Economics

The Inflationary Aussie Property Space: Where no one can hear you dream

CoreLogic: Rate rises seem likely for February and March. This likely means further falls in housing demand and values in … Read More

The post The Inflationary…

Some tough numbers out of the Aussie Bureau de Statistics (ABS) this week. Goodness gracious. Hitting all kinds of sectors in all kinds of mostly unwelcome ways.

That’s more of a 50/50 proposition over in the perpetually bummed out property space.

If you missed it, the Bureau smacked us with quarterly headline inflation of 1.9% over December, a slight but really annoying increase from the 1.8% read from the September quarter.

Annual Aussie inflation was 7.8%, and that’s very close to the orbit the Reserve Bank of Australia (RBA) predicted of a peak in headline inflation at 8% some time this year.

More importantly, underlying core inflation (the RBA’s preferred reading on inflation), which is measured by trimming excessively volatile components of the CPI, actually fell in the quarter, from 1.9% in September to 1.7%.

At a fulsome 6.9%, annual core inflation is still a long, long, long, long way from the 2-3% target range set by the RBA.

However, according to CoreLogic head of research and fearless nemesis of the unknowable numeral Eliza Owen, December marked the first fall in quarterly core inflation since March 2021, following eight consecutive interest rate rises from May 2022.

“Despite headline figures surprising to the upside this quarter, the worst of inflation could still be behind us,” she told Stockhead.

Inflation across the combined OECD slowed to 1.8% in the September 2022 quarter, after peaking at 2.1% through June. That’s also a positive, if not a pattern.

