Economics

The Stock Market Forecast For Next 3 months: Buckle Up

Unravelling the Secrets of Stock Market Success: Updated July 2023 Forget about determining the stock market forecast for next 3 to 6 months or even…

Unravelling the Secrets of Stock Market Success:

Updated July 2023

Forget about determining the stock market forecast for next 3 to 6 months or even 1-year forecasts. How can you truly trust the accuracy of such predictions if you don’t even know what factors to consider? It’s time to delve into what truly matters. Here’s a concise summary of key aspects you should focus on:

1. Mass Psychology: Understand the collective sentiment that drives market behaviour. Tap into the power of understanding how the majority thinks to gain an edge.

2. Contrarian Investing: Embrace a different perspective and seek opportunities where others fear to tread. Learn how to identify undervalued assets poised for potential growth.

3. Spotting Emerging Trends: Anticipate market shifts by identifying sectors on the verge of breakthroughs. Stay ahead by recognizing emerging trends before they become mainstream.

4. Identifying Strong Stocks: Discover the method for pinpointing robust stocks within those promising sectors. Uncover the criteria that separate the winners from the rest.

5. The Basics of Technical Analysis (TA): Master the fundamentals of TA, a powerful tool for fine-tuning your entry and exit points. Enhance your decision-making process with technical indicators.

Remember, there’s no magic formula guaranteeing success. However, when you integrate and apply the above strategies, your chances of achieving remarkable results significantly increase.

Dealing With Reality: A Pragmatic Stock Market Forecast for Next 3 Months

Stupidity begets more stupidity; it is astonishing to see how the masses still place so much faith in these silly forecasts when it has been proven, time and again, that most experts know next to nothing. Monkeys with darts fare better than most experts in the stock market; that should give anyone pause for thought.

The stock market can be a complex and unpredictable entity. Hence, coming up with a stock market forecast for next 3 months is not easy. While many investors rely on projections and predictions to guide their decisions, it’s essential to consider the bigger picture and focus on trends instead. In this essay, we’ll explore why trends are a more reliable indicator of stock market performance and how to use them to make informed investment decisions.

Firstly, it’s essential to acknowledge that relying solely on forecasts and predictions can be risky. Many so-called experts have been repeatedly proven wrong, and studies have shown that even monkeys with darts can perform better than most market analysts. This should give investors pause and encourage them to think beyond short-term predictions.

Unearthing Patterns in the Market: From Novice to Knowledgeable

One of the biggest mistakes made by novice investors, and even those who have spent considerable time in the markets, is failing to learn and educate themselves truly. Merely absorbing useless news or blindly following other people’s trading ideas does not lead to growth. It’s crucial to remember that what works for someone else may not work for you. Your risk profile, mindset, and discipline (or lack thereof) are unique; thus, you must develop your customized strategy.

Incorporating ideas from successful traders into your trading style can be beneficial, but blindly following their every move will eventually lead to losses. Instead, please keep it simple and focus on the fundamentals. Novice traders should start by identifying the trend. Investors better understand the market’s performance and direction by analysing long-term trends and patterns. This enables them to make informed decisions rather than relying on guesswork or hearsay.

