Economics

Personal Consumption Expenditures Price Index: +0.2%

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year. Here is BEA: Personal income increased…

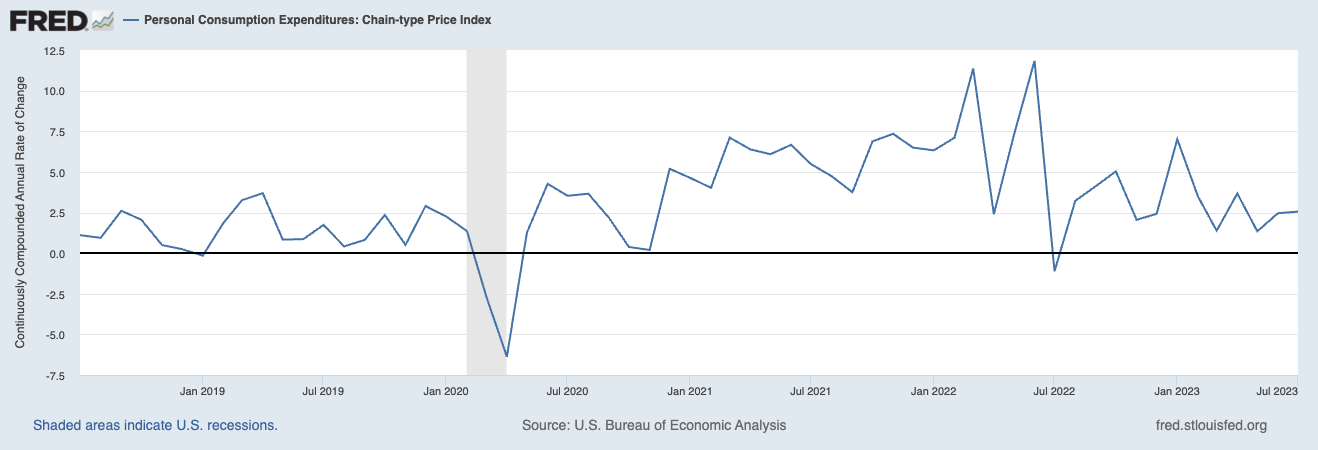

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year.

Here is BEA:

