Economics

Seriously? Swissie a Safe Haven During a Banking Crisis?

We are reposting an oldie but goldie piece, given the market jitters over Credit-Suisse. We are baffled by the conventional wisdom that a bank run or crisis…

We are reposting an oldie but goldie piece, given the market jitters over Credit-Suisse.

We are baffled by the conventional wisdom that a bank run or crisis is deflationary.

Yes, in the early 1930s, when the Fed and other central banks failed to provide liquidity and perform their duty as the “lender of last resort” to banks experiencing bank runs. Banks failed, closed their doors, savers lost everything, and the money supply, according to Milton Friedman, shrank around 25 percent.

Printing Press Redux

We know from recent experience the central banks will do whatever it takes to save the system. And whatever it takes means firing up the printing press until the cows come home.

You smell deflation; I smell inflation and lots of it.

Moreover, look at the Bank Assets to Home Country GDP chart below, — albeit old and outdated — and note how overbanked the European financial system is, most notably in Switzerland. If the past few days evolve into a full-blown banking crisis – a “big if” – the ECB and SNB will be forced to do a lot of “whatever it takes.”

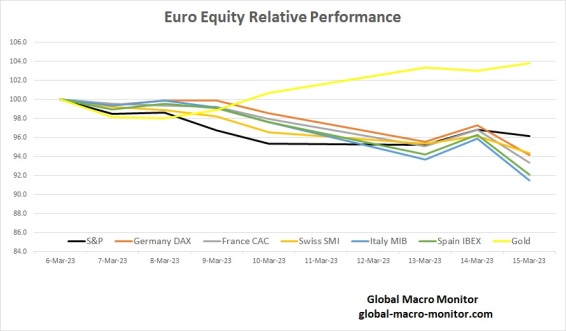

A banking crisis in vulnerable Europe is relatively and significantly more destabilizing than in the United States. Markets sniff it and are spanking European equities.

Seriously? Swissie a Safe Haven During a Banking Crisis?

Here’s in an interesting chart, originally posted over at Zero Hedge, that makes us wonder do we really want to be long the Swiss franc during a European banking crisis? Note the chart may be a little dated, but we think you get the picture. Click chart for bigger picture and better resolution.

(click here if chart is not observable)

(click here if chart is not observable)

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…