Economics

“Stuck In Mud”: Stagflation Risks Soar In Germany After Fresh Data

"Stuck In Mud": Stagflation Risks Soar In Germany After Fresh Data

Germany could be on the brink of a recession as data released on Friday…

“Stuck In Mud”: Stagflation Risks Soar In Germany After Fresh Data

Germany could be on the brink of a recession as data released on Friday showed the economy stagnated in the first quarter. The energy crisis has significantly hindered economic growth in Europe’s largest economy. Also inflation data eased in April but remains elevated, with rising concerns about stagflation.

According to preliminary data from the federal statistics agency Destatis, gross domestic product flatlined from January to March versus the previous quarter, after contracting by .5% in the final quarter of 2022, narrowly averting a “technical recession.”

However, a flat reading might be readjusted to a contraction when final figures are released at the end of next month (May 25).

The preliminary reading fell short of the .2% on-quarter growth expected by economists surveyed by The Wall Street Journal.

Destatis said household and government expenditures slumped in the first three months of the year.

“The German economy remained stuck in the mud at the start of 2023, only barely avoiding recession,” Pantheon Macroeconomics’ chief eurozone economist Claus Vistesen said.

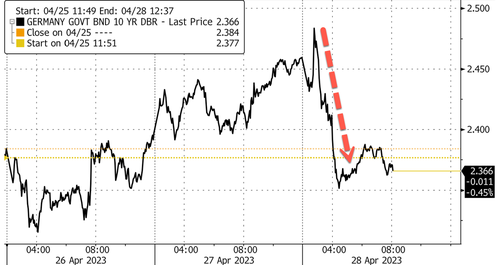

German 10-year yields fell as much as 13bps to 2.352% on the news.

After preliminary data on GDP was released, consumer price data for April showed inflation was easing. Consumer prices rose 7.6% from a year ago — down from March’s 7.8% print.

Elevated inflation and faltering economic growth are signs of stagflation.

Meanwhile, “Traders have subsequently firmed up bets on a 25bps rate hike from the ECB next week, with market pricing implying a near 90% probability versus 80% earlier this morning,” according to Bloomberg.

Next Thursday’s rate hike expectations have been sliding all week.

ING’s global head of macro, Carsten Brzeski, warned recession risk has yet to pass:

“The recent renaissance in industrial production could very well carry the economy through the second quarter.

“However, we are afraid that looking into the second half of the year, the German economy will continue its flirtation with recession.”

The biggest takeaway from the deteriorating GDP and persistently high inflation is that Europe’s largest economy is stumbling into stagflation.

Tyler Durden

Fri, 04/28/2023 – 08:55

inflation

stagflation

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…