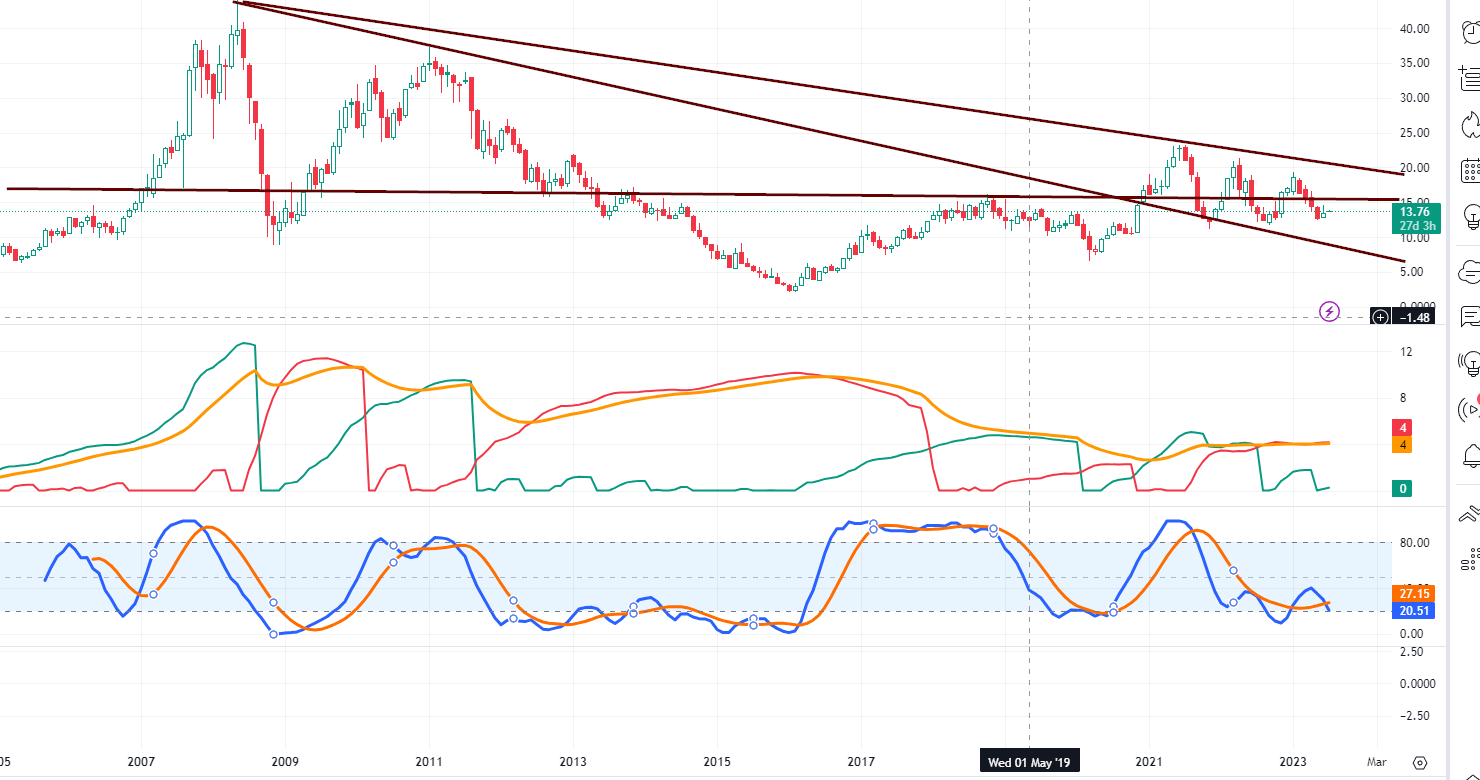

When analyzing trends, pay close attention to the V readings, as displayed in the accompanying image. These readings offer valuable insights into market volatility, aiding investors in anticipating potential shifts. While the current market may be at an all-time high, monitoring the trend and watching for signs of stability or decline remains crucial.

Remember, the key to success lies in developing your personalized strategy. Invest time learning, adapting, and growing, and you’ll be on your way to achieving your financial goals in the markets. Remember, the trend is your friend; everything else is rubbish or noise.

A great read: Unlocking the Power of the Best Stock Market Indicators

Trend Analysis: Unveiling the Next Stock Market Prediction

In today’s market, it’s clear that active players with skin in the game are driving the bullish trend. However, while some quickly jump on board, a contrarian perspective reveals a more cautious approach is needed. While the masses may be far from bullish, the active players driving the market are getting ahead of themselves. Giving these players more weight than before is essential, as the sidelines have been crowded for an unusually long period. If all those with skin in the game turn bullish, it’s a contrarian signal that the market is ripe for a pullback.

However, it’s essential to view this pullback through a bullish lens. Almost every market performs well, including stocks, bonds, precious metals, and bitcoin. It’s rare to see so many markets performing so well over such a short period, which is abnormal and warrants caution. Rather than aiming for more aggressive entry points, we take a more conservative approach in 90% of all our pending plans. While jumping on the bullish bandwagon is tempting, a contrarian perspective demands caution and a more measured approach. While active players drive the bull market, a contrarian perspective urges caution and a more conservative approach. It’s essential to view pullbacks through a bullish lens.

Profit from Panic: Buying Amid Market Uncertainty

In investing, the best time to buy is often when the masses are scared, and the markets are acting erratically. While this may sound counterintuitive, a contrarian perspective reveals that the period of stress and chaos that many investors fear can often be the perfect opportunity to make a move. We have gone through similar market phases many times, with the most recent occurring from November 2018 to roughly February 2019. During this time, the masses were scared and reacted in the wrong way at precisely the right time. But for those who were disciplined and patient, it was a time of opportunity.

