Economics

Stocks Are Overbought Relative To Bonds

Stocks Are Overbought Relative To Bonds

Authored by Simon White, Bloomberg macro strategist,

The stock-bond ratio is on the high side, suggesting…

Stocks Are Overbought Relative To Bonds

Authored by Simon White, Bloomberg macro strategist,

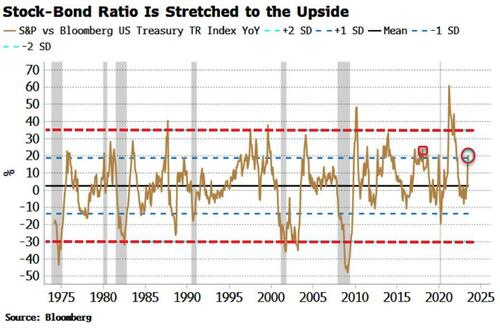

The stock-bond ratio is on the high side, suggesting some mean reversion is possible, i.e. for stocks to underperform bonds. This can happen either through stocks selling off more than bonds, or more likely given bonds’ oversoldness, bonds rallying by more than stocks.

Stocks have given back some ground in recent weeks, down about 4% from their July high, but bonds have sold off even more, with 10-year yields almost 60 bps higher at ~4.3%.

This has led to the stock-bond ratio’s annual growth rate hitting levels last seen in 2018 and briefly in early 2020. As the chart below shows, the stock-bond ratio is mean reverting, and we are around growth levels where it could soon revert to the mean (or overshoot to the downside).

This is consistent with the depressed equity risk premium (ERP).

The ERP captures the relative valuation between stocks and bonds. It has fallen to more than 15-year lows as the earnings yield drops relative to the 10-year yield. Stocks only offer ~30 bps more yield than a 10-year Treasury bond.

The attraction of risk-free cash at high rates is a significant one.

Why take the risk of stocks when you can lock in 4.3% for ten years, or well over 5% for under a year, for effectively zero risk?

Indeed such juicy offerings are enhancing long/short equity funds’ returns.

Their shorts typically fund most of their longs, and they can invest remaining cash in high-yielding bills or MMFs to bolster returns.

One anticipated feature of the current inflationary regime that has come to pass is the now positive correlation between stocks and bonds. In the days of low-and-stable inflation their negative correlation meant bonds were a good hedge for stocks. That is no longer the case.

Given that bonds are short-term oversold, and assuming this positive correlation persists, then it’s more likely we see stocks-bonds mean reverting through bonds rallying more than stocks, as falling yields allow equities to end their three-week losing streak.

Tyler Durden

Fri, 08/18/2023 – 08:30

inflation

correlation

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…