Economics

Peter McGuire: We’re stuck on oil’s 2022 rollercoaster and we should get off soon and sit in a bath

The theory out of Goldman Sachs is that a newly unleashed Chinese economy, amped up on the typical energy intensive … Read More

The post Peter McGuire:…

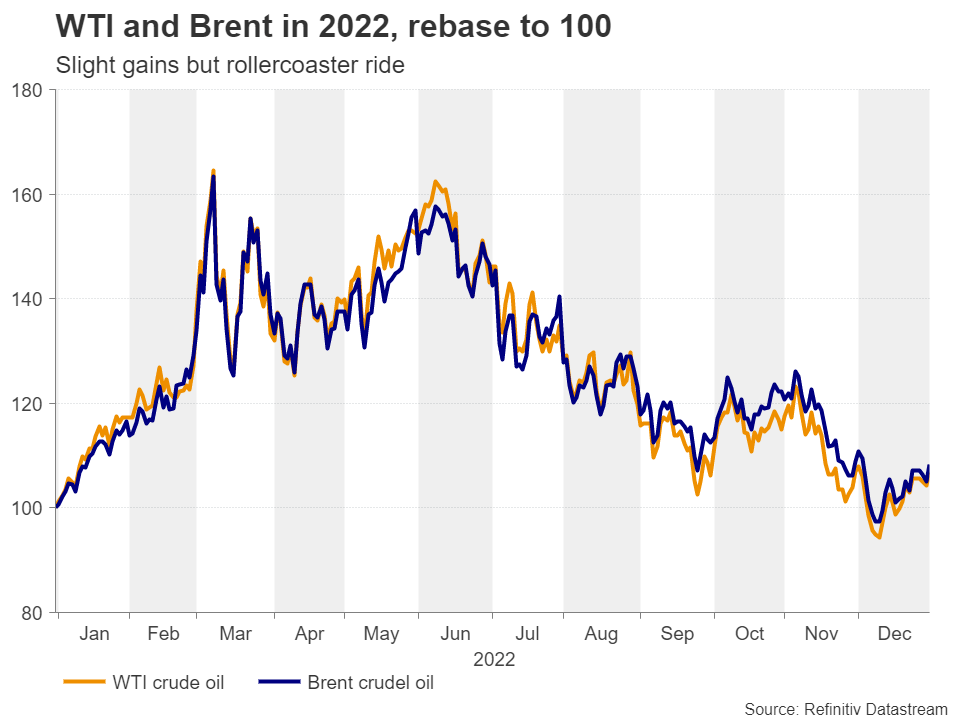

The theory out of Goldman Sachs is that a newly unleashed Chinese economy, amped up on the typical energy intensive economic stimulus, will drive global oil demand hard this year and there’ll be significant growth too – somewhere around an extra 2.7 million barrels of oil a day.

Even without the shennanigans out of Russia, the usual dramas in the US or the footsies over at OPEC+, Goldman now says that China-alone will lead to a demand-supply imbalance by mid-year.

By Christmas 2023, a barrel of Brent will be going for US$105, Goldman Sachs reckons.

But Peter McGuire, CEO of XM Australia says the year in oil markets won’t be that cut and dried, and certainly not in the months ahead.

“No one even knows what’s really happening inside China right now, let alone in a few months.”

Pete spoke to SH from God’s own slice of Sydney (Coogee) last week and told us the price of the Commodity of the Year 2022 and the Increasingly Essential Commodity of 2023, could go either way.

A rock and a hard place for oil?

SH: Pete thanks for the time – to borrow your own phrase – Is oil stuck between a rock and a hard place right now? Goldman’s made a big call on the direction oil will go this year. Are we about to see prices go back to where they were when all this started getting ugly and Putin crossed the border into Ukraine?

PMcG: After trading all over in 2022, oil is apparently starting the new year stuck somewhere between a rock and a hard place, we’ve got the outcomes of ongoing market-related themes which could just as easily end up working in favour or against it. In other words, the risks surrounding oil are 2-sided, and it remains to be seen which will prevail in the weeks and months to come.