Regarding the markets, discipline and patience are paramount to success, and right now, patience is called for. While the active players may be driving a bullish trend, a contrarian perspective demands caution and a more measured approach. Investors can confidently navigate the current market and make more informed decisions by waiting for opportunities to arise and avoiding impulsive decisions. By remaining disciplined and patient, investors can take advantage of market fluctuations and make sound investment decisions. So, rather than following the masses, take a contrarian approach and wait for the right opportunity to come your way.

Great Read: Copper Market News Analysis: Unveiling Today’s Signals and Trends

Charting Your Course: Avoid the Noise by Buying the Dip

Currently, we have two factions of players: those who have stakes in the market and those who possess cash reserves. The former group is overly bullish, evidenced by the simultaneous upward trend of all asset classes, including bonds, stocks, precious metals, and Bitcoin. This is a curious phenomenon indeed, for it is rare that such diverse markets would simultaneously experience soaring prices. It stands to reason that a reckoning must occur, but do not fret.

This candid moment of turbulence is the same opportunity we’ve been awaiting. Of course, the masses will inevitably panic, as that is their nature. But do not follow their lead, for the herd always loses. Given the current volatility, the Stock Market Forecast for the Next 3 months is challenging to predict, but the long-term trend is indisputably positive. Therefore, one would be wise to welcome substantial market corrections with enthusiasm. Embrace them, my friend. The overall trend is positive, so whether you like it or not, the smart move would be to embrace strong corrections with gusto.

The masses are poised on the edge of a great precipice, ready to leap blindly into the abyss and suffer the consequences for a decade. We’ve seen it before in the crash of ’08, but history repeats itself, and the flock never seems to learn from its missteps. They’ll forever be pawns in a game they can’t comprehend. Don’t forget to keep a trading journal; the best time to take notes is when blood is flowing freely on the streets.

Stock Market Forecast Next 3 to 6 Months

Forget forecasts and start with the basics; without a trading journal, you will never discover what type of trader you are. You will forever talk to the representative who is just an illusory version of the real you.

When there’s blood on the streets, that’s the best time to take notes. For example, the coronavirus was just the trigger for the impending market correction. Even if it weren’t, some other event would be used to justify the correction. What will happen now is the masses will panic and regret it when the markets recover. However, they’ll then falsely assume that the subsequent correction will follow the same path. When it’s time to sell, they’ll continue to buy. We all know what happens after that.

At a certain point, buying the dip doesn’t work, and that point is reached when the masses turn euphoric. Backbreaking corrections are always painful. That’s why they’re called backbreaking. However, unlike in the old days, one can’t tell which revision will become harrowing. Just look at how many times the market conned the bears over the past ten years into shorting, only for 90% of those shorts to turn into massive losses as the market reversed course just as fast. Even if you have one big home run, it won’t cover the 90% loss rate. More importantly, we doubt that most of the bears had the staying power to hang in there until their bets paid off.

Patience: The Key to Accumulating Wealth as an Investor

The impatient investor or trader that overtrades would be better served by investing their money in an index fund and spending leisure time guzzling beer or mowing the lawn. Fortune does not favour the foolish, so despite receiving numerous emails urging us to adopt a more aggressive stance, we must disagree. We did not follow the playbook of the masses, and were we to do so? We would not be here, still standing, after more than 18 years. That said, we will continue to issue entry points on stocks we deem excellent long-term prospects.

The very same people now asking us to take a more aggressive stance were those who panicked when we advised them to buy during the COVID crash. Once again, we ask: why do you want to purchase when caution is advisable, and why do you panic when it is time to buy? The truth shall set you free, but it will cause you considerable anguish before it does. And do keep in mind that if you append an “O” to “Hell,” you get “Hello.” Only the patient investor makes money; the impatient investor or the one that overtrades would be better served if they put their money in an index fund and allocated their free time to drinking beer or mowing the lawn. Tactical Investor

