Economics

The recession is already being televised as The Fed, ECB, RBA and BoE get their licks in before Christmas

As Sydney slept on Wednesday afternoon in New York, France was playing Morocco, Elon Musk was selling more Tesla and … Read More

The post The recession…

As Sydney slept on Wednesday afternoon in New York, France was playing Morocco, Elon Musk was selling more Tesla and SBF was still under arrest, the few people left over watched the US Federal Reserve play Bad Santa.

The Americans lifted rates by 50 basis points – as widely expected – but this time with a few extra special mélanged signals that imply inflation is beginning to cool, but also that the risk of letting prices escape is insane enough for Fed officials to vow to fight inflationary prices forever.

“We have more work to do,” Jerome Powell promised, indicating there’s more rate hikes ahead, something investors really didn’t want spelled out.

The central bank has lifted the cost of borrowing to its highest level in 15 years as America’s central bankers continue their crusade.

Meanwhile, at the home of our Christine Lagarde, the European Central Bank (ECB) went small overnight (Thursday Geneva time) at it’s latest meeting, electing to lift its key rate by a smaller than expected 50 bps, from 1.5% to 2%.

Lagarde told reporters that from the beginning of March 2023 it would begin to reduce its balance sheet every month by circa by 15 billion euros (US$16 billion) at least until Q2 2023.

And around midnight our time, the Bank of England’s Monetary Policy gang voted 6-3 in favour of their own 50bps hike.

The BoE’s rate is at 3.5%, after inflation topped a four decade high October.

The annual rise in the Brit’s consumer price index (CPI) at least eased to 10.7% in November, according to new date on Wednesday.

With the RBA guys at Macquarie Place not getting the rates band back together until February next year, Aussie investors have largely been sitting idly by to assess whether Australia has arrived at a restrictive rate, or whether there will be a few more rate hikes early next year.

The consensus for the RBA to bump up the cash rate by 0.25% (25bps) to 3.10% was an easier bet than the US Federal Reserve which this week was slated to wrap its 2022 policy carnage, with a rates raise of 50bps.

A meeker hike would be welcome after 4 hammer blow 75bps moves.

Both banks will welcome the chance to walk away for the Christmas period as the appetite for speculation remains a thematic undercurrent and as signs of slowing inflation emerge.

In the states on Tuesday, the US Labor Department reported the consumer price index over there rose 7.1% in November on a year-over-year basis.

Yay. Kind of.

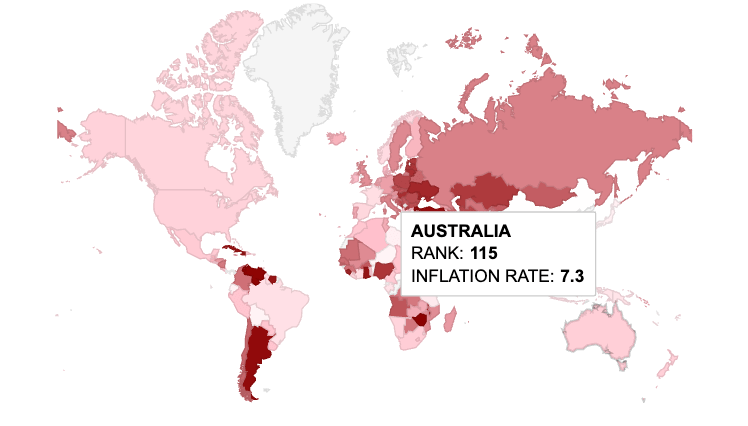

Inflation by nation

Yes, That’s nicely below the Dow Jones forecast for a 7.3% gain.

Yes, the cost of living – food, essentials outside energy – remain in buoyant territory.

Wall Street stocks moved sharply higher on the back of the news, the S&P 500 gaining 0.8% on Tuesday.

The Nasdaq Composite and Dow Jones Industrial Average moved quickly higher on the news, but did settle ahead of the close.

