Economics

Tomorrow’s Federal Reserve Meeting Could Mark This Bear Market’s End

Tomorrow, May 3, the Federal Reserve will announce its latest plans for U.S. monetary policy. And it may be the most important day of the year for stocks.

Why?

Because…

Tomorrow, May 3, the Federal Reserve will announce its latest plans for U.S. monetary policy. And it may be the most important day of the year for stocks.

Why?

Because it could determine whether the stock market falls back into an ugly bear market or starts a new bull market breakout.

That’s because tomorrow is so-called “Fed Day.” At around 2 p.m. EST, the U.S. Federal Reserve will announce its rate-hike decision for the month of May. Thirty minutes later, Fed Board Chair Jerome Powell will take the stage in a live press conference to answer questions about the Fed’s policy stance and potential future rate hikes.

This Federal Reserve press conference will be the make-or-break moment for stocks.

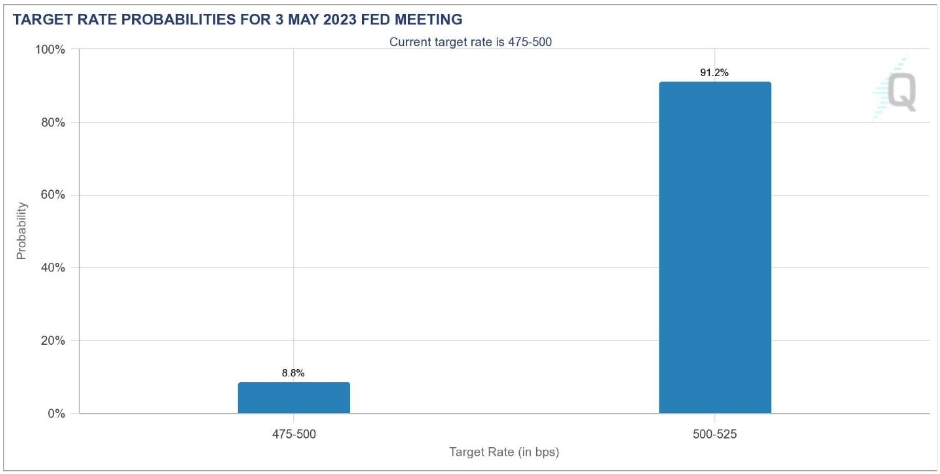

Pretty much everyone knows the Fed is going to raise interest rates by 25 basis points tomorrow. The futures market is pricing in 90% odds of a 25-basis-point hike and just 10% odds of no hike. All signs point to another rate hike on Wednesday, and therefore, another rate hike is already priced into the stock market.

But investors are much less certain about what the Fed will do at its next meeting in June. Futures pricing suggests a 70% chance the Fed stops its rate-hike campaign next month. But that means the market is still pricing in a 30% chance for another rate hike.

The market will seek clarity on the odds of a June rate hike on Wednesday.

And Powell will provide that clarity in the press conference.

Therefore, if Powell tilts hawkish and suggests another hike is likely, stocks will sink. If he tilts dovish and suggests a pause is likely, stocks will soar.

It is no coincidence that, from a technical perspective, the S&P 500 currently sits at a critical level (4,180). And it could either prove to be the launching point for the next leg higher in the 2023 stock market rally – or that rally’s ceiling.

The bulk of evidence strongly suggests Powell will lean dovish and stocks will soar.

Determining the Fed’s Next Moves

Let’s look at the things that determine the Fed’s decision-making: inflation and employment.

For starters, inflation is coming down rapidly. The Fed has already successfully cut inflation in half from its peak, and most signs suggest inflation will continue to decline.

Commodity prices keep falling. Global supply chains have been fully restored. Consumer spending is slowing.

And, perhaps most importantly, bank lending is collapsing.

Bank lending fuels the U.S. economy. The more banks lend, the more money consumers and enterprises have to spend and the higher the demand side of the inflation equation.

But bank lending has fallen off a cliff over the past month, driven mostly by the failures of Silicon Valley Bank, Signature Bank and, most recently, First Republic.

Indeed, bank lending over the past four weeks has dropped by the most it has since the 2008 financial crisis and by the third most in the history of the U.S. economy.

With bank lending collapsing, inflation should keep collapsing toward the Fed’s 2% target.

In fact, just look at the last two times bank lending crashed like it is crashing today: late 2001 and late 2008. Both times, the Fed was cutting rates and inflation was at 1%.

The Fed appears to have solved the inflation problem.

Consequently, it potentially created a labor problem.

Throughout 2022, the theme of the labor market was “labor shortage.” Now, it’s “job cuts.” For the first time since early 2021, companies are mentioning “job cuts” more frequently than “labor shortage” on their conference calls.

The labor market shift has begun.

And the Fed has a dual mandate: stable prices and full employment. It’s hiked rates enough to the point of reattaining price stability. Yet it appears to be just one to two hikes away from killing the labor market.

Considering this dual mandate, then, the Fed should slam the pause button in June.

We suspect Powell will hint as much tomorrow in the press conference.

The Final Word on the Federal Reserve

It’s easy to play the “tough guy” and stay aggressive with rate hikes when everyone still has a job. It is near impossible to do so when people start losing their jobs.

Well, people are starting to lose their jobs. Historically speaking, this is when the Fed pauses.

And when the Fed pauses, stocks tend to rally.

In short, stocks are on the cusp of a major make-or-break moment. And whether or not we sprint into a new bull market or remain stuck in a bear market could be determined tomorrow.

We think the odds rest strongly in the bulls’ favor.

Either way, it is time to buckle up.

If we do get a dovish Fed and huge breakout rally, then we strongly believe this portfolio of stocks will absolutely soar – with potential returns of 50%-plus by summer’s end.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The post Tomorrowâs Federal Reserve Meeting Could Mark This Bear Marketâs End appeared first on InvestorPlace.

inflation

commodity

monetary

reserve

policy

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…