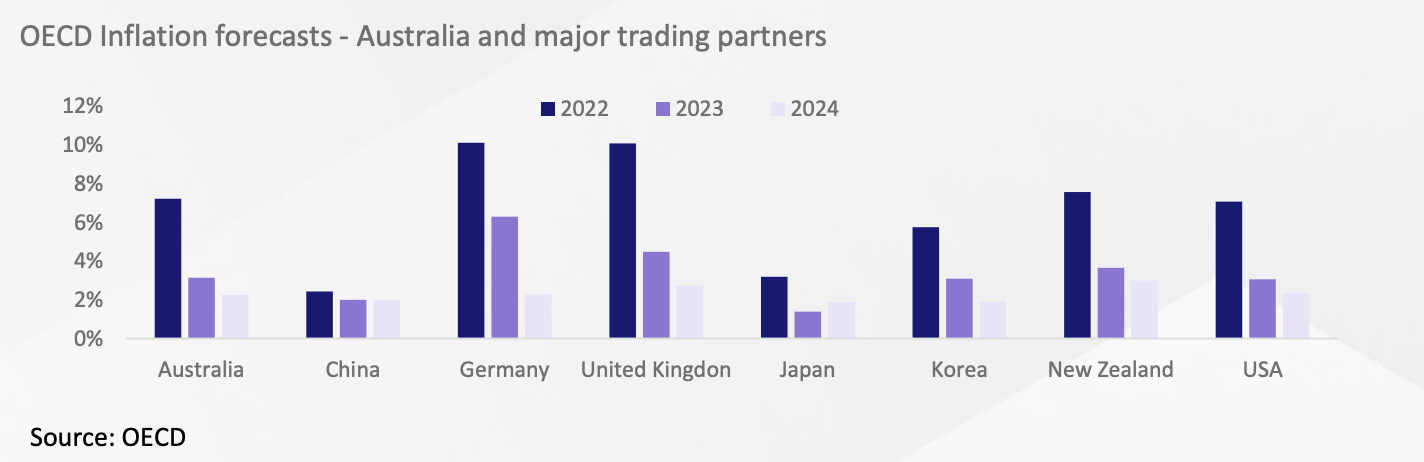

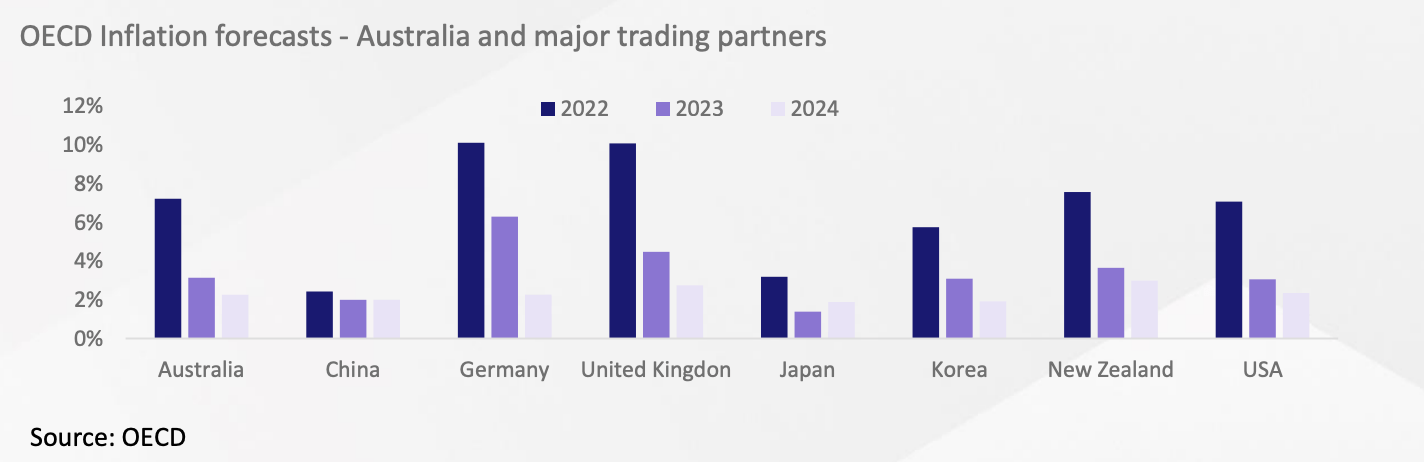

Eliza reckons the forecasts from out of the OECD also suggest a fall in inflation through 2023 across most major economies, as global economic demand starts to slow under the weight of rising cash rates.