Stock Market Sector Projections for the Next 6 to 12 Months

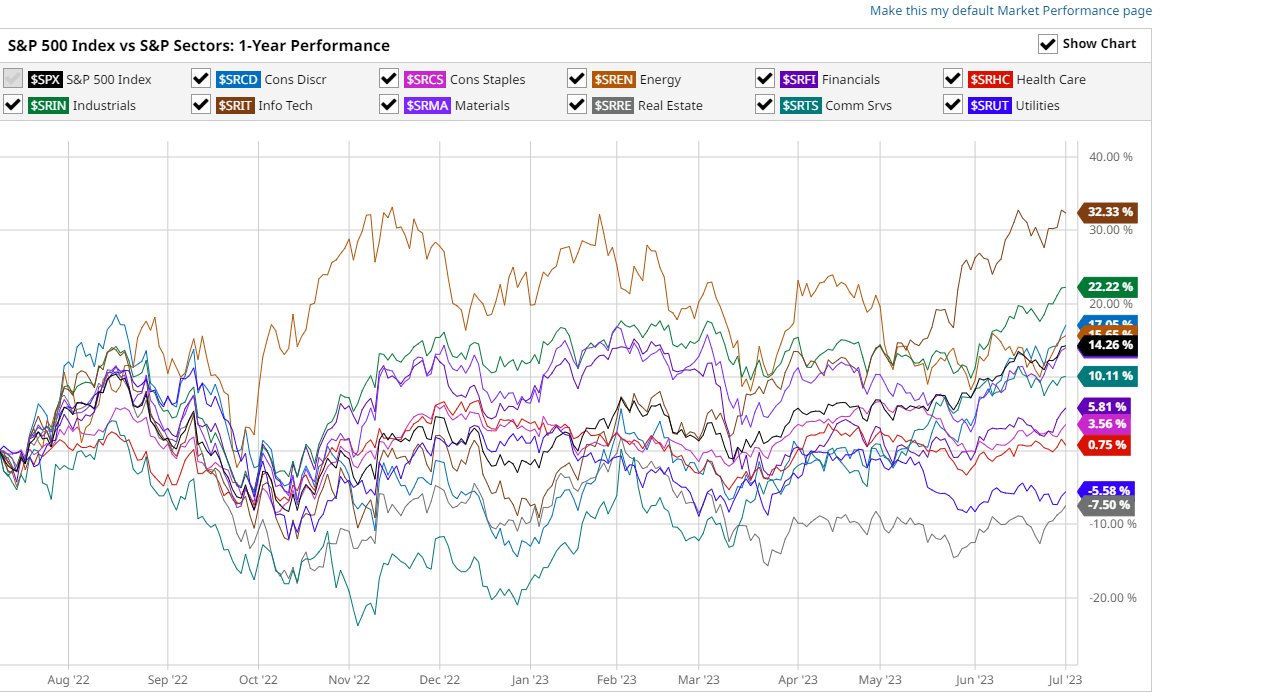

As of June 30, 2023, the AI-driven frenzy has temporarily disrupted market forces. Notably, the S&P 500 and Nasdaq have primarily relied on the influence of approximately nine major players. Meanwhile, other sectors have experienced underperformance. However, examining the one-year charts indicates that former highflyers like energy and other commodity players are poised for a resurgence. This expectation is driven by the Federal Reserve’s commitment to continue raising interest rates, despite a slight retreat in inflationary pressures. While the situation does not warrant a complete halt, the Fed remains vigilant.

Those willing to take calculated risks might find potential gains by allocating funds to energy companies like OXY, a favoured choice even by Warren Buffett, who consistently expands his position in this play. The copper, steel, and precious metals sectors are also expected to perform well. The projected next US dollar Rally is anticipated to reach a multi-year high.

