Economics

This new CPI read is nuts: Inflation’s ‘clearly peaked’. Risk of more hikes ‘now very high’. Probs ‘soon as next week’.

The Reserve Bank Governor basically spent 30 minutes saying his board doesn’t know what they’re doing and are pretty much … Read More

The post This new…

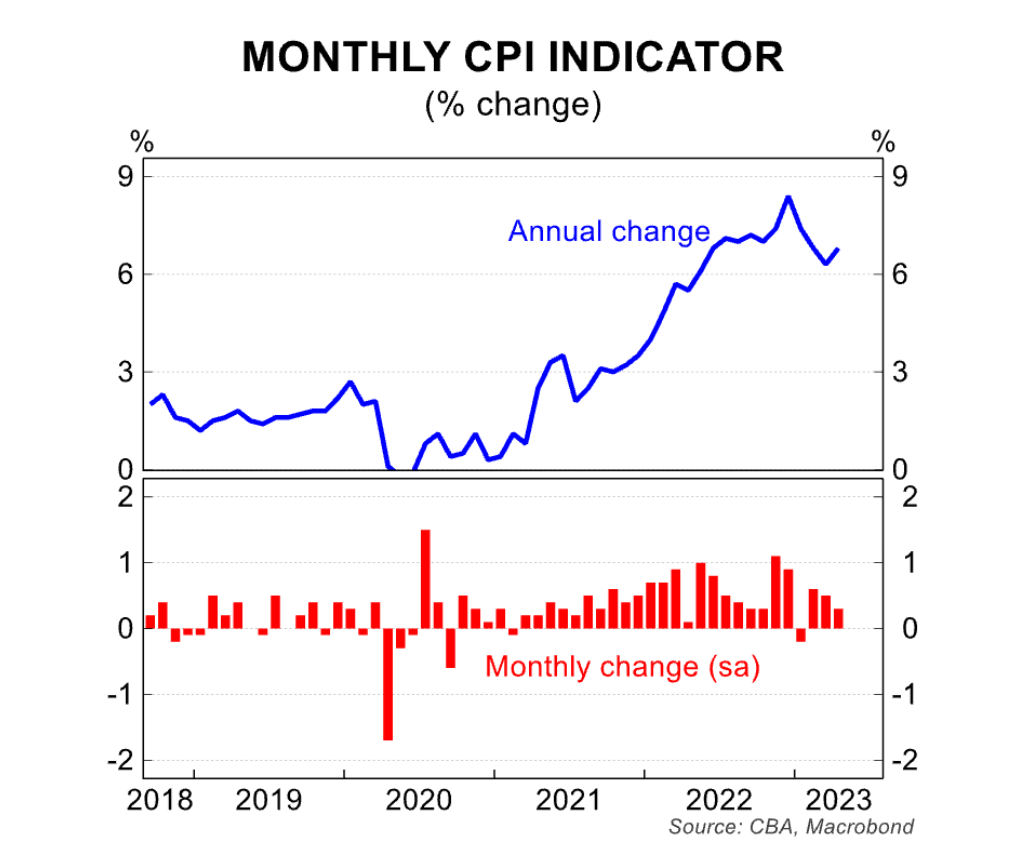

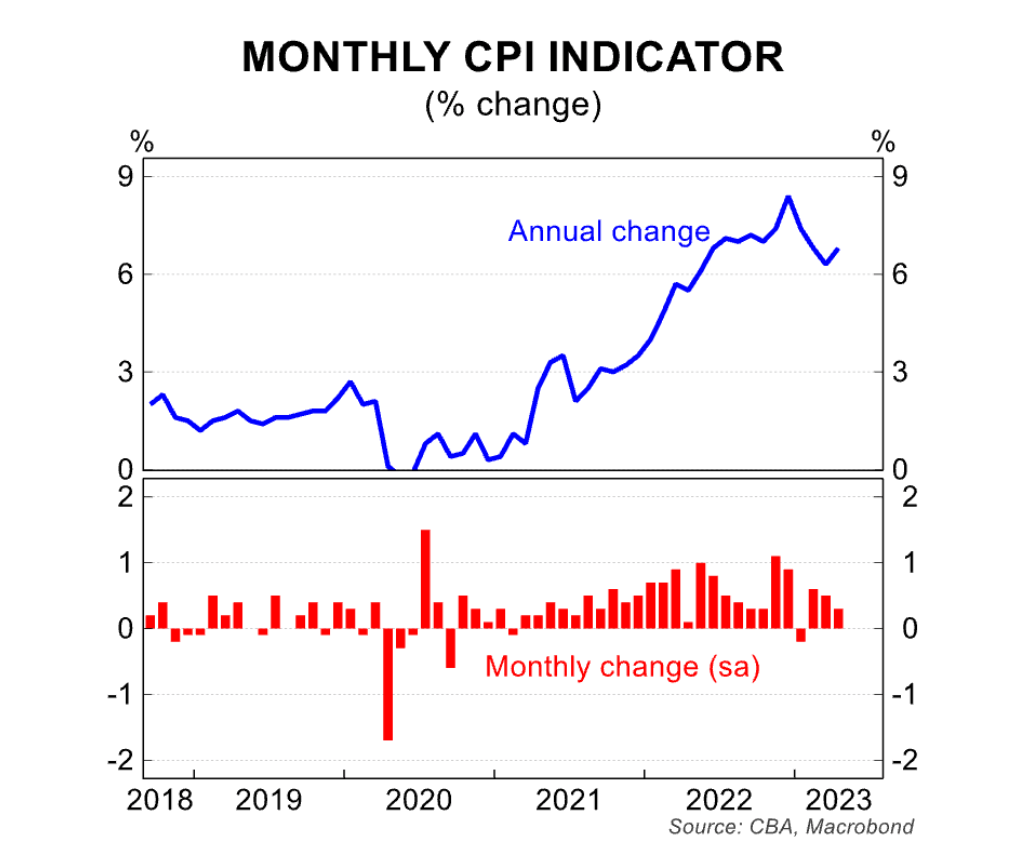

- Consumer prices rose 0.3% for April, slower than the 0.5% pace recorded in March.

