Economics

Sticky Global Inflation Will Keep Lid On Liquidity

Sticky Global Inflation Will Keep Lid On Liquidity

Authored by Simon White, Bloomberg macro strategist,

Global median inflation rate has…

Sticky Global Inflation Will Keep Lid On Liquidity

Authored by Simon White, Bloomberg macro strategist,

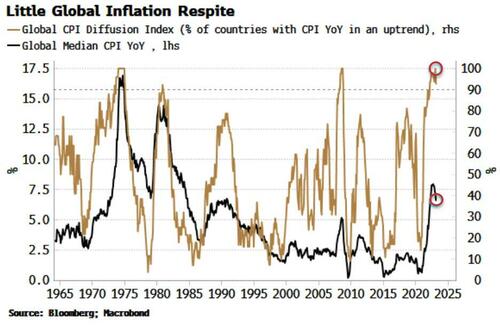

Global median inflation rate has fallen from its peak, but all major countries are still in an inflationary uptrend, keeping several central banks in tightening mode for now.

UK inflation surprised to the upside again, highlighting a global problem. The global median CPI rate has only marginally fallen from its recent peak. And the percentage of major EM and DM countries whose year-on-year CPI is in an upwards trend is back at 100% after a brief dip.

Inflation is living up to its reputation of being like toothpaste – easy to get out of the tube, but difficult to put back in.

Central banks, especially those further behind the curve like the BOE and the ECB, are keeping their foot on the brake, but becoming more circumspect given the growing risks to financial stability from higher rates.

This is leading to a continued squeeze on global liquidity. The Global Financial Tightness Indicator (GFTI), essentially a diffusion of global central-bank rate hikes, had started to rise, suggesting liquidity conditions were beginning to ease.

But the Advanced Global Financial Tightness Indicator, which gives a four-month lead on the GFTI, has turned down again, suggesting the GFTI will soon do likewise.

This will be a continued headwind for global assets and inhibit economic growth.

This is part of the plan, of course, to quell inflation, but the risks from unintended consequences are manifest, and central banks will almost always only know they have pushed too far after the fact.

In the UK, the BOE will be mindful of the cumulative build-up of borrowers coming off fixed-rate mortgage deals and paying significantly higher rates.

At some point this will bite. There are already signs of distress, though, with a marked pick-up in insolvent companies.

Tyler Durden

Wed, 04/19/2023 – 10:50

inflation

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…