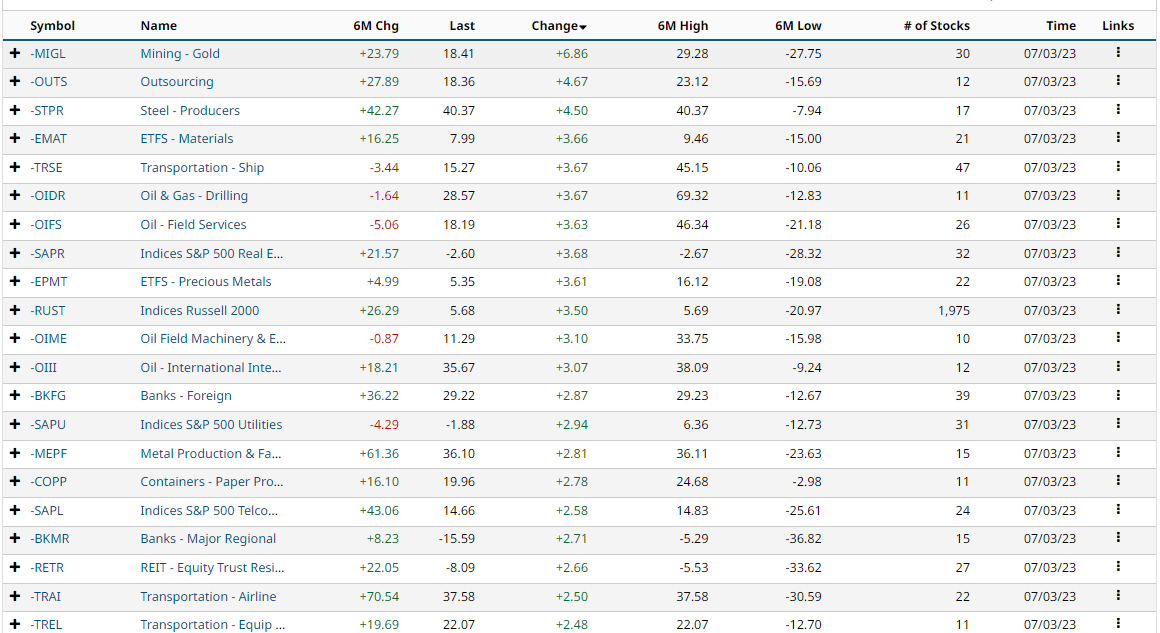

Stock Market Forecast 2023: Identifying the Leading Sectors for Growth

As of July 5, 2023, a glance at the chart below reveals the dominance of commodities, energy, and several cyclical sectors among the top 20 performers over the past 6 months. This trend persists when extending the timeframe to one year. Notably, many stocks within these sectors have experienced significant pullbacks and are trading in the oversold range on the monthly charts. Prominent examples include OXY, VALE, STLD, GEF, EMR, and more. These stocks are highly anticipated to exhibit substantial growth over the next 3-6 months.

One effective approach for utilizing this data involves initially identifying the strongest sectors spanning a period of 6 to 12 months. Subsequently, attention can be focused on stocks that have experienced pullbacks. Analyzing the technical aspect using monthly charts proves advantageous as each bar on such a chart represents a month’s worth of data.

Longer-term charts are preferable as they help filter out extraneous market fluctuations. The key objective is to identify stocks currently trading within significantly oversold ranges. An exemplary illustration can be found in the machinery-electrical sector, where EMR stands out. The likelihood of this stock trading above 106 within the next 6 months is relatively high. Similarly, within the steel sector, VALE, and the energy sector, PBR presents excellent investment opportunities.

VALE Market Forecast for Next 6 months

Achieving a monthly closing at or above 16 should lead to a test of the range between 20, 40, to 22, while a monthly closing at or above 22 will signal a series of new 52-week highs. In the short term, the market outlook remains volatile as the markets are oversold and searching for opportunities to release some pressure.

We anticipate volatile market activity from July until roughly the end of August 2023. Beyond that period, the markets will likely establish a bottom and initiate a strong rally until the end of November or early December. Stocks like VALE, PBR, and OXY are expected to perform exceptionally well during this upward trajectory.

The State of the Stock Market: A Quarterly Review and Outlook

The stock market experienced significant volatility in the first quarter of 2023. While some sectors have performed well, others face headwinds that could impact future growth. Here is a summary of the market’s performance so far and what to expect for the rest of the year:

First Quarter in Review

Gains and Losses: The major indices have fluctuated between gains and losses in the first three months of the year. The S&P 500 is up 7.4%, the Dow Jones Industrial Average has gained 6.3%, and the Nasdaq Composite has added 4.2%. However, all three remain below their record highs from January.

Top Performers: Consumer services, discretionary, and technology stocks have outperformed due to strong earnings, spending, and innovation.

Underperformers: Financials, energy, and healthcare stocks have underperformed due to regulatory issues, lower oil prices, and rising costs. Bank failures that triggered a credit crunch hit the financial sector hard.

The Rest of 2023

Fed Policy: The Federal Reserve is expected to continue raising interest rates to combat inflation, which could weigh on growth and valuations. However, if inflation moderates, the Fed could slow or pause rate hikes, boosting the market.

