Economics

Payrolls Might Be The Jolt That Fully Shakes The VIX Awake

Payrolls Might Be The Jolt That Fully Shakes The VIX Awake

Authored by Simon White, Bloomberg macro strategist,

Jumpy yields are prone to…

Payrolls Might Be The Jolt That Fully Shakes The VIX Awake

Authored by Simon White, Bloomberg macro strategist,

Jumpy yields are prone to rising further if jobs data out later today is much better than expected, taking stocks lower and boosting higher a recently resurgent VIX.

This week has brought focus on US fiscal profligacy. Large and persistent fiscal deficits, the hallmark of the Treasury put, are inflationary.

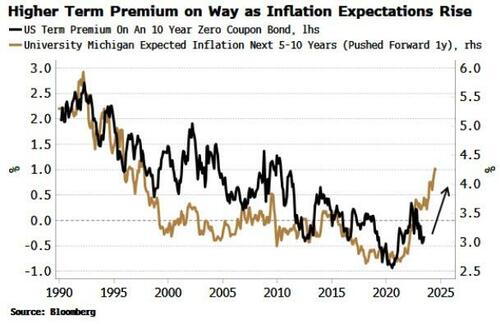

Inflation expectations have been rising for some time now, and reflecting this term premium is beginning to rise, taking yields higher with it.

Further, the market is faced with a deluge in supply at the same time as the Fed, US banks and foreigners are all reducing their Treasury holdings.

At such a febrile time, yields are exposed to further upside moves. Today’s jobs data, if it comes in much stronger than expected, would be one potential catalyst.

Payrolls has been trending lower this year, and leading data anticipates there’s more to come. The tightening in consumer credit, for instance, confirmed in the release this week of the latest Senior Loan Officer Survey, points to payrolls growth that will soon be contracting.

But month-to-month payrolls is very volatile, and a much stronger out-turn than the 200k new jobs expected would likely spur another ratchet higher in yields. Claims, continuing claims and ADP all would support stronger payrolls for July.

Stocks would likely take it on the chin.

They’re on track for one of their worst weeks since the banking turmoil in March.

A fall in stocks would likely trigger another rise in the VIX, which has awoken in the last few days, right on cue as far as seasonals are concerned. August and September are typically the months that see the largest rises in the VIX.

The VIX is low relative to FX and bond implied volatility, and positioning of speculators in VIX futures has been rising but remains net short. Moreover, the call-put ratio in the VIX remains elevated, which can foreshadow a rise in the underlying.

Tyler Durden

Fri, 08/04/2023 – 08:10

inflation

fed

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…