Economics

Rising U.S. Interest Rates and Emerging Market Distress

The Issue:

The recent swift tightening of monetary policy in advanced economies, especially the United States, in response to high inflation poses significant…

The Issue:

The recent swift tightening of monetary policy in advanced economies, especially the United States, in response to high inflation poses significant challenges to emerging market and developing economies.

The Facts:

- Increases in U.S. interest rates associated with higher inflation expectations or, especially, the perception that the Fed has shifted toward a more aggressive policy are likely to lead to more adverse spillovers on emerging and developing economies than when higher interest rates are the result of improved prospects for the U.S. economy.

- Using historical data, the World Bank study estimated that, for the average emerging market/developing economy, the probability of facing a financial crisis in a given year from 1985 to 2018 was 3½ percent. But the study estimated that the probability of a crisis almost doubled, to about 6½ percent, when the 2-year yields in the U.S. increased by 25 basis points because of market expectations of a shift toward more aggressive Fed policy. By comparison, the impact of an increase in interest rates due to improved prospects for the U.S. economy did not materially affect the likelihood of currency crises in emerging markets and developing economies.

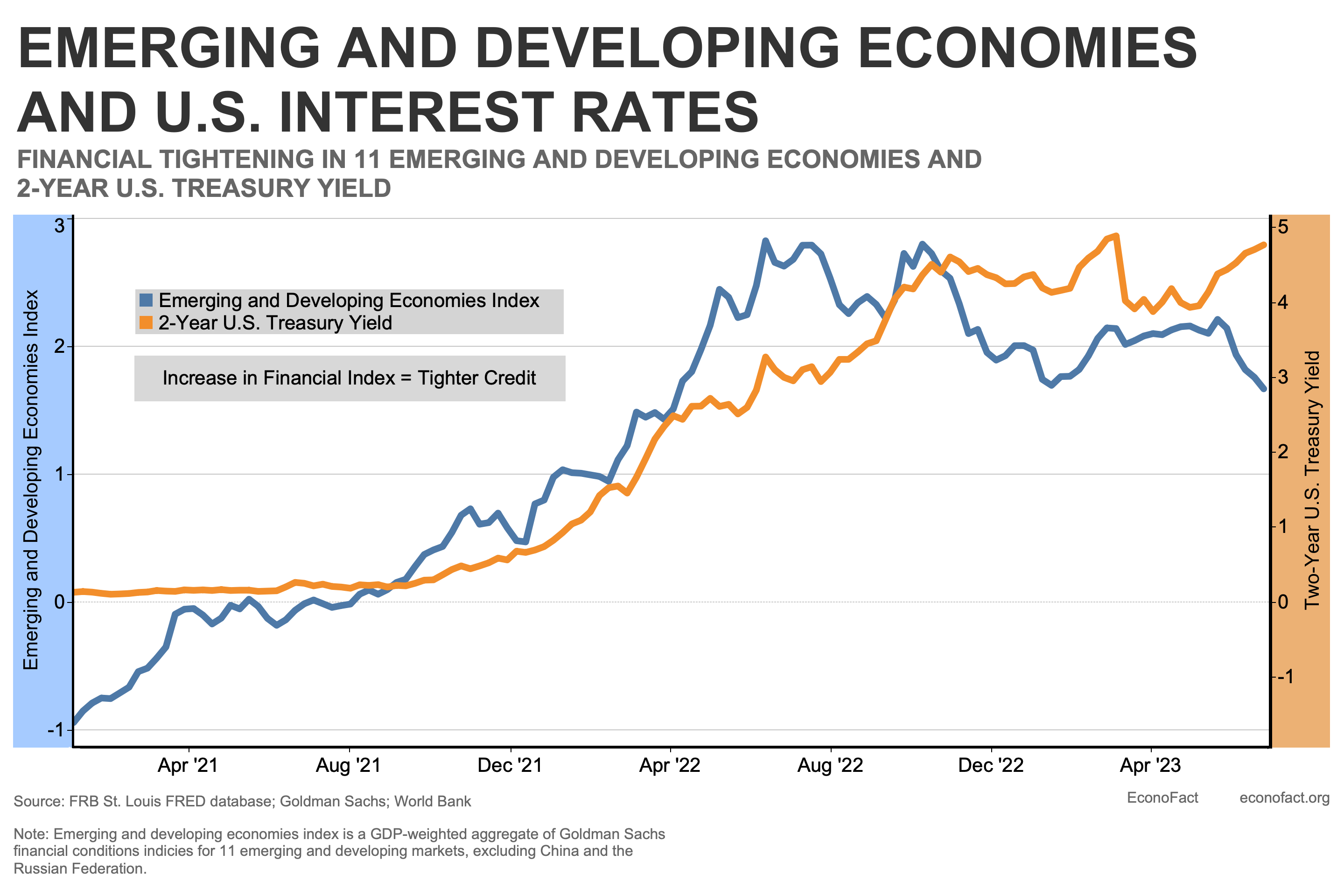

- Since the end of 2021, there has been an increase in the share of emerging markets and developing economies with sovereign spreads exceeding 10 percentage points (that is, government bond yields that are 10 percentage points or greater than the bond yields of countries with AAA ratings). The interest rate facing corporate borrowers in an emerging market or developing economy rises with increases in that country’s sovereign interest rate. The financial conditions in these economies have become more challenging with rising U.S. interest rates: as shown in the chart, emerging market financing conditions rose rapidly in tandem with the yield on U.S. two-year Treasury bonds amid the rapid tightening of monetary policy that began in March 2022.

- Countries with shorter records of borrowing in international markets and countries whose borrowing is below investment grade with weak monetary and fiscal policy frameworks have been particularly exposed. Indeed, from January 2022 to May2023, sovereign risk spreads in emerging and developing economies with weaker credit ratings (Caa and below) rose by more than 12 percentage points; in contrast, spreads in emerging and developing economies with stronger credit ratings (Baa and above) increased by only 0.2 percentage points.

inflation

monetary

markets

policy

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…