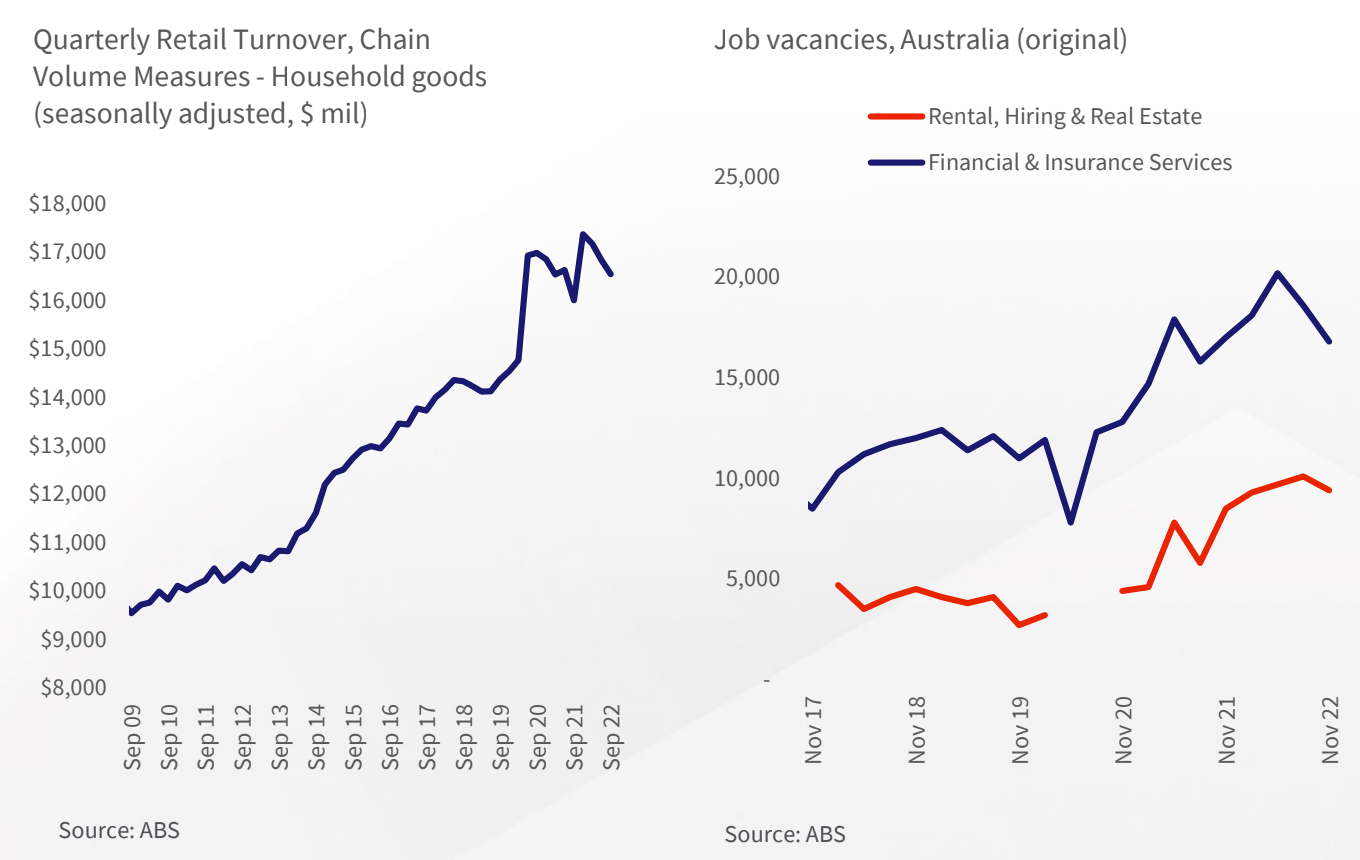

“In Australia, many housing market metrics suggest the rate of growth in new build costs and rents is slowing, while falling property prices and volume of sales are indirectly taking some of the heat out of our property-laden economy.

“The housing component has the highest weighting of any sub-group, so a slower rate of growth in housing costs is a key factor that should support a further reduction in both core and headline inflation.

“December CPI figures showed housing costs were still up a substantial 1.9% in the quarter, but this was down from a 3.2% lift in the three months to September,” she says.

Eliza: Softer housing market is helping calm the Aussie economy

But how will this read hit our housing market in 2023, Ms Owen?

“Well,” Eliza says, starting from the top.

“The extent to which inflation slows down is what the RBA will watch to decide whether to keep tightening, or to take its hands off the throat of the economy. Therefore, the inflation outlook remains important to the housing outlook.”

“In the year ahead, inflation may be subject to the competing forces of falling global demand, but rising demand from China as the country moves away from zero COVID.

“The potential for extreme weather events should also be kept in mind, as this can impact production capacity, and lead to inflation spikes,” she adds as an unwelcome reminder of the mess we’re currently in.

The bottom line: We haven’t hit the bottom line

According to CoreLogic the stronger-than-expected headline inflation read for December – and because core inflation is way, way out of the RBA’s target range – means a further bump in interest rates seems most likely for February, and possibly March.

“This will likely mean further falls in housing demand and values in the months ahead. However, with inflation potentially moving through a peak, we are likely to see interest rates peak lower than some forecasters were expecting last year.

“Once interest rates stabilise, we would expect consumer sentiment to improve alongside a gradual stabilisation in housing prices,” Elisa concludes.

The post The Inflationary Aussie Property Space: Where no one can hear you dream appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…