Public Health: The Omicron variant poses uncertainty, but the market could recover if vaccines and treatments prove effective and cases decline.

Analyst Forecasts: Analysts project average returns of 8% for the S&P 500, 7% for the Dow Jones, and 9% for the Nasdaq for the rest of 2023. However, these forecasts are subject to change based on new developments.

Experts cautiously optimistic over Stock Market Outlook for 2023

BCA Research, an economic forecasting firm, expressed confidence in their early June report titled “So Far, So Good On The Road To 4500.” They correctly predicted that the large-cap stock index would come close to their year-end 2023 forecast of 4500. However, BCA’s optimism for the year’s second half is cautious.

The firm wrote that they remain tactically overweight on equities but plan to move to an equal weight position once the S&P 500 hits 4500. They do not expect the stock rally to last beyond the summer, even though the index may exceed their 4500 target.

One reason is that BCA thinks Wall Street forecasts will become too optimistic, but negative surprises will emerge in corporate earnings. BCA also predicts a recession will hit the economy in the first half of 2024.

6-Month Market Forecast & the Market Roadmap for 2023

While some may believe that the Federal Reserve is hesitant to face another financial crisis akin to 2008-2009, we reject this notion. The Fed is not afraid; instead, they are the “big bad wolf,” existing to intimidate the masses. Let’s not forget that they enabled the 2008-2009 crisis. In our view, the Fed’s current actions are designed to give the impression that everything is under control when laying the groundwork for the next shock event.

The masses’ mindset must be utterly destroyed to establish a lasting bull market, as exemplified by the 2008-2009 crisis. The prominent players in the market are seeking a prolonged bull market of 7 to 10 years, and to achieve this, they will need to stir up the hornet’s nest. Be ready to seize the upcoming buying opportunity. The subsequent sell-off is on the horizon, but don’t be dismayed – it will pave the way for a multi-month rally.”

NDX and SPX 6 Month outlook: June 21, 2023 update

The Russell 2000 reaching the 1900-1920 range indicates an upcoming surge in volatility, with potential false downward moves before a corrective phase begins. Bullish sentiment readings have consistently increased, notably from 47 to 49.00 in the previous week.

This suggests a possible head fake scenario, where the index appears to correct but reverses and trends higher, similar to the NDX. The secondary resistance zone for the Russell is between 1980 and 2020, and ending the week above 1920 would increase the chances of testing this zone.

The ideal setup involves the Russell trading within the 1980-2020 ranges, accompanied by bullish sentiment trading above 50, ideally reaching 55 or higher. Long-term investors are advised to take profits on tech stocks that surged due to an AI Mania-driven rally and wait for a market pullback before investing fresh funds.

Insights into Market Dynamics: Navigating Inflation and Corporate Earnings

Despite some positive economic signs, many analysts remain cautious about the stock market’s prospects for the remainder of the year. Inflation remains stubbornly high, and the Federal Reserve is expected to continue raising interest rates aggressively to combat it. This could pressure corporate earnings and valuations, potentially leading to a market pullback.

One strategist predicts that the S&P 500 could fall over 15% from current levels by the end of the year as earnings disappoint and the Fed continues tightening. He expects corporate profits to decline sharply due to high inflation, supply chain issues, and slowing demand.

However, not all analysts are as bearish. If inflation modifies and the Fed slows or pauses rate hikes, the market could stabilize or resume its upward trend. Much will depend on the inflation trajectory, interest rates, and corporate earnings over the coming quarters.

Moving forward, let us delve into a retrospective analysis of our historical predictions. We shall conveniently append dates alongside the titles to facilitate a clear understanding of the time frames we are referencing.

Riding the Wave: Focus on Trends, Ignore Noise

May 2022

The markets are run by machines now, see? These machines are programmed to start selling when specific targets are hit, and then more selling follows until the cycle ends. But remember, every bull market ends on a high note. But listen here, humans program these machines, so the only difference is that the machines sell instead of people. Don’t let the media fool you; they’ll be pushing stories about the upcoming bear market. Pay no attention to the noise and instead focus on one thing: the masses weren’t euphoric when the markets started selling off.  The hysteria surrounding this pandemic is growing, even though none of the scary projections has come true. Some folks are playing games with statistics, see? They assume everyone will get infected and apply the mortality rate to the entire global population.

