Economics

Regional property takes a dive; NAB says the RBA hasn’t even begun messing with your life

The latest property data shows regional houses are lingering unsold on the market while NAB reckons the RBA is just … Read More

The post Regional property…

Australia’s flight of fancy to the country life could already be over, with some of the snazziest regional getaways already seeing the property values slip silently away, like a Canberran with a car full of kids and a bureaucracy to watch on Monday.

The latest data has vendor discounts climbing all over it and regional properties lingering unsold despite an entire summer on the market.

A searching examination of the country’s 25 largest non-capital city regions by property prognosticators CoreLogic shows 13 areas recorded rising house values over the year to January 2023, down a full third from the 21 over the year to October 2022.

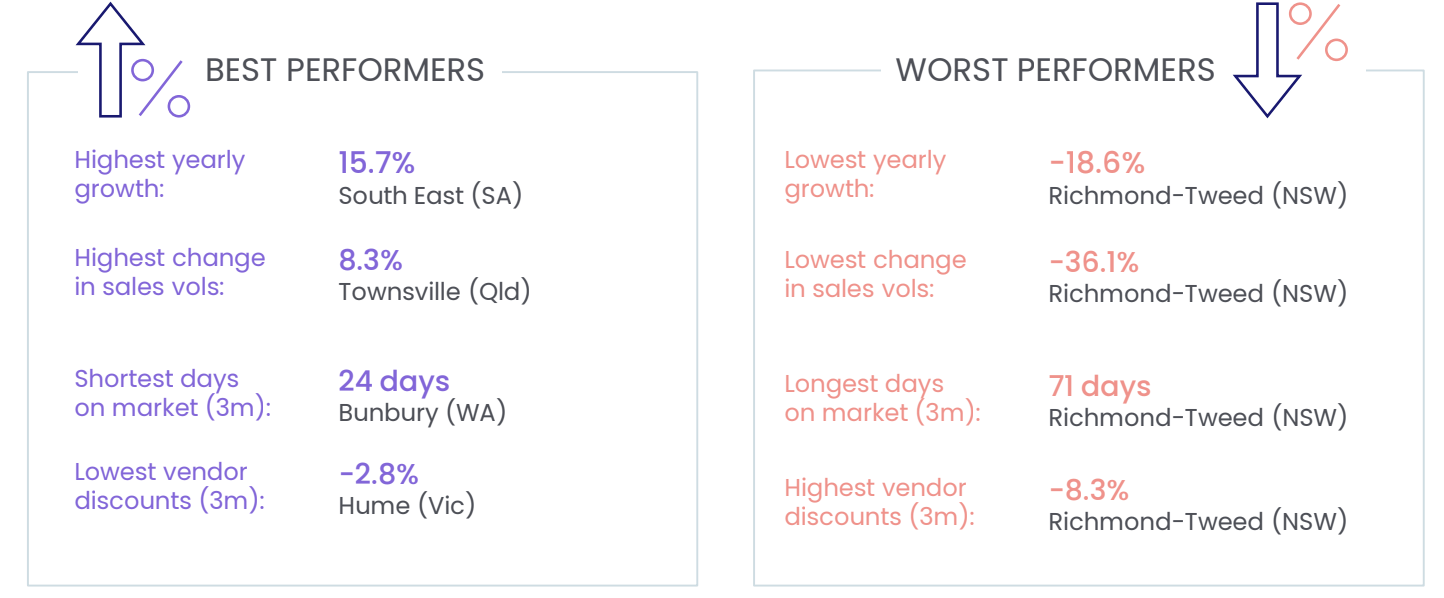

The southeast of South Australia – like Kangaroo Island, the Fleurieu Peninsula and the Limestone Coast – has come in as our best performing regional house market, with an annual value growth of 15.7%.

The NSW regions of New England and North West and Riverina weren’t too far behind, with values increasing 11.5% and 10.1% respectively.

