Economics

Oil Jumps After Russia Threatens To Cut Output In Response To Price Cap

Oil Jumps After Russia Threatens To Cut Output In Response To Price Cap

After two weeks of silence in detailing how it would react to the…

Oil Jumps After Russia Threatens To Cut Output In Response To Price Cap

After two weeks of silence in detailing how it would react to the G7 oil price cap, overnight the Kremlin raised the stakes for the west when state-run Tass news service quoted Deputy Prime Minister Alexander Novak as saying that Russia may reduce output by 500,000 to 700,000 barrels a day in response to the cap.

While not yet formalized, President Putin plans to sign a decree on the nation’s reaction to the threshold on Monday or Tuesday, containing unspecified “preventive measures.”

“A risk-on sentiment and a weaker US dollar are helping oil today,” said Giovanni Staunovo, a commodities analyst at UBS Group AG. “The Russian comments are also helping but the market probably wants to see it before it believes, hence a muted response.”

As the war in Ukraine grinds on, traders have been waiting for Moscow’s full response to the cap, a policy that imposed a $60-a-barrel ceiling on Russian crude in a bid to reduce the Kremlin’s income while keeping exports on the market. While the policy has largely worked so far, with Russia’s popular Urals oil trading below $60 due to sharp discounts to Brent, as the price of oil rises, Urals will also rise above the critical threