Economics

US Economic Growth Expected To Continue In Q4

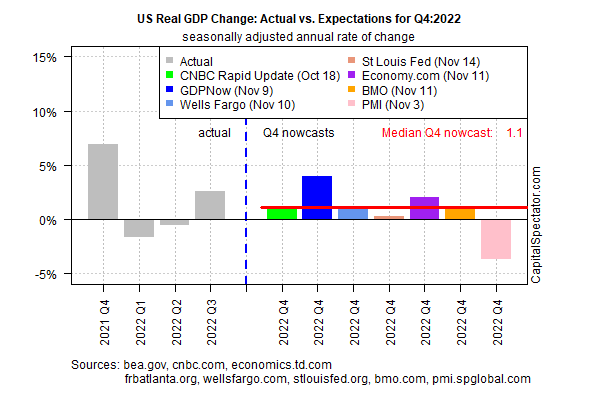

The recovery in US economic activity in the third quarter appears set to continue in Q4, based on the median for a set of estimates compiled by CapitalSpectator.com….

The recovery in US economic activity in the third quarter appears set to continue in Q4, based on the median for a set of estimates compiled by CapitalSpectator.com. Although the numbers point to a slowdown in growth, the current Q4 nowcast highlights the possibility that output will post back-to-back quarterly increases for the first time this year.

Today’s Q4 estimate indicates a modest 1.1% increase in Q4 GDP (seasonally adjusted annual rate). The nowcast marks a substantial slowdown from Q3’s 2.6% increase. The official Q4 data from the Bureau of Economic Research is scheduled for release on Jan. 26.

The outlook for continued growth in Q4 pushes back on the recession narrative that’s been circulating lately, but it’s premature to assume that the danger for the business cycle has passed. The full effects of the Federal Reserve’s recent interest-rate hikes have yet to fully impact the economy and so the risk of downgrades to growth are a real and present danger in the weeks ahead.

The inverted 3-month/10-year US Treasury yield curve continues to paint a dark outlook for the economy. The spread between the two maturities fell deeper into negative terrain on Tuesday, signaling heightened risk of a US recession in the near term.

“Nothing is certain in these markets but yes, I think [the inverted yield curve] is a strong clue of a recession ahead,” says Antoine Bouvet, a senior rates strategist with ING.

For now, however, the numbers published to date still reflect economic growth. Notably, US payrolls continued rising in October, although the increase is the softest in nearly two years. But initial jobless claims – a leading indicator – remain low, suggesting that a recession isn’t imminent.

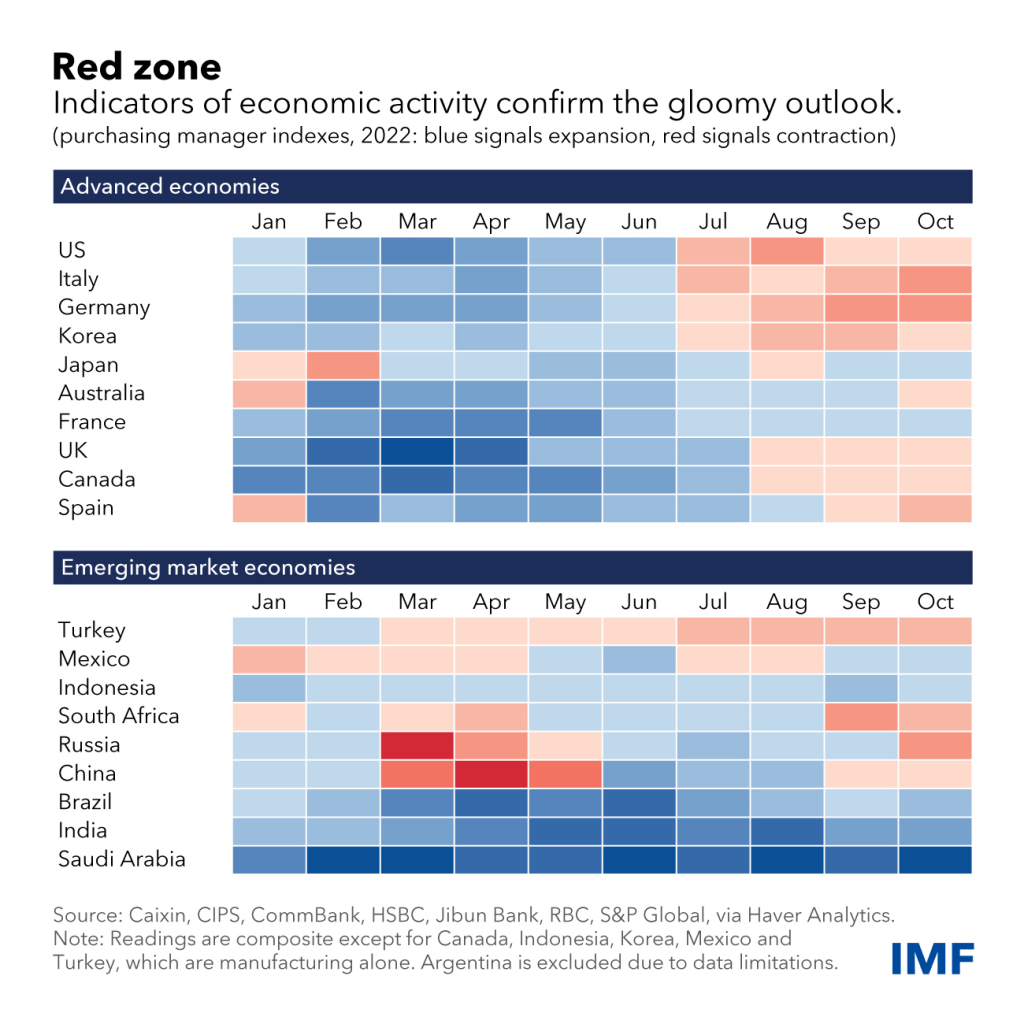

The next several months, however, will be a stress test as economies around the world face the accumulating effects of interest rate hikes and blowback from the ongoing Ukraine war.

“Readings for a growing share of G20 countries have fallen from expansionary territory earlier this year to levels that signal contraction,” writes Tryggvi Gudmundsson at the International Monetary Fund. “That is true for both advanced and emerging market economies, underscoring the slowdown’s global nature.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…