Economics

The Treasury Put Will Turn Investing On Its Head

The Treasury Put Will Turn Investing On Its Head

Authored by Simon White, Bloomberg macro strategist,

Large and persistent fiscal deficits…

The Treasury Put Will Turn Investing On Its Head

Authored by Simon White, Bloomberg macro strategist,

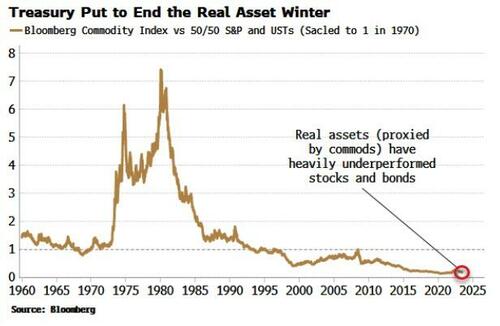

Large and persistent fiscal deficits will entrench inflation and decimate the long-term real return of stocks and bonds, while reversing the secular underperformance of real assets.

Leviathan is back. After the post-GFC years of fiscal restraint, governments around the world are now running persistently higher deficits. This is a sea change, and it means a markedly different investment environment.

The Fed put was a backstop for financial assets. But the Treasury put is a different beast.

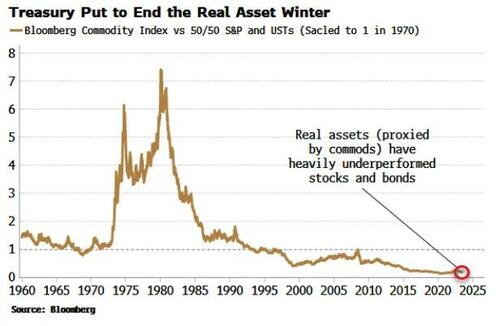

Assets may be able to post a positive nominal return, but in real terms they are likely to do poorly. Real assets, after 60 years of dreadful underperformance, are poised to finally begin outpacing stocks and bonds.

For the years following the Lehman crisis, the Fed put was the norm. Exceptionally loose monetary policy ensured risk assets had a safety net. But central banks were unable to rehabilitate the real economy while governments kept their belts tight. That belt began to loosen in the years leading up to the pandemic, and then snapped altogether during it.

Fiscal and monetary policy were now working hand-in-glove. Governments rewrote the rulebook on what they would backstop: jobs, businesses, consumption – nothing was seemingly outside its remit. Creating money is one thing, but to have an impact on the real economy it must be spent, and governments fulfilled that role in spades. Finally, the full force of monetary expansion was realized.

The pandemic and its effects have now largely faded, but the fiscal deficits remain. With economies now more reliant on government spending, and the electorate’s ever-higher expectations of what their governments should shield them from – job loss, ill health, high energy prices, even death – it is becoming increasingly difficult to see how sovereigns can rein deficits back in to pre-pandemic norms any time soon.

Russell Napier of Orlock Advisors has called this the Treasury put. But what does it mean?

From a market perspective, it means structurally higher inflation and bond yields, and a weaker dollar. It also means a constructive environment for stocks (in nominal terms), due to the reduced risk of severe recessions. Furthermore, it means real assets should begin outperforming financial assets.

Governments running persistently large deficits is almost certainly not sustainable over the long term, even more so when unfunded pension and health-care liabilities are included. Nonetheless, that is where we are for now, so let’s look at this new paradigm more closely.

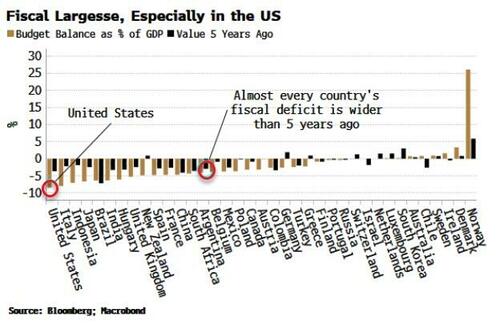

The pandemic is behind us, but fiscal deficits in almost every country are more than what they were five years ago. Most egregious is the US, whose deficit is not only still more than twice the size it was in 2017, but is the largest in the world in GDP terms.

Over the last 50 years, it is unprecedented for the budget deficit to be so wide outside of a recession (assuming the US is not quite in a recession just yet).

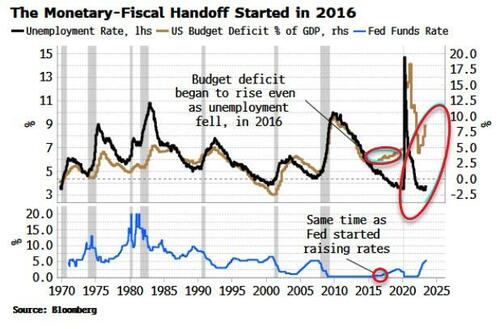

2016 was a pivotal year. Prior to that, the budget balance moved almost in lockstep with the unemployment rate. Taxes and fiscal stabilizers such as job insurance move up and down with the economic cycle and thus the unemployment rate. But in 2016 that changed. The budget deficit rose even as the unemployment rate fell.

The proximate cause was mainly the rise in the cap on discretionary spending. But the remote cause was the Fed raising rates for the first time since the financial crisis and no longer expanding its balance sheet. Fiscal policy had begun to support monetary policy. This was a mere hors d’ouvre for what was to come in the pandemic, but it was in 2016 the Treasury put was born. It will prove to be more potent than the Fed put.

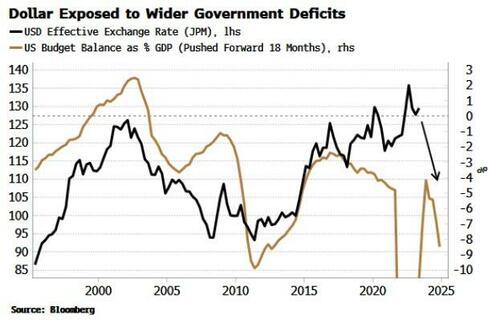

For the dollar, it will be increasingly detrimental. Large fiscal deficits point to a structural decline in the currency. The lags vary but average around a year and a half. The dollar’s current downtrend has come around almost right on cue after the US’s massive fiscal expansion.

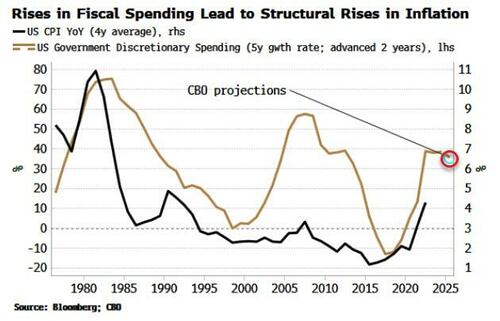

A weaker dollar has fanned the flames of inflation. Yet this is just one vector of price growth. Governments are inherently inflationary, with the chart below showing that significant rises in discretionary spending lead to structural rises in price growth. Swollen fiscal deficits ensure inflation is likely to remain supported over the long term, which risks a secular increase in bond yields from rising term premium.

The years of the Treasury put will be radically different.

Monetary policy will be trying to dispel inflation rather than rouse it. Real returns will be more consequential than nominal returns, and real assets such as commodities will end their long underperformance against financial assets. Adaptability is key to prospering in this new investing world.

Tyler Durden

Thu, 07/20/2023 – 08:20

dollar

inflation

commodities

monetary

policy

fed

monetary expansion

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…