Economics

US Stocks Still Lead Global Markets In 2023 By Wide Margin

Markets around the world took a hit last week, but American shares are still the clear performance leader for the major asset classes year to date, based…

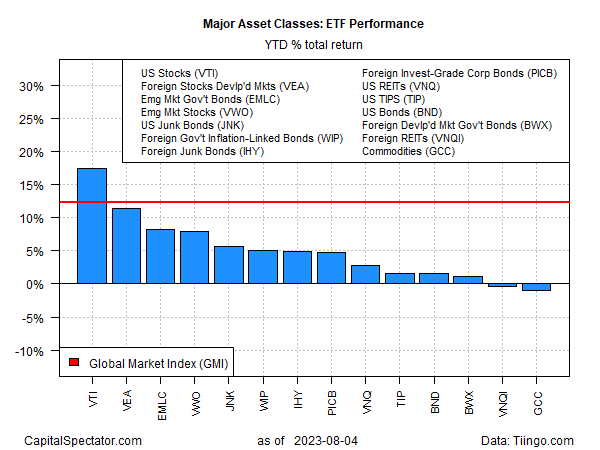

Markets around the world took a hit last week, but American shares are still the clear performance leader for the major asset classes year to date, based on a set of ETFs through Friday’s close (Aug. 4).

Vanguard Total US Stock Market Index Fund (VTI) fell 2.1% last week, its biggest weekly setback since February. Yet the ETF is still up more than 17% for the year. That’s well ahead of the second-best performer for the major asset classes year to date via Vanguard Developed Markets Ex-US Index Fund (VEA), which is ahead by 11.5% in 2023.

The gap between the best and the worst slices of the major asset classes year to date widened to 18.5 percentage points last week after a broad measure of commodities took a hit. WisdomTree Enhanced Commodity Strategy Fund (GCC) fell 1.2% last week, flipping the ETF to a modest loss for 2023.

Despite the latest setbacks, the Global Market Index (GMI) is still up more than 12% this year. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

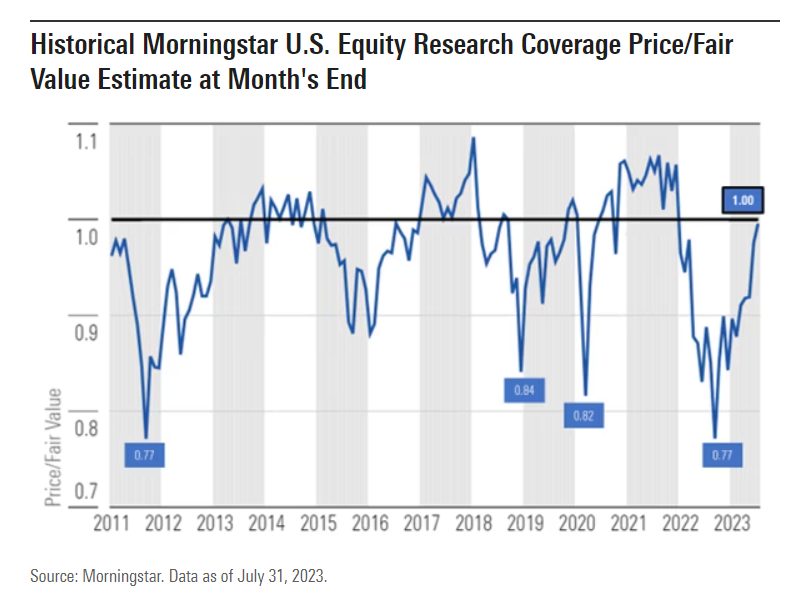

Morningstar advises that US equities overall are now fairly valued. “According to a composite of the more than 700 stocks we cover that trade on US exchanges, as of July 31, 2023, the U.S. equity market was trading at a price/fair value ratio of 1.00.

Looking at fair value estimates for the market’s components suggests that value stocks are worthy of a bigger tilt, Morningstar reports. “Based on our valuations, we continue to advocate for an overweight position in value, and to underweight both growth and core categories. We also continue to recommend overweighting mid- and small-cap stocks.”

Meanwhile, markets will be keenly focused on Thursday’s update of US consumer inflation data for July, which is expected to report mixed results (scheduled for Aug. 10). The consensus point forecast sees the potential for a setback in the inflation battle brewing, according to Econoday.com. Headline CPI is expected to rebound a bit to a 3.3% year-over-year pace from June’s 3.0%. Relatively mild stuff, given the fall from 9% back in mid-2022. But if this week’s forecast is correct, the modestly firmer price trend will mark the first time in more than a year that headline CPI’s annual rate accelerated.

Core CPI is expected to hold steady at a 4.8%, but that’s still a substantially hotter pace and well above the Fed’s 2% inflation target. Bottom line: markets may face more turbulence if the CPI numbers stoke new concerns that the Federal Reserve’s interest-rate hikes may roll on.

Comments by Federal Reserve Bank Governor Michelle Bowman over the weekend suggest that stalled progress on inflation will strengthen the central bank’s resolve to extend its policy tightening in the months ahead. “I also expect that additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2% target,” she said in prepared remarks for a speech this past Saturday.

Monetary policy is not on a “preset course,” she reminded, explaining: “We should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled.”

Thursday’s inflation report will help the central bank and markets reassess the current state of recent disinflation progress.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

inflation

commodities

commodity

monetary

markets

reserve

policy

fed

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…