However, CoreLogic’s Angel of Death and Head of Research Eliza Owen says the nation’s most popular lifestyle markets have copped it worst amid the softer property conditions and the central bank’s apparent rate-increases-in-perpetuity.

NSW’s chic coastal and hinterland Richmond-Tweed region logged the worst performance across all of Eliza’s metrics, registering the lowest annual growth rate, largest drop in sales volumes, longest days on market, worst dressed and highest vendor discounts.

“It is unsurprising the Richmond-Tweed region recorded the strongest decline in house values and a sharp increase in other important metrics.”

Regional housing market

“This was the region where values skyrocketed, with houses increasing more than 50% during COVID, taking the median house value to more than $1.1 million. Since then much has changed with borders reopening, outbound travel returning, workers returning to the office not to mention the overlay of nine rate rises. It’s been a swift and significant shift.”

Eliza says those regional areas where double-digit annual growth rates were still occurring were predominantly areas that had emerged from a long period of subdued capital growth performance.

“The COVID-boom unlocked enormous value across more affordable regional tree-change markets such as South Australia’s South East region. The surge in demand for areas such as New England and North West was also likely to have been due to a spill over from nearby markets such as Richmond-Tweed, where the strong migratory sea-change trend and low interest rates priced out many lower income households.”

Richmond-Tweed’s house market value fell 18.6% in the year to January, with sales volumes down 36.1% (in the year to November) and houses sitting on the market for 71 days. Vendor discounting hit -8.3% for the same period. Despite the drastic shift in market conditions, houses in the region are still up 23.7% on pre-COVID levels.

Houses in the Illawarra region, 90km south of Sydney, recorded the second lowest yearly change of -12.6% after values surged 44.0% through the recent upswing.

Houses sold fastest in Bunbury (WA) where the median time on market over the three months to January was 24 days. Queensland’s Toowoomba region recorded the second fastest sales time, with a median time on market of 28 days.

Meanwhile, the National Australia Bank says the fun for Aussie homeowners will continue unabated with more interest rate rises – at least three of them in the post this year – as the Reserve Bank turns on the pain-o-meter to Full Sting.

The NAB rejigged its Aussie economic outlook this week, hiking their peak of RBA hiking a fair bloody whack – Alan Oster’s team now forecasting the cash rate to top out at 4.1% in May, smiting earlier forecasts of just 3.6%.

It comes as the combined value of our residential real estate dropped to $9.2 trillion at the end of January, down from $9.3 trillion the previous month. This – again it’s Eliza – decline in home values represents a 7.2% decrease over the past 12 months, the largest annual drop since May 2019.

Last month, national home values fell 1.0%, slightly less dramatic than the 1.1% fall in December and below the peak monthly decline (-1.6%) of August, but still in Golden Globe territory.

The highest annual growth rate in dwelling values among the regional and capital city dwelling markets was across Regional SA, at 15.3%. The lowest change in values was across Sydney, where home values declined 13.8% in the past year.

Sales volumes continue to just keep on a sliding lower as buyers evaporate and their worthless cash remains off the table.

CoreLogic reckons in the 12 months to January, there were 500,550 sales nationally, down over 19% compared to the previous year. That said, sales estimates are still 4.6% above the decade average.

The cash rate target has already risen 0.25 basis points this year to a decade high 3.35%.

For a standard half a million 25-year loan, that’s delivered an extra $930 to the monthly mortgage bill, since last May.

NAB now says those bills can grow by at least another $180.

Consumer spending is off the charts considering what’s happening, so you can expect the central bankers will dig deep in their arm wrestle with toppy inflation.

“The RBA’s framing of domestic inflationary pressures has clearly changed and as such, we judge it to be unlikely the Board will feel comfortable pausing [rates] before May,” NAB says.

The post Regional property takes a dive; NAB says the RBA hasn’t even begun messing with your life appeared first on Stockhead.

inflation

markets

reserve

interest rates

central bank

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…