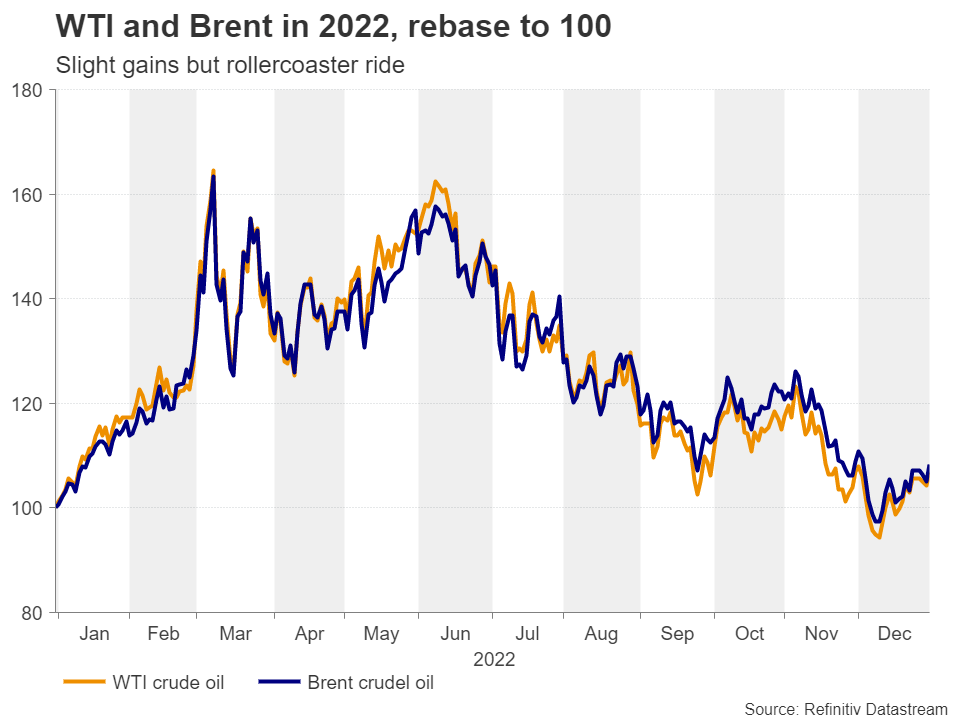

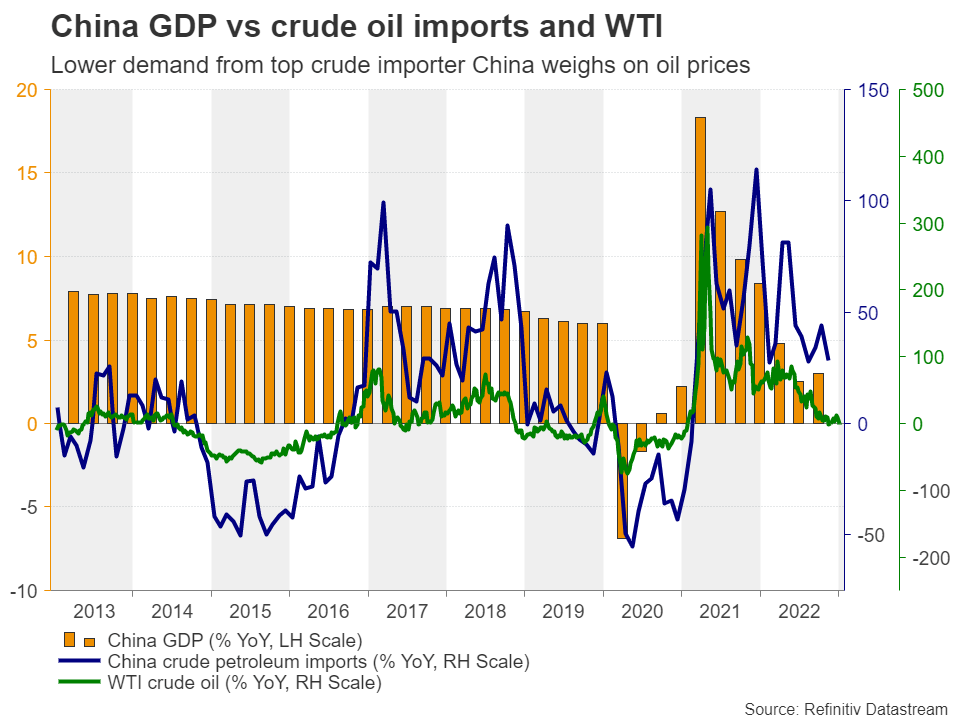

SH: Oil prices finished 2022 slightly ahead… WTI and Brent crude oil futures by your calculations circa 7% and 9% respectively… But these numbers are a long way from describing what a stunning year it’s been for oil and the companies that produce them.

PMcG: Mate that’s right, great research! From around US$75 a barrel, WTI just shot up. Spiked or surged… or pick a word. I think it hit around US$130 in the aftermath of Russia’s invasion… before suddenly reversing south soon thereafter as sky-high inflation and aggressive tightening by the big central banks went and sparked fears about a global recession… and thereby concerns about weaker demand … it was a rollercoaster.

SH: And you don’t think it’s over at all do you.

PMcG: No. As we are, total uncertainty and heaps of volatility… oil has a potentially very wide trading band ahead.

SH: Is the reopening of China a positive development?

