Economics

US Economy Still Appears On Track For Rebound In Q3 GDP Data

The US economic outlook remains dicey as various macro and geopolitical risk factors continue to swirl, but a rebound is still intact for the current nowcast…

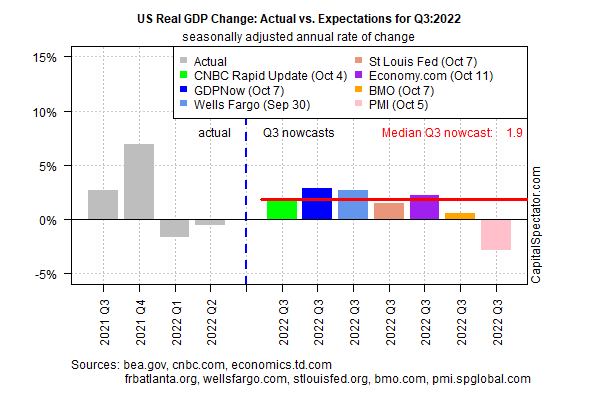

The US economic outlook remains dicey as various macro and geopolitical risk factors continue to swirl, but a rebound is still intact for the current nowcast of the upcoming third-quarter GDP report, based on the median for a set of estimates compiled by CapitalSpectator.com.

Today’s revision indicates a moderate 1.9% increase in Q3 GDP (seasonally adjusted annual rate). The nowcast marks a bounce from the previous update at September’s end. More importantly, if the median estimate is correct, US GDP will post its first quarterly increase this year. The official data from the Bureau of Economic Research is scheduled for release on Oct. 27.

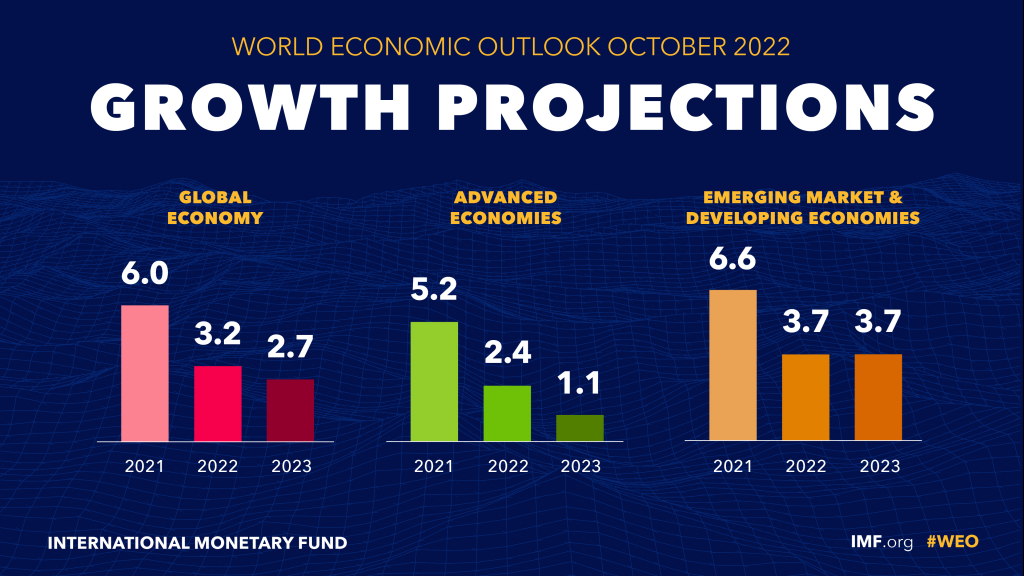

Despite the relatively upbeat outlook for output in Q3, macro risks appear to be rising, suggesting that any rebound in US economic activity in the July-through-September period could be short-lived. The IMF, for example, issued a new warning for the global economy on Tuesday, advising in its World Economic Outlook report: “The worst is yet to come, and for many people 2023 will feel like a recession.”

For the US, the odds now favor the start of an NBER-defined recession in November, according to a set of proprietary indicators published in The US Business Cycle Risk Report. As outlined at CapitalSpecator.com last week, economic activity looks set to skew slightly negative next month.

A key factor that persuades many economists that US output will contract, or at least slow to a crawl in the months ahead, is the ongoing tightening of monetary policy by the Federal Reserve. “I fear that we risk a very high probability of a damaging recession that was totally avoidable,” says Mohamed El-Erian, Allianz’s chief economic adviser. “Even [Federal Reserve] Chair Powell has gone from looking for a soft landing to soft-ish landing to now talking about pain. And that is the problem. That is the cost of a Federal Reserve being late. Not only does it have to overcome inflation, but it has to restore its credibility.”

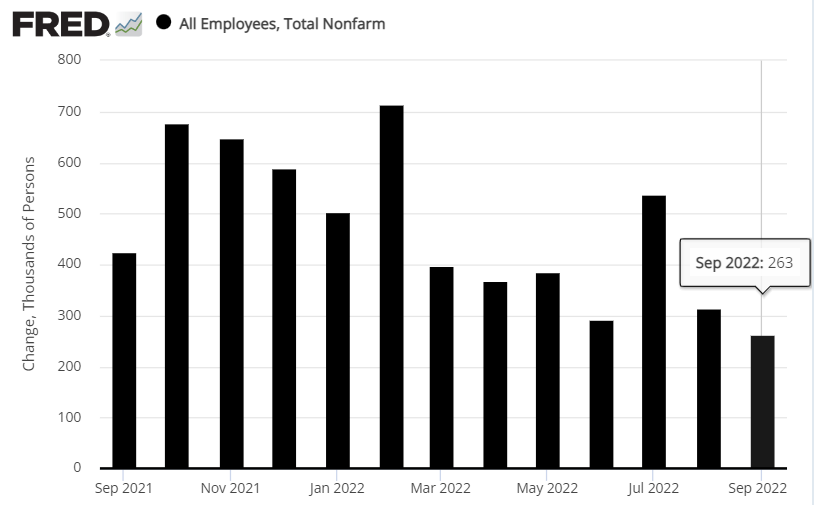

A strong labor market remains a positive counterpoint to the gloomy estimates. US payrolls rose 263,000 in September. That’s a solid gain, but it’s also the softest increase since April 2021 and highlights the fact that the pace of hiring continues to slow.

Bottom line: the fourth quarter is shaping up as the acid test for US economic resiliency. Perhaps it’s too close to call at this point for deciding if output will stay positive or not. The upcoming Q3 GDP report will be a key release for deciding how to manage expectations. For the moment, a rebound in growth appears likely.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…