Economics

Stocks boosted on premature debt ceiling deal hope

US stocks are stuck in wait-and-see mode until we get the next debt ceiling talk update. Over the weekend, President Biden provided optimism that a deal…

US stocks are stuck in wait-and-see mode until we get the next debt ceiling talk update. Over the weekend, President Biden provided optimism that a deal could be reached, but no meaningful concessions have been made from either side. Until we have Republicans and Democrats move a little on tax increases, increasing the debt ceiling, or federal spending, any optimism is premature.

Stocks pared gains as stagflation risks returned after a disappointing manufacturing report that showed prices paid rose but factory activity plunged. It seem that after every economic reading, Wall Street has more reminders on how hard it will probably be to get inflation anywhere close to the Fed’s target. A recession seems like the only way pricing pressures will get closer to 3%.

Debt Ceiling

Over the weekend, US President Biden maintained his “optimistic” stance that Democrats and Republicans would be able to reach an agreement to raise the US debt limit and avoid a default. Staffers worked throughout the weekend, including the Mother’s Day holiday in hopes that they could provide some progress to Tuesday’s big meeting. Biden is hoping tomorrow’s meeting with Republicans will show some progress that drives confidence that the US will avoid the catastrophic consequences of defaulting. If successful, Biden may choose to attend the G7 summit in Japan.

We have yet to see any market stress, so it might be difficult for both sides to make any significant concessions.

Turkey

After 20 years of power, the Turks are not sure if they want President Recep Tayyip Erdogan to remain in power. Turkey continues to struggle with inflation and the country is still feeling the effects of a couple massive earthquakes. With 64 million potential voters, it looks like the weekend election was unable to produce a winner with over 50% of the total vote. Financial markets love clarity and this first round of voting did not produce come close to provide a clear winner. The Election board announce this election will have a second round as Erdogan finished with 49.5% of the vote, while main rival Kemal Kilicdaroglu finished with 44.89%.

The Turkish lira weakened as markets will have to deal with uncertainty for and some might expect Erdogan to win in two weeks, which would imply some traders are expecting his unorthodox monetary policy to remain in place, which calls for rate cuts despite multi-decade high inflation.

Democracy is gaining momentum in Turkey, but it seems that Erdogan is still the favorite given how crucial his international ties are for the economy.

Empire

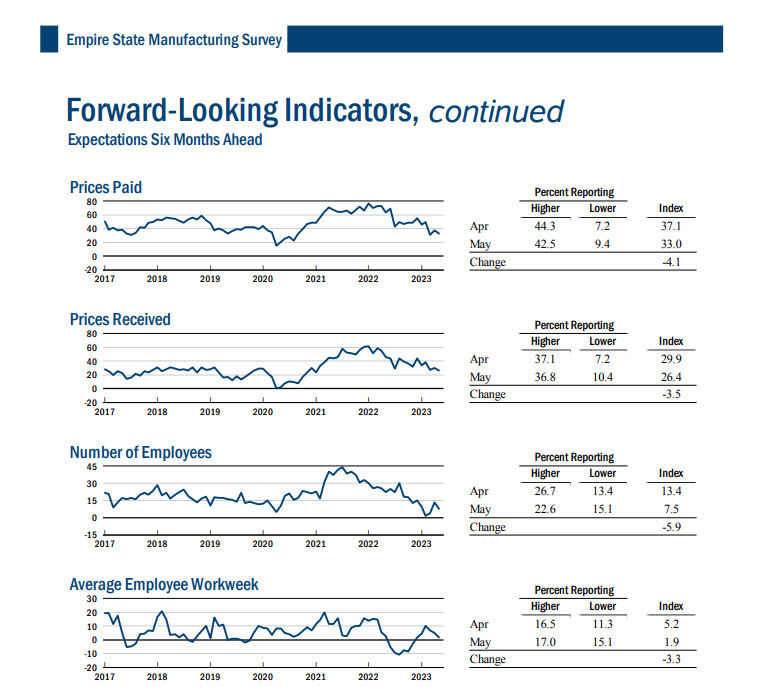

The first Fed regional survey showed manufacturing activity plunged in May. The Empire State survey showed inflation pressures remained while conditions significantly worsened. The New York Fed Empire index fell 31.9, much worse than the expected decline of 3.9, and a significant reversal to the temporary rebound of 10.8 seen in April.

The Fed’s tightening cycle is starting to hit the economy and that helped send yields sharply lower.

inflation

stagflation

monetary

markets

policy

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…