PMcG: It is if you’re not in China… in early December, investors cheered headlines of a gradual easing of COVID restrictions and a reopening of the world’s second largest economy. Oil prices joined the party and rebounded from a nearly one year low on hopes that demand from the world’s top crude importer could be restored.

PMcG: ….That said, with COVID infections soaring in many districts, the optimism faded fast. Investors became worried that, let alone the risk of reversing relaxations, the Chinese economy may take much longer to recover. There are also increasing concerns about the risk of new variants spreading to the rest of the world, resulting in economic complications elsewhere as well and thereby more reduction in fuel consumption. And all this as major economies, like the EU, the US, and the UK, are already considerably wounded.

SH: What about the cap on Russian oil?

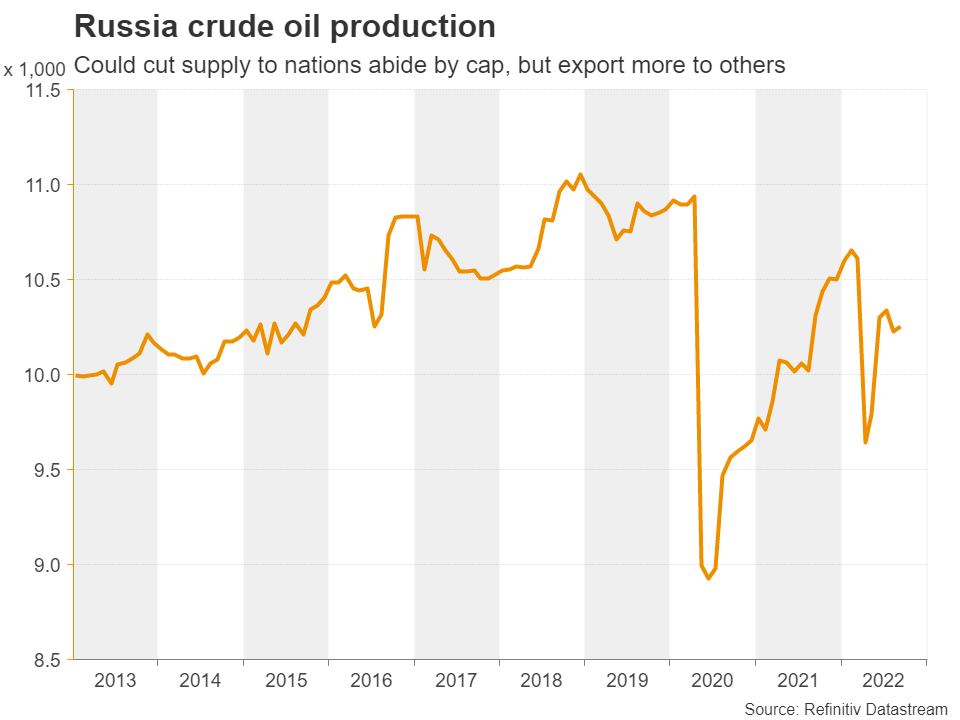

PMcG: Apart from China’s reopening, the cap imposed by the G7 nations on Russian oil is another double-edged sword. Following the verdict, Russia decided to ban the supply of oil to nations that abide by the cap for five months starting in February, which is supportive for prices.

PMcG: Nonetheless, given that more Russian oil is now shipped to China, Turkey, and Indonesia for refining and that there are no restrictions for the US and Europe on importing petroleum products made with Russian oil outside Russia, any gains in oil prices from Russia’s banning may be limited and short lived.

SH: US reserves, OPEC, and winter also adding some unknowable variables into the oil equation

PMcG: Well clearly another source of demand may be the US decision to replenish its strategic petroleum reserve after selling record amounts last year… While the list of arguments pointing to a limited recovery includes the possibility of OPEC reversing some of its production cuts announced in November, as the cartel’s own projections point to increasing demand in 2023.

Winter is also a variable in the oil equation. EU nations’ ability to pile up oil before Russia’s retaliating measures take full effect and a mild winter so far have allowed oil prices to stay in downtrend mode. However, should winter get colder in the coming months, demand for heating oil could increase and thereby lift prices.

SH: The outlook seems blurry for now, are we back to backing the USD?

PMcG: Blending everything together, the short-term outlook of oil looks blurry for now. Having said that though, what appears to be a clearer case for the next months is that a sustained uptrend may be off the books. Even if the Chinese economy recovers faster and oil demand is restored, and even if supply tightens more due to Russia’s decisions, a strong recovery in oil prices could well refuel inflation.

Should the central banks respond by re-accelerating and extending their tightening crusades, the global economy is very likely to fall into a deeper recession than currently estimated, which would eventually weigh on oil prices due to speculation that demand for energy could be dented again. A rebound in the US dollar as it reclaims the throne of the ultimate safe haven may also weigh on oil.

