% from 8% in 2020 and 8.8% since expectations in September.

The continued erosion shows that VRT’s stand-alone margins remain far below the 7.8% and 9.4% of 2020 and 2021, respectively, and that management has been unable to take effective corrective measures after 2-years.

We do not know for sure if transfer pricing is playing a role in investor presentations. However, there should be evidence when 4Q22 is released. If E&I is generating only 50% of the AOP that was originally expected, VRT should record an impairment to goodwill, which was $1B of the $1.8B net assets acquired. If E&I is performing within a reasonable range of expectations, no impairment charge will be taken.

We assume there is a reason management did not disclose the previous relationship with E&I. At the moment, obscuring transfer pricing issues is the hypothesis that makes the most sense. Recall, at the time the acquisition was announced, management reduced AOP and FCF guidance for 2021 by -10% and -32%, respectively – only to miss the lowered numbers by a wide margin just 3-months later.

If the company went into 2022 without E&I and only 6% AOP margins as our hypothesis suggests, the stock would likely have collapsed like 99% of all other SPACs.

In our view, avoiding wholesale collapse is ample motivation for both the high price tag paid for E&I and the possible the use of internal transfer pricing to obscure continued decline in the much larger, core business.

IV. 4Q22 Positive Guidance Will Not Help the Dismal 2023

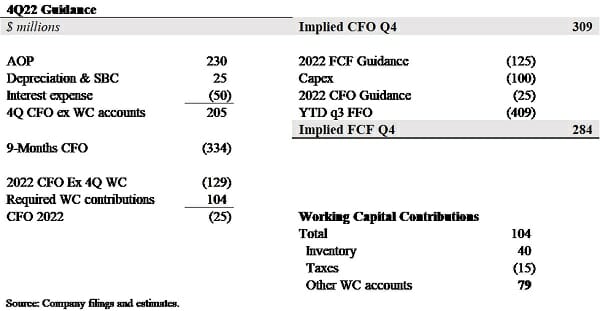

VRT has put focus on delivering the 4Q22 numbers after numerous guidance mis-announcements in its short history. However, even if the AOP number is met, total working capital additions of +$104M required to meet FCF guidance could be a stretch for the company. Moreover, if AR turns into a cash contributor, that will likely accelerate repayments under the factoring ABL facility thus mitigating the benefit.

VRT ended 3Q22 with $258M in cash, down $181M for the 9-month period. The company drew-down $280M from the ABL facility over the time.

The table shows estimated 2022 cash flow in the context of management guidance.

As the table above illustrates Q4 should bring in some much-needed cash. However, the $284M FCF, if achieved, will be used to pay $75M of tax receivable agreement to the company’s PE sponsor along with ~$5M on the term loan and ABL loan (other than FILO) payments. Combined, they will likely halve the cash contribution.

The only way forward is to keep growing sales even at low to negative margin in order to access cash from the ABL facility. The cost is high. Using our estimated true AOP margin of 2.2%, ABL factoring would consume nearly 50% of the incremental margin.

There is around $215M available on the ABL facility and $258M in cash. By our estimate, the cash poor model could lead to VRT’s insolvency in 2H23. Management is doubtless aware of the short funding runway and will have to do an equity offering. If 4Q22 AOP meets/beats, we would expect an offering in 1Q23.

Management’s long history of margin promises goes back to the going public days when company presentation projected AOP margins to improve from 10% in 2018 to 11.7% in 2021 generating $511M and $557M of AOP in 2020 and 2021. The actual results are $342M for 2020 and $470M in 2021 which includes a significant acquisition and litigation settlement adjustment. ($404M net of them.)

Investors should take the promises of $740M of AOP in 2023 or 61% increase from 2022 with appropriate skepticism. After all, instead of a bridge with specific numbers to explain the large increase, the latest management presentation includes a slide stating that VRT is “Transforming to a high-performance culture to drive operational excellence.” It evokes a female parent state with a baked good.[2]

Legal Disclaimer

In no way should this report be taken as investment advice or constitute responsibility for investment gains or losses. The information in this report should not be relied upon for investment decisions. All investors must conduct their own due diligence and consult their own investment advisors in making trading decisions.

This is not a solicitation to transact in any of the securities mentioned. The data herein has been obtained from public sources we believe to be reliable. However, the information is presented on an ‘as is’ basis and we make no warranty of any kind as to the accuracy, timeliness and/or completeness of any material contained in this opinion piece.

[1] Shakira version coming soon.

[2] Motherhood and apple pie.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…