The hysteria surrounding this pandemic is growing, even though none of the scary projections has come true. Some folks are playing games with statistics, see? They assume everyone will get infected and apply the mortality rate to the entire global population.

That’s just crazy talk! It’s like taking everyone to get the flu to make the numbers bigger. These shock jocks are twisting the data to suit their needs. The more extreme the deviation, the better the opportunity. Mark my words, in six months, the crowd will regret throwing out the baby with the bathwater. So keep a cool head, take notes, and wait for the markets to turn.

Key Insights from the Stock Market Forecast For the Next 3 Months

Dec 2021

The Stock Market Forecast For the Next 3 months indicates a potential for further downward movement. It’s a volatile market, and successful investors must adapt to changing conditions. Understanding the reasons behind market fluctuations and resisting the urge to follow the masses is key. The patient investor can make money, while those who overtrade or act impatiently may find better results with an index fund.

It’s worth noting that the MACDs still need to dip lower, and historical patterns suggest that after a long correction, there is often one more downward move. There is a possibility that the Nasdaq could dip below 10,000, presenting a great buying opportunity. In this current environment, passive investing has gained significant popularity, with big players targeting the masses. This creates a buyer’s market, but caution is advised.

It’s essential to avoid being unrealistically bold. Many good stocks are available within the oversold range, offering numerous opportunities. Letting the mountain come to Mohammed is wise rather than rushing into all the oversold stocks. Additionally, although some positions have been sold due to the Dow trigger being activated, many new pending plays are still on the horizon. It’s worth noting that only half of the holdings were sold in most cases.

The MACDs are dangerously close to reaching their 2009 lows, which suggests a long-term screaming buy opportunity. Even without a MOAB or a FOAB, this event should be considered a significant buying signal. While Stock Market Forecast For the Next 3 months predicts further downward movement, patient and cautious investors can exploit this buyer’s market. Adapting to changing conditions is crucial since the market takes no prisoners.

Seizing Opportunities: Unveiling the Potential Amidst Market Volatility

The MACDs are perilously close to breaching their 2009 lows. If this came to pass, dear readers, it would be prudent to consider it a long-term screaming buy, even without a MOAB or a FOAB. With such a signal, one would not need to know Stock Market Forecast For the Next 3 months. The answer would be more pronounced; the outlook would be downright bullish. Although we have sold many positions due to the activation of the “Dow trigger,” let us not forget that we have many new pending plays. Furthermore, in most cases, we have sold only half of our holdings.

It is wiser to be cautious than recklessly bold in the current climate. Why? So many excellent stocks are trading in the extreme and insanely oversold range that it would be impossible to invest in all of them. In other words, dear reader, many opportunities are available today. It is a buyer’s market, and we can afford to let the mountain come to Mohammed in such an environment.

Hold Steady: Stock Market forecast for the next 3 months

May 2021 Update

We must reiterate a point made ad nauseam in the past and will likely need to do so ad infinitum in the years ahead. The typical mindset is predisposed to failure; people tend to invest when caution is required or to sell when it is the opportune time to purchase. Ask yourself why you feel compelled to dive in when everything appears hunky-dory and the urge to flee when everything is awry. If you cannot answer that question candidly, you will never progress and flourish as a successful trader. It may seem harsh, but the market is no place for traders reluctant to adapt to ever-changing conditions. The market takes no prisoners, and the only dictum that applies to it is “adapt or perish.”

Navigating Market Volatility: Insights and Outlook

July 2020 Update

Verily, the markets doth rally on ill news and becometh frenzied at any small glimmer of hope. This market has no valid order and has been dubbed the “market of disorder” in this bull market. At first glance, one may think this is cause for concern, but it is an advantageous long-term development, for it shall keep all in suspense regarding the market’s trajectory. This was the smallest bear market in all history and was nipped in the bud ere it could even gain momentum.

In the end, the crowd shall always falter; let it be known to all when so-called experts prophesy of market collapse and chaos, for nought but their hubristic egos shall go up in smoke. Given the present reaction from the multitude, the coronavirus pandemic shall be forgotten, but the repercussions of those who succumbed to fear shall linger for many years to come.

