Economics

The US Dollar’s Influence On The Stock Market Isn’t Trivial

How many factors influence the equity market’s performance through time? It’s a long and variable list and no one’s ever sure about the exact inventory…

How many factors influence the equity market’s performance through time? It’s a long and variable list and no one’s ever sure about the exact inventory in real time, except for Mr. Market, who never speaks on such things. But through the process of reverse engineering we can guesstimate what’s relevant, and what’s not. Among the factors that deserve to be on the short list: the ebb and flow of the US dollar.

Like any one factor, forex risk’s influence on the US stock market is dynamic. It’s also just one piece of an ever-changing puzzle. But for many investors it’s overlooked, but that’s an oversight easily corrected.

The logic here is that there’s a fundamental connection between the US economy and the value of the dollar in foreign-currency terms. That relationship, not surprisingly, spills over into the stock market. As Hilton Capital Management recently explained:

“US-based companies with overseas sales (or investments) in foreign currencies will eventually need to repatriate income back to dollars. Converting a weaker currency into the dollar will translate into fewer dollars, potentially impacting sales and profit expectations. Approximately 30% of S&P 500 Index revenues are generated overseas, which can significantly impact index performance.”

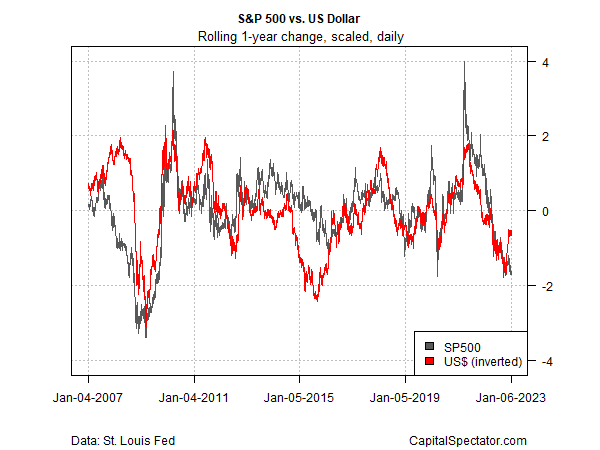

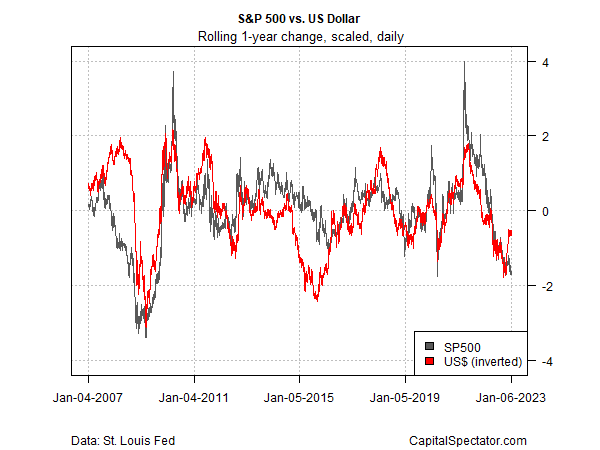

Empirically it’s easy to see the connection. The chart below compares the rolling 1-year change for the S&P 500 Index vs. the greenback (defined as the Federal Reserve’s Nominal Broad US Dollar Index). For a clearer picture of the relationship the US dollar change is inverted and both time series are scaled.

The dollar-stocks dance isn’t perfect. Indeed, sometimes the relationship is close to non-existent. But at the extremes there’s useful information to consider.

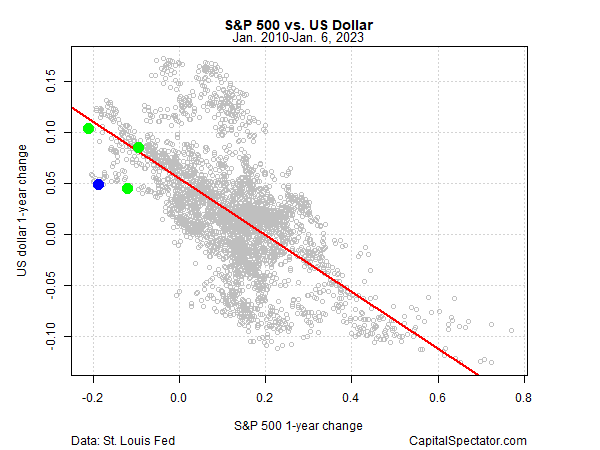

For another perspective, the next chart shows how the 1-year change in the S&P 500 stacks up against the 1-year change for the US dollar. Note that in this chart the dollar’s change is raw (i.e., it’s not inverted) and the numbers aren’t scaled. The current data is shown by the blue dot: the S&P is down by nearly 19% vs. the year-ago level (as of Jan. 6) while the US dollar is higher by roughly 5%. The three green dots show the data sets for the previous trio of points when the S&P’s 1-year return was at a recent trough. The red line is the regression of the relationship.

The implication: the deeper the S&P 500’s 1-year decline when the US dollar’s 1-year return is relatively high is a factor that suggests the weakness in stocks is relatively extreme and due for a rebound. Yes, there are other factors to consider. The equities-dollar relationship is but one variable for estimating ex ante performance. Context is important, but this much is clear: ignoring forex risk is effectively throwing away valuable information for managing expectations on the equities outlook.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…