- Yet the 6.8% annual rate snapped market expectations of just 6.4%

- CBA says “inflation has clearly peaked”; AMP decides “the risk of another rate hike is now very high.”

Be careful what you wish for.

The ABS on Wednesday when it dropped the new monthly quasi-basket of rising prices:

The consumer price index (CPI) is a quarterly measure of inflation published by the Australian Bureau of Statistics (ABS).

The ABS also publishes a monthly CPI indicator, which is more timely and includes updated prices for around two-thirds of the CPI basket each month.*

*This one is pretty new. We (Australia, the RBA, economists I like) needed it to go monthly because the quarterly measurement was a hella long time to wait for inflation data when everyone else knows how bad theirs is per month.

But it’s also caused a little confusion.

Kicking back at his now regular senate BBQ in Canberra on Wednesday – his punishment for repeatedly promising that at 0.1% the cash rate ‘would not move up until actual inflation rises between 2 and 3 percent which is not expected to happen until 2024 at the earliest.‘ – the Reserve Bank Governor Dr P Lowe basically spent 30 minutes saying his board doesn’t know what they’re doing and are pretty much slaves to the stats when it comes to what comes next for Aussie rates.

‘Data-dependent mode’ is how Lowe described the current decision making process for the central bank, raising a million, possibly a trillion questions from me alone. The most pressing around what the RBA’s normal ‘mode’ is and just how many other modes it’s currently operating on.

He finished up just in time to be entirely unhelped by the Bureau of Stats’ new stats on inflation for April.

The ABS CPI Indicator for April has Aussie consumer prices (remember: more timely, yes – but only made up of prices for circa 66% of the full CPI basket) rising by 0.3% over the month (seasonally adjusted), which Commonwealth Bank economists report – in what appears to be a slightly husky tone – that ‘the inflationary impulse is cooling.’

The annual rate of inflation, however, king hit expectations. It hit 6.8% from 6.3% prior and 6.4% expected.

The monthly CPI read is at least, a step down in the pace of growth from February (+0.6%) and March (+0.5%).

But over at Capital Economics, Asia-Pacific senior economist Marcel Thieliant is reading this read radically differently.

“It now looks more likely than not that Q2 inflation will overshoot the RBA’s forecast of 6.3%,” Thieliant says. “Coupled with the increasing strength of the rebound in the housing market and continued sluggish productivity growth, that will almost certainly convince the RBA to raise interest rates again.”

But, wait. More rises? After more slowing? Are you sure Marcel?

“Oui. Perhaps as soon as next week.”

AMP Capital’s Dr Shane Oliver reckons the numbers are getting all-skewed, with the monthly kick partly down to the last April’s crash in fuel prices due to the impact of that fuel excise we’re certainly missing. Add on to that this year’s fulsome 7% rise in the April holiday travel and accommodation costs over school hols and Easter and even a bit of ANZAC day.

“The ABS’s seasonally adjusted CPI also shows a sequential stepping down in monthly inflation from around 1%mom in both November and December to 0.3%MoM in April, which is a good sign,” Dr Oliver reckons.

But, Dr Oliver concedes it is hard to know just how reliable the seasonal adjustment factors are, given that the Monthly CPI is so new. And perhaps because the ABS are a bunch of troopers, but troopers totally outgunned by the volume of their workload.

I won’t go through the detail, there’s clothes and such, but aside from rents just smashing on ahead (and electricity costs rising at at 15.2%YoY set to rise further from July), it’s all just got the feel of a really good first draft of a badly rushed mid-term essay.

CBA called the whacky bits “upside surprises (in) some items in the CPI basket.”

“The good news is that the trend in inflation remains down and our Pipeline Inflation Indicator continues to point to further falls ahead,” CBA economists wrote.

Shane Oliver:

“Given this along with falling real retail sales and signs of a rising trend in unemployment our base case remains for the RBA to keep rates on hold next week. However, with inflation still very high and upside risks to wages flowing from the upcoming minimum wage increase, the still tight jobs market and faster public sector wages growth the risk of another rate hike is now very high.”

That was stronger than market expectations that looked for a slight up‑tick to 6.4% (CBA on consensus).

CBA:

Annual inflation excluding volatile items (fruit & veg and petrol) eased from 6.9% to 6.8%. Inflation excluding volatile items and travel fell from 6.9%/yr to 6.5%/yr.

The bottom line is still that the annual rate of inflation continued to decelerate and is lower than where it was in the December quarter last year and the March quarter this year. Today’s data still suggests inflation has peaked.

So. We’re clear we’re not much clearer on all this.

The post This new CPI read is nuts: Inflation’s ‘clearly peaked’. Risk of more hikes ‘now very high’. Probs ‘soon as next week’. appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…