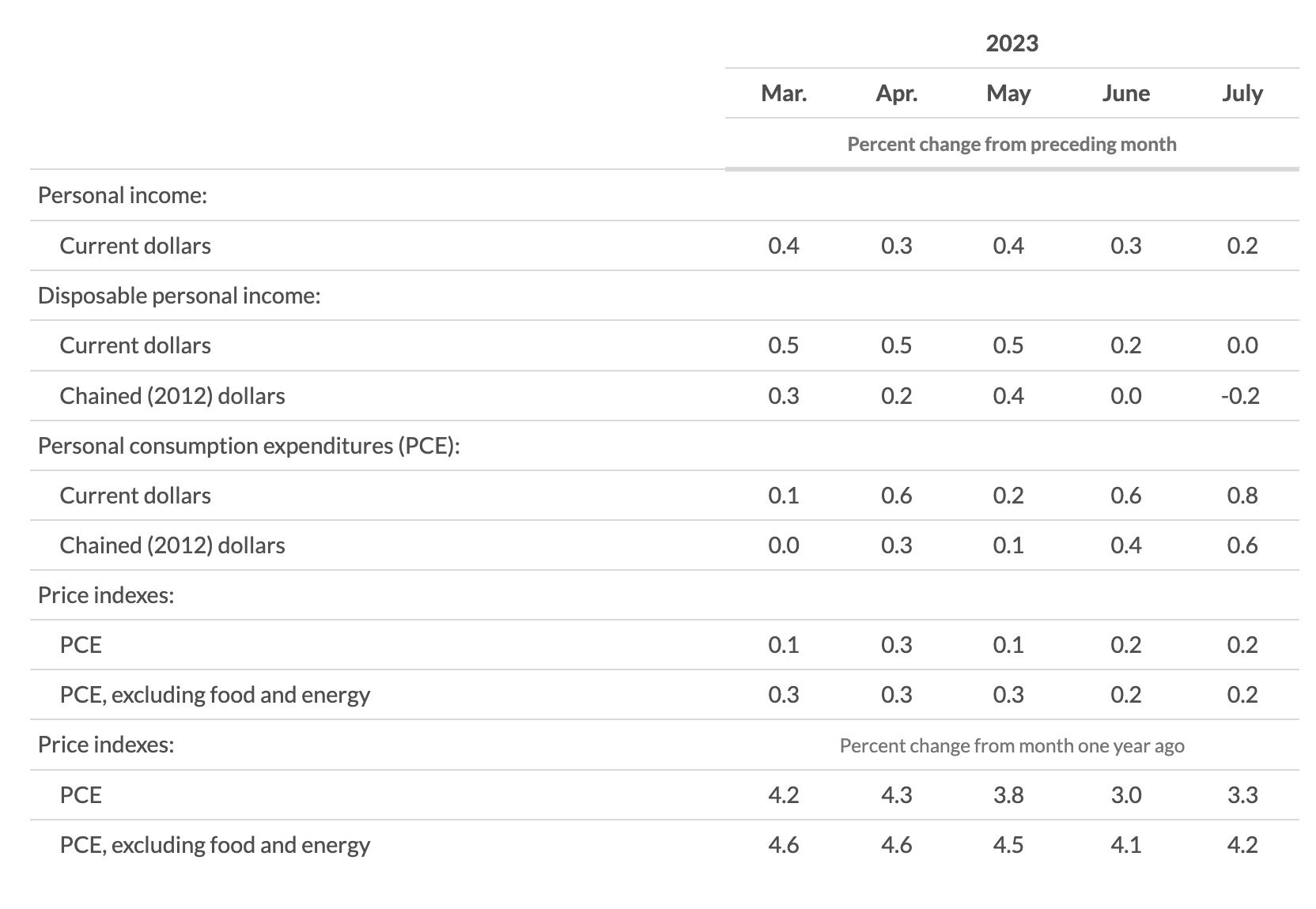

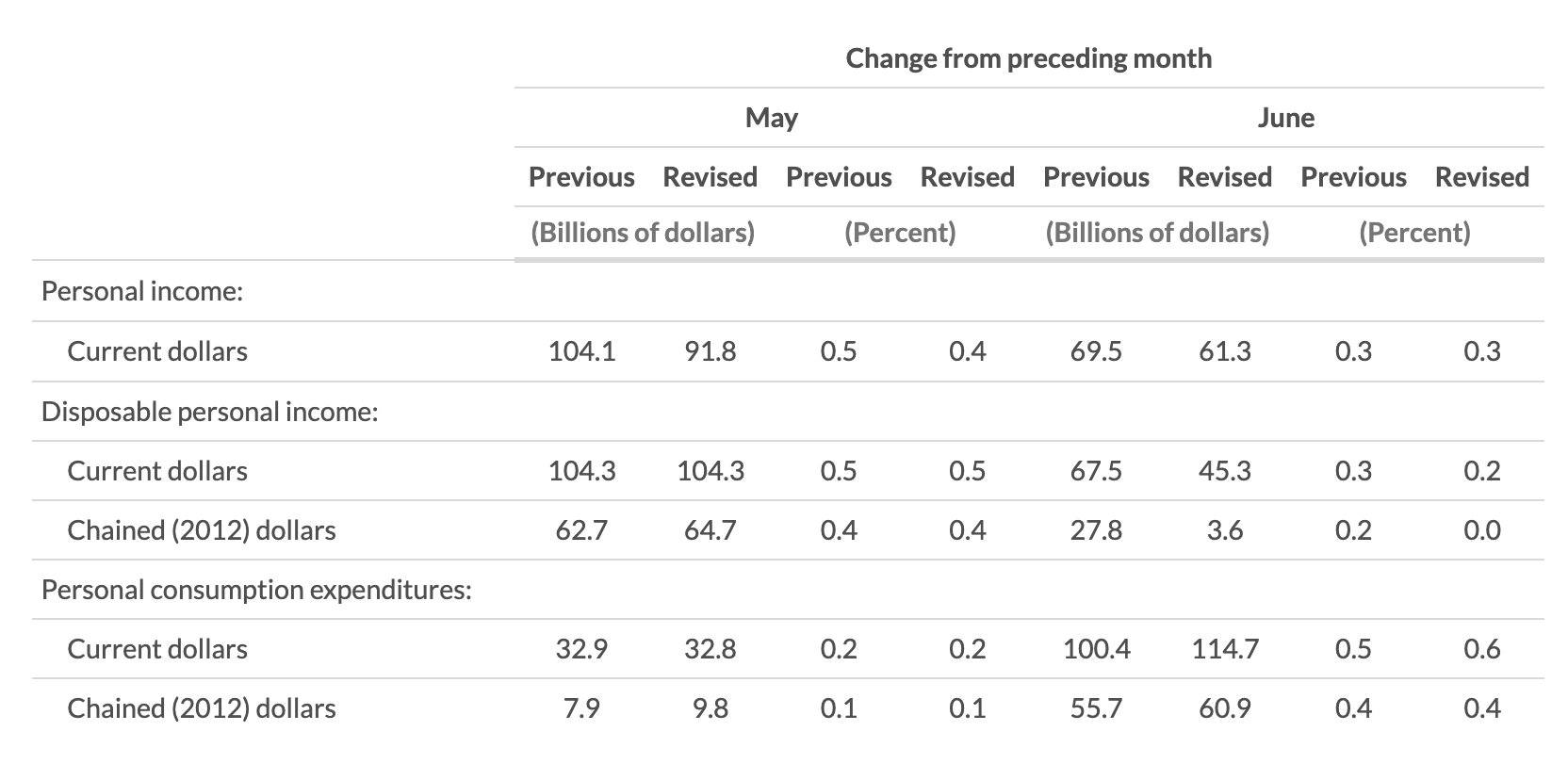

Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July, according to estimates released today by the Bureau of Economic Analysis (table 3 and table 5). Disposable personal income (DPI), personal income less personal current taxes, increased $7.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $144.6 billion (0.8 percent).

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent (table 9). Real DPI decreased 0.2 percent in July and real PCE increased 0.6 percent; goods increased 0.9 percent and services increased 0.4 percent (tables 5 and 7).

I feel like a broken record here, but 0.2%? PUH-leeze, the FOMC is done.

Source:

Personal Income and Outlays (BEA, July 2023)

Previously:

Five Ways the Fed’s Deflation Playbook Could Be Improved (Businessweek, August 18, 2023)

2% Inflation Target is Silly (July 26, 2023)

A Dozen Contrarian Thoughts About Inflation (July 13, 2023)

Inflation Expectations Are Useless (May 17, 2023)

Some charts that make it look like I know what I am talking about…

The post Personal Consumption Expenditures Price Index: +0.2% appeared first on The Big Picture.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…