Economics

The $1.5 Trillion Banks Are Trying to Hide

“Those who don’t learn from history are doomed to repeat it.” – George Santayana Silicon Valley Bank learned this lesson when its managers decided…

“Those who don’t learn from history are doomed to repeat it.” – George Santayana

Silicon Valley Bank learned this lesson when its managers decided to over-leverage themselves on short-term debt, sending shockwaves through the financial markets.

Folks… that’s only the start.

Wall Street doesn’t want you to peer too closely at their books…

…because anyone with half a brain would take one look and realize there’s a MUCH BIGGER PROBLEM building behind the scenes.

There is $2.92 trillion worth of commercial real estate loans, according to the latest Federal Reserve data.

$1.5 trillion of that debt is due for interest rate adjustments in the next three years.

Yep, more than 50% of ALL the commercial real estate loans in the U.S. will get their interest rates adjusted in the next three years.

Nearly all this debt locked in interest rates before or during the pandemic, paying pennies on the dollar.

Imagine owning an office building where a fifth of your space sits empty. You’re barely scraping by as is.

Now imagine your monthly loan payment, the largest single expenditure, more than doubling.

If that sounds severe to you, it’s because it is.

Our country is careening towards a hidden real estate bubble that could make 2008 look like a speed bump.

We want to make sure our readers are 100% PREPARED when doomsday hits.

That’s why we’re going to walk you through the warning signs and show you what to look for and how to CASH IN on the coming calamity.

Bank Metrics 101

In this situation, two metrics matter more than any other: delinquencies and charge-offs.

Delinquencies refer to loans where the borrower is behind on payments.

Charge-offs are loans that the bank no longer expects to collect any payments on and decides to write-off the loan.

The Federal Reserve reports both of these measures.

Let’s start with delinquency rates.

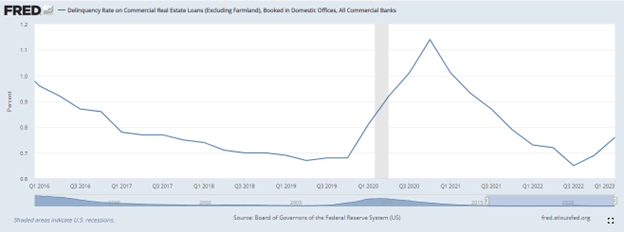

Permabulls will tell you commercial delinquency rates are at levels that are some of the lowest in history.

That’s true. Q1 2023’s 0.76% reading is on par with the readings from 2016-2019 and below the average 1% rate in the years leading up to the financial collapse.

This rate is often a precursor to charge-offs… which are also slowly rising…

Loan delinquencies and defaults can and do happen. The amount of loans that go bad waxes and wanes with the economy.

Banks can weather bad loans, provided they aren’t caught off-guard.

Here’s the unfancy explanation…

- Loans are assets on a bank’s balance sheet. This is offset by the deposits we make at a bank.

- Whatever money a bank makes from its business either becomes cash or gets reinvested into the business by, say, buying computers.

- All the money a bank makes is held on the liabilities side under “retained earnings.”

- When a company pays dividends, it pulls that money out of cash and retained earnings. Poof! Gone from the balance sheet.

- Otherwise, we assume the money is either in cash or elsewhere in the business.

- All that money is considered Tier One capital. That’s what banks use to cover bad loans.

- If a loan were to go bad, the company reduces the asset line for that loan and pulls the same amount out of retained earnings.

So, banks are required to have retained earnings worth 4.5% of all their assets, with those assets adjusted for risk.

Here’s where things get funky…

Loans obviously have a certain amount of risk. But guess what has a 0% risk associated with it?

Government debt… the same thing that sank Silicon Valley Bank.

Sure, we can liquidate that debt pretty quickly. HOWEVER, it may not be worth what the bank listed it for, even if it marked them to market (realized losses each quarter).

Hopefully, you see where this is going.

And what most people don’t realize is that we don’t need the charge-off rate to climb all that much to create the conditions for a bank collapse.

Staying Ahead of the Pack

Besides writing this newsletter, we’re big readers ourselves.

One of our favorite daily newsletters is Jim Woods’ Eagle Eye Opener.

In one of his latest issues, Jim tackled the regional banking fiasco head-on, explaining how the market “perceives” the problem.

What we found fascinating was Jim’s ability to create a scenario-based investment plan that incorporates the latest data, Fed readings and more.

This is the KEY TO NAVIGATING MARKETS.

Investing is an exercise in probabilities. We never know anything for certain.

Even with the commercial real estate bomb sitting on bank balance sheets, we could see the Fed cut interest rates back to zero, save the banks and all will be well.

It’s not likely. But WE MUST BE PREPARED.

If you want to get the latest market insights and updates packaged and emailed to you before the opening bell…

…saving you immense time and headaches…

…then DO YOURSELF A FAVOR.

CHECK OUT JIM WOODS’ EAGLE EYE OPENER!

The post The $1.5 Trillion Banks Are Trying to Hide appeared first on Stock Investor.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…