The curiosity here – as far as I’m concerned – is that if the US does slip into recession, then it’s a Fed-led bed they’ll be lying in. It’s not a structural disaster, it’s an artificial slowdown and one the cause of the recession can always turn off. The Fed sure has been slamming it’s feet on the economic brakes by hoisting rates, telegraphing the slowdown to come and ensuring every move it makes is already in the post.

An Aussie Christmas break

According to CMC Markets Azeem Sherrif any pause in our tightening cycle could demonstrate a local willingness to lead by example, as we did a few months ago, when Dr P. Lowe et al made the RBA the first developed global central bank to downshift the pace of interest-rate increases to 25 basis points at its past two meetings.

“The RBA is currently in the midst of its sharpest tightening cycle, having raised rates by 2.75% since its first hike in May, Azeem told Stockhead.

“The RBA has repetitively stated that they aim to bring inflation down to 2-3% on average. They have forecasted that CPI will peak at 8% by end of 2022 and then begin to decelerate in 2023. Economists have also reduced their forecasts for economic growth in Australia right through to 2024, reflecting the expected tighter monetary policy.

Money markets imply a peak rate of 3.8% next year while according to the usual suspects surveyed by Reuters, economists are expecting the central bank will pause at 3.6%.

“Interestingly enough, futures are pricing in a cash rate of 2.96% for December’s meeting which is approximately a 0.15% rate hike. The risk is to the downside if the RBA throws in a sneaky 0.15% hike, which will add to further optimism for Australian equities.”

Over at the CBA Gareth Aird suggests we’re near the peak of the tightening cycle, while the big thinkers at Goldman Sachs are envisioning rate hikes as a concerning ongoing concern into next year.

CBA has one more hike to 3.1% while Goldman predicts 5 more to 4.1% in May, which is a pretty broad rate outlook divergence.

Economic indicators

Azeem says the raft of indicators and data released at home during December has been… “interesting, to say the least.”

From retail sales, monthly CPI, credit & building releases – all of which point to Australia’s “resilience to sticky inflation” and display leading signs of Australia potentially achieving a soft landing ahead of the rest of the world – an idea which has added to optimism with the local bourse.

When Australian retail sales declined -0.2% for the first time this year – suggesting households are starting to feel the strain of rising rates and while one sparrow doesn’t make it Spring – could this be a leading indicator of consumer sentiment shifting & households reducing some of that toppy spend?

“The monthly CPI reading was a huge surprise to the local market, reigning in at 6.9% vs 7.6% forecasted and a trimmed mean of 5.3% vs 5.7% forecasted.

“Now although this monthly reading doesn’t capture the full extent of inflation inputs, it was a great indicator of how the economy is faring. This is obviously quite positive for Australia, indicating that inflation may be slowing down, but similarly to retail sales, one data point doesn’t form a trend, so the quarterly inflation read will continue to remain key for assessing monetary policy.

It’s too late to apologise

At home, Azeem says the quietly incredible concessions made by Governor Lowe – apologising for getting the whole transitory inflation story wrong – were a little gobsmacking in their timing alone.

“It felt like it was the appropriate time to apologise to the Australian public and acknowledge the RBA’s errors in miscommunication with their forward guidance and how it could be misconstrued by consumers. I mean sure, acknowledging your mistake is great, but some may ask “is it too late now to say sorry?”. I guess we’ll never know who and how many people were affected by this call.”

On a positive note, the RBA reckons Australia does have “a strong probability of achieving a soft landing than almost any other developed country.”

This is from the Governor himself.

“Lowe is citing that wage growth will be an important indicator, suggesting that the best outcome for Australia would be for wages to pick up, but not overshoot,” Sheriff told Stockhead.

“I think that’s achievable. It’s not achievable in many other countries because they’ve already gone past the point.”

The post The recession is already being televised as The Fed, ECB, RBA and BoE get their licks in before Christmas appeared first on Stockhead.

inflation

monetary

markets

reserve

policy

fed

central bank

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…