Now, in case the surging infections in China result in more economic complications and the reopening of its borders more spreading of the virus to the rest of the world rather than spurring an economic recovery, oil prices may come instantly under pressure, with WTI perhaps falling below $70 per barrel.

SH: Give us the technical analysis is baby steps?

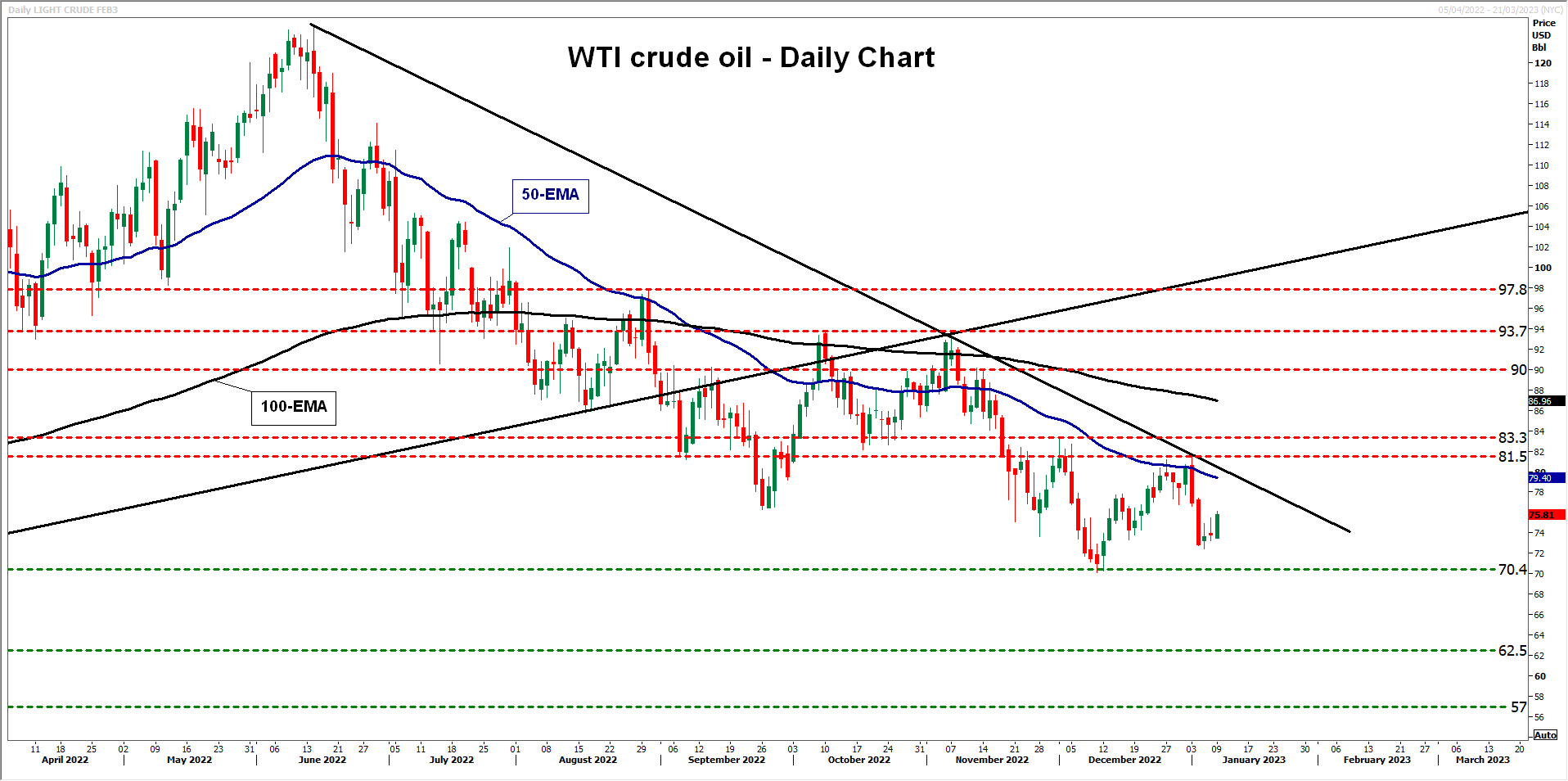

PMcG: From a technical standpoint, WTI crude oil remains below the long-term uptrend line taken from the low of April 28, 2020, below the downtrend line drawn from the high of June 14, and below both the 50- and 200-day exponential moving averages.

On top of that, last week, the black liquid came under selling pressure after hitting the short-term downtrend line, which implies that the bears may have not said their last word, despite allowing a rebound at the start of this week.

The post Peter McGuire: We’re stuck on oil’s 2022 rollercoaster and we should get off soon and sit in a bath appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…