Economics

Stocks’ Bullishness Is On Increasingly Thin Ice

Stocks’ Bullishness Is On Increasingly Thin Ice

Authored by Simon White, Bloomberg macro strategist,

Stocks are prone to significant further…

Stocks’ Bullishness Is On Increasingly Thin Ice

Authored by Simon White, Bloomberg macro strategist,

Stocks are prone to significant further downside as overly optimistic hopes of a mild recession and an end to inflation fail to materialize.

Stocks are always glass-half-full. Despite rapid rate rises and pockets of acute stress in the banking sector, they appear to be expecting only a modest downturn and an end to the inflationary regime. Even more rose-tintedly, earnings are behaving as if the recession is already behind us.

Equity markets, though, have a habit of remaining jubilant right up until the asteroid strikes (October 2007?). So you don’t have to be a total killjoy to raise some questions to avoid getting sucked into what is likely to be another bear-market rally.

A cursory look at where equities are tell us they are not fearful about the economic backdrop. Only 16% off the highs and virtually unchanged over the last year, this is one of the mildest bear markets on record.

Stocks are currently trading as if any slump would be gentle. Options on the S&P have started to price in a greater possibility of deeper falls as put skew rises, while bigger upside moves are seen as less likely as call skew falls. Stocks are therefore implying some risk of a downturn, but are not expecting a big shock.

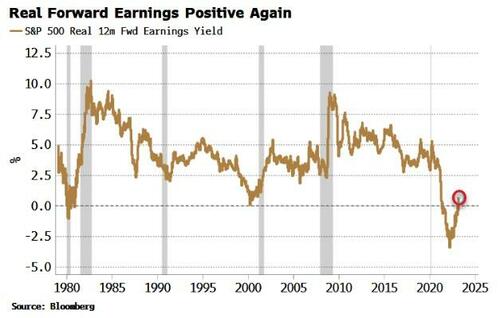

Forward earnings on the other hand have been rising, to the point where the real earnings yield is now positive again.

In fact, earnings and forward earnings’ behavior is historically consistent with a recession that has already started. Earnings are a lagging indicator and typically don’t start falling until after the downturn has begun. Earnings today have already begun to fall. Similarly, forward earnings often only begin to rise once the recession is underway.

Either way — a mild recession or one that’s come and gone — equities appear relaxed about inflation.

Duration is generally to be avoided if you believe inflation is going to remain high. Up until last year, lower-duration sectors such as energy and utilities were leading the market. This year these sectors are underperforming, while higher-duration ones such as tech and consumer discretionary are in front. Stocks are pricing inflation as yesterday’s problem.

But equities look to be mis-pricing recession and inflation risk.

A whole suite of indicators are symptomatic of a recession, and the recent steepening of the yield curve is consistent with a slump beginning as early as June.

Indeed, there is a strong relationship between the maximum inversion of the yield curve before a recession, and the peak-to-trough fall in equities.

As the chart below shows, the ~110 bps peak inversion of the 2s10s curve is consistent with a 35% total fall in equities, i.e. another ~19% fall in the S&P from here.

Further, inflation is likely to remain much stickier than stocks expect. Acyclical inflation in the US is driven by global factors, primarily China.

As China opens up, monetary easing is beginning to gain traction, which is soon expected to feed into higher inflation in China. Thus US inflation, boosted by acyclical inputs, is prone to start rising again, leaving higher-duration stocks and sectors at risk of a selloff.

It’s not just China though: other structural drivers such as elevated profit margins and wage growth are likely to lead to much stickier, more entrenched inflation. Stocks, instead, appear to be taking their cues from inflation swaps, which see headline CPI settling back to ~2.5% within a year.

The bond market is also not pricing in the risks of high inflation, inferred by term premium’s largely quiescent behavior so far. The equity risk premium – the excess earnings yield on stocks above Treasury yields – is also at more-than-10-year lows. But if we adjust it for term premium, the ERP is near 20-year lows. As the chart below shows, two of the last major market tops were accompanied by a very low adjusted ERP.

In a world of no or mild recession and inflation’s capitulation it would make sense for this measure to be so low. But there is no margin of safety.

A recession or higher inflation would see the risk premium rise and equities fall, potentially significantly.

Equities may see the glass as half-full, but they might not like the taste of what’s in it.

Tyler Durden

Fri, 03/31/2023 – 07:20

inflation

monetary

markets

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…