Economics

Top Swiss Watch CEOs See Gloomy Outlook As Demand Woes Materialize

Top Swiss Watch CEOs See Gloomy Outlook As Demand Woes Materialize

Following an unprecedented surge during the pandemic, the luxury watch…

Top Swiss Watch CEOs See Gloomy Outlook As Demand Woes Materialize

Following an unprecedented surge during the pandemic, the luxury watch market has been in a downturn for about a year. The current question is whether the watch market’s bottom is in or if prices are set to take another leg down.

To answer that question are industry insiders from some of the biggest Swiss watch brands, from Patek Philippe to Oris, who offer a gloomy outlook.

“I see in the past two months, the market is a little bit slower than before,” Thierry Stern, the chairman and controlling shareholder of Patek Philippe SA, the family-owned Geneva-based brand, told Bloomberg in an interview.

“I don’t say that it’s very bad — not at all. But I just see that it’s slowing down,” Stern added.

Even though Swiss watch manufacturer Oris has seen revenues jump double-digit percentage points so far this year, Co-CEO Rolf Studer said signs of softening demand from retail orders are beginning to hit.

“The sell-out has been continuously good but then stocking has been a little bit softer,” Studer said in an interview.

Comments from the heads of Patek Philippe and Oris come after a blowoff top in demand and record Swiss watch exports during the pandemic. Trillions of dollars in central bank money printing had to find a home, and one of those homes was mechanical timepieces.

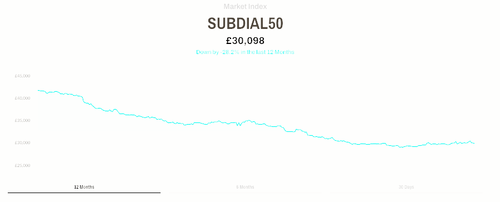

One example of the cooling demand in the secondary watch market is the downturn in the Subdial50 index, an index tracking the top 50 most traded second-hand luxury watches on the pre-owned market. The index is down 28% in the last 12 months.

There are no indications that the Subdial50 index will experience a substantial recovery in the coming months, as the IMF warned Tuesday the world faces an increasing risk of a hard economic landing after central banks aggressively tightened and ignited financial stability concerns.

So if you’re trying to buy the dip in the luxury watch market, the insight the heads of at least two Swiss watch companies give is that demand is slowing, thus more supply, and likely more downward pressure of secondary market prices.

Tyler Durden

Thu, 04/13/2023 – 05:45

central bank

money printing

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…