Some may never recover, but that tale is for another day. The Dow appeareth to be on course for 28K, as the current price doth separate it by only 1K from its destination. The present moment is opportune to reflect upon one’s sentiments during the market’s descent in March when we maintained steadfastly that this was nought but a manufactured crisis and that the markets shall rebound. Indeed, we are now merely 3K away from the illustrious 30K mark, a stunning triumph.

All Good Things Must Come to an End: Recognizing Limits to Upward Trends

No market may sustain a linear trend; subsequently, the longer the Dow retreats, the greater the correction. Inceptional data suggests that the era of minor edits hath reached its close. Verily, we may be on the cusp of a new epoch of market moves; rapid down days followed by yet more abrupt reversals. Thus, it behoves all to perceive each sharp pullback through a bullish lens.

The coronavirus selloff was a mass hysteria-based event. The hoi polloi cast aside all and sundry in their haste to seek sanctuary. Alas, the result was a base plate of heads for all. The coronavirus selloff was a mass hysteria-based type event. The masses threw the baby, the bathtub and everything out in their haste to seek safety—the result was that they were handed their heads on a filthy tin platter.

This article was initially published on September 17, 2019, and has undergone several updates since then. The most recent update was carried out in July 2023

FAQ: Stock Market Forecast for Next 3 Months

Q: Can stock market forecasts accurately predict the next 3 months?

A: Stock market forecasts are often unreliable, as even experts can be proven wrong. Relying solely on predictions can be risky.

Q: What should investors focus on instead of short-term forecasts?

A: Investors should analyze long-term trends and patterns to better understand the market’s performance. Trends can provide valuable insights for making informed investment decisions.

Q: How can investors identify trends in the market?

A: Monitoring V readings, which indicate market volatility, can help identify trends. It’s essential to watch for signs of stability or decline and consider the overall trend as a more reliable indicator.

Q: What is the outlook for the stock market in the next 3 months?

A: Predicting the stock market’s performance in the short term is challenging. However, considering the positive long-term trend, investors may view substantial market corrections as buying opportunities.

Q: Should investors buy during market uncertainty?

A: Market uncertainty can present opportunities for investors. Buying when the masses are scared and volatile markets can be advantageous but requires discipline and patience.

Q: How should investors navigate market volatility?

A: Investors can take advantage of market fluctuations by remaining disciplined and patient and avoiding impulsive decisions. Focusing on long-term trends and ignoring short-term noise is key.

Q: What should investors do when markets experience significant corrections?

A: Investors should view market corrections through a bullish lens instead of panicking like the masses. Embracing firm corrections with enthusiasm can be a wise approach.

Q: How can investors accumulate wealth over time?

A: Patience and a long-term perspective are crucial for successful investing. Avoiding overtrading, staying disciplined, and identifying excellent long-term prospects are essential to accumulating wealth.

Q: How can investors seize opportunities during market volatility?

A: Monitoring MACD indicators and potential dips in the market can reveal attractive buying opportunities. Remaining cautious and taking advantage of crowd behaviour can lead to profitable outcomes.

Articles of Interest

The Stock Market Forecast For Next 3 months: Buckle Up

Best Time To Buy Stocks: Embrace Panic, Seize Opportunity

Winning with Nasdaq 100 ETF: Riding the Right Side of the Trend

Stock Market Trend Analysis Decoded: Unveiling the Insights

The Dynamics of Crowd Behavior: Understanding Mass Psychology

Crowd Psychology: Unlocking Success in the Stock Market

Real life doppelgangers

Dollar Rally: Is it Ready to Rumble?

What Happens If The Market Crashes?

Psychological Manipulation Techniques: Directed Perception

Random Thoughts: Web of lies Woven by Powerful Individuals

Copper News: Playing the Shortage Story

Zero to Hero: How to Build Wealth from Nothing

Mob Psychology: Breaking Free to Secure Financial Success

Simplifying the Complex: Understanding Psychology for Dummies

References

The Crowd: A Study of the Popular Mind: Gustave Le Bon

Five warning signs of market euphoria: Investopedia

Why people lose money in the markets: The Balance

Homerun definition: The free dictionary

What is the media: OER services

Prepare for massive stock market opportunities: Market Watch

What is mass hysteria: Medical News Today

The post The Stock Market Forecast For Next 3 months: Buckle Up appeared first on Tactical Investor.

dollar

inflation

commodities

commodity

markets

reserve

policy

metals

interest rates

fed

us dollar

inflationary

aim

nasdaq

copper

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…