Economics

Trade Deficit Shrinks Dramatically: Interpretations

The trade balance [November release] rose to -$83.3 billion vs. Bloomberg consensus of -96.3 billion. The goods trade deficit with China also shrank sharply….

The trade balance [November release] rose to -$83.3 billion vs. Bloomberg consensus of -96.3 billion. The goods trade deficit with China also shrank sharply.

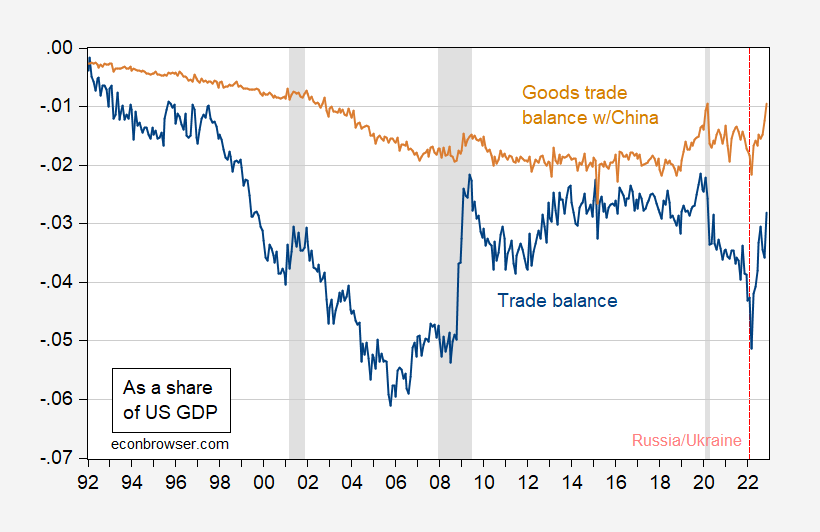

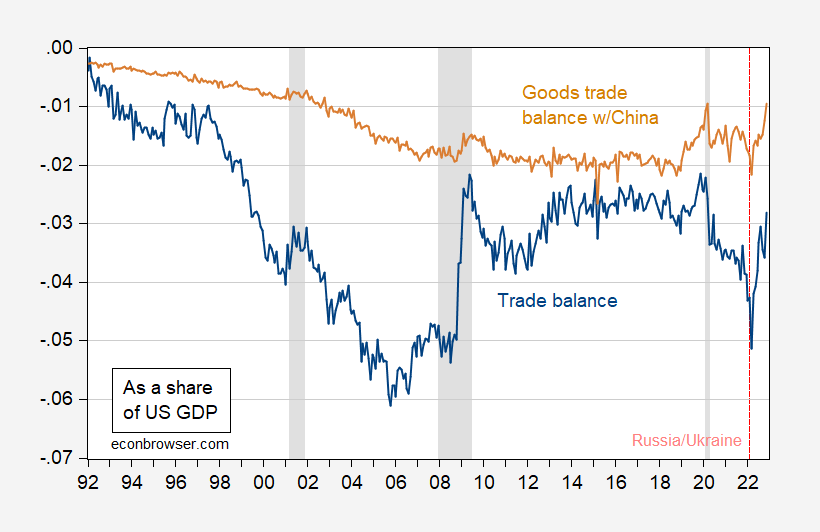

Figure 1: Trade balance as a share of GDP (blue) and goods trade balance with China (tan). US goods exports to, imports from China seasonally adjusted by author using X-13. GDP is IHS-Markit S&P Global. NBER defined peak-to-trough recession dates shaded gray. Source. BEA via FRED, IHS-Markit, NBER and author’s calculations.

The sharp improvements were caused by import declines exceeding export declines. While sharp, at least part of the decline made sense given past US dollar depreciation.

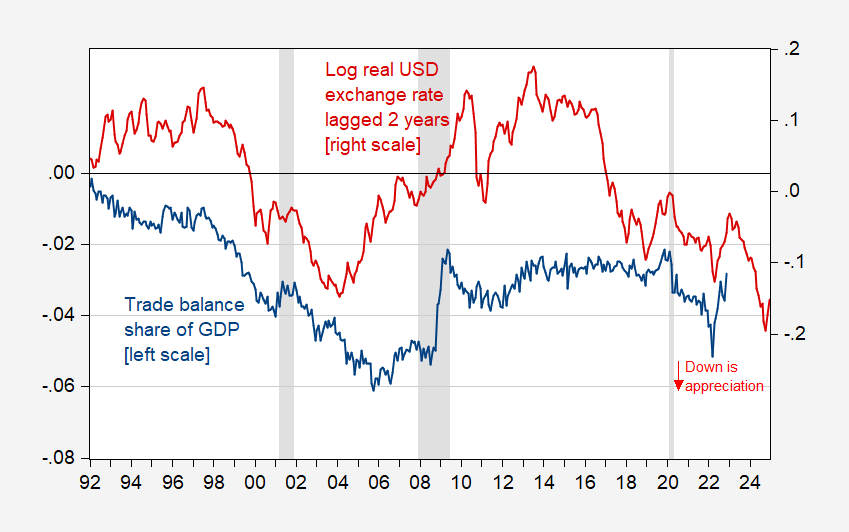

Figure 2: Trade balance as a share of GDP (blue, left scale) and real US dollar exchange rate against a broad basket of currencies, in logs 2006M01=0, lagged two years (red, right scale). GDP is IHS-Markit S&P Global. Real dollar is goods trade weighted through 2005; goods and services trade weighted thereafter. NBER defined peak-to-trough recession dates shaded gray. Source. BEA via FRED, Federal Reserve via FRED, HS-Markit, NBER and author’s calculations.

I’ve plotted the two series so that they should show a positive correlation, with a 2 year lag. Certainly, over the most recent two year period, the correlation is showing up as expected. That being said, with the dollar appreciation that occurred in the preceding two years, we should expect some return to expanding deficits, depending in part on how GDP evolves both at home and abroad.

Is the improvement in the trade balance good news insofar as GDP is concerned? In a mechanical sense, conditioning on the other components of GDP as already measured, a smaller trade deficit means the estimate of current GDP should be raised. On the other hand, to the extent that the imports are falling because of decreased import demand from reduced expenditures, rather than from expenditure switching, that means that the prospects for future GDP growth are darkened.

I’m not sure that we can infer from the composition of the import decline. Consumer goods led the decline, percentage-wise; however, given the boom in consumer spending on goods over the past year, I’m not sure what to make of this. Capital goods imports accounted for a much smaller decline, so maybe this does not signal an investment cutback due to a perceived incipient recession.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…