Economics

The Role of the Federal Reserve in US Economy

The Federal Reserve and Its Ineffectiveness The Federal Reserve, commonly known as the “Fed,” is the central banking system of the United States. It…

The Federal Reserve and Its Ineffectiveness

The Federal Reserve, commonly known as the “Fed,” is the central banking system of the United States. It was established in 1913 to promote a stable financial system and regulate monetary policy. However, there is growing concern among economists that the Fed’s efforts have been largely ineffective. Despite the Fed’s attempts to control inflation and stimulate economic growth, the US economy continues to suffer from long-term structural issues such as wealth inequality and a lack of investment in public infrastructure.

The Fed’s Negative Impact on the US Economy

While the Fed was established with the intention of promoting economic stability, many argue that its actions have actually harmed the US economy. The Fed’s low-interest-rate policies have created a culture of debt and easy credit, encouraging risky investments and contributing to the 2008 financial crisis. Furthermore, the Fed’s quantitative easing policies have inflated asset prices, benefiting the wealthy at the expense of the middle and lower classes.

The Fed’s Lack of Accountability

Another concern regarding the Fed is its lack of accountability. The Fed operates largely independently of the federal government, with little oversight from elected officials. This lack of accountability has led to a situation where the Fed’s policies are not subject to democratic scrutiny, allowing unelected officials to wield significant power over the US economy. Furthermore, the Fed’s opaque decision-making process and lack of transparency have led to accusations of cronyism and favouritism towards Wall Street banks.

The Fed’s Influence on Income Inequality

One of the most pressing issues facing the US economy today is income inequality. While the Fed’s policies are intended to promote economic growth and stability, they have actually exacerbated wealth disparities. By keeping interest rates low and printing money, the Fed has effectively transferred wealth from savers and retirees to wealthy investors and corporations. This has led to a situation where the rich get richer, while the poor and middle-class struggle to make ends meet.

Alternatives to the Federal Reserve

Given the problems with the Fed, many economists are calling for alternative monetary policies. One proposal is to return to the gold standard, which would limit the Fed’s ability to manipulate the money supply and prevent inflation. Another proposal is to establish a public banking system, which would provide low-cost loans to individuals and small businesses, promoting economic growth and reducing income inequality. While these proposals are not without their drawbacks, they offer a compelling alternative to the current system of Fed control.

Conclusion

While the Federal Reserve was established with good intentions, its actions have often had negative consequences for the US economy. From creating a culture of debt and easy credit to exacerbating wealth disparities, the Fed’s policies have left many Americans struggling to make ends meet. Moving forward, it is crucial that we consider alternative monetary policies that promote economic stability and reduce income inequality.

Refrences

- Bernanke, Ben S. (2010). The Role of the Federal Reserve in the Global Economy: A Historical Perspective. Speech given at the Federal Reserve Bank of Kansas City Economic Symposium in Jackson Hole, Wyoming, August 27, 2010.

- Gertler, Mark and Peter Karadi. (2015). Monetary Policy Surprises, Credit Costs and Economic Activity. European Economic Review, 78, 96-115.

- Mishkin, Frederic S. (2007). The Federal Reserve’s Role in the Global Economy: A Historical Perspective. Speech given at the Federal Reserve Bank of Kansas City Economic Symposium in Jackson Hole, Wyoming, August 31, 2007.

- Sims, Christopher A. (2010). US Monetary Policy During the Great Recession. American Economic Review, 100(2), 51-56.

- Taylor, John B. (1993). Discretion Versus Policy Rules in Practice. Carnegie-Rochester Conference Series on Public Policy, 39, 195-214.

Other Articles of Interest

Technological Progress

Read More

Exploring the Depths of the Unconscious Mind

Read More

The Cycle of Manipulation in Investments

Read More

Is everyone losing money in the stock market?

Read More

Short-Term vs Long-Term Investing Strategies

Read More

Understanding the Kansas City Financial Stress Index

Read More

Minimize the Risk of Losing Money in the Stock Market

Read More

Securing Your Future: The Power of Long-Term Investments

Read More

Investment style: Going Against the Grain

Read More

Mastering Money: Your Financial Playbook

Read More

The Importance of Keeping a Trading Journal: A Path to Better Investment Decisions

Read More

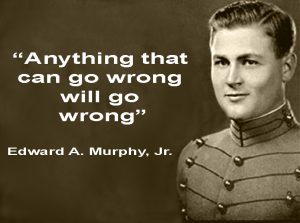

Exploring the Intersection of Investing & Murphy’s Law

Read More

War of Attrition: Strategies for Thriving in Times of Crisis through Investment

Read More

Dow Jones Outlook: Understanding the Dangers & Rewards of Crisis Investing

Read More

Financial Stress: The Surprising Opportunity for Savvy Investors in the Stock Market

Read More

Financial anxiety

Read More

Investment Opportunity & Market Crashes

Read More

Copper outlook VIA CPER

Read More

Existing home sales

Read More

Stock Market Crashes in History

Read More

Stock market crash history

Read More

The post The Role of the Federal Reserve in US Economy appeared first on Tactical Investor.

gold

inflation

monetary

markets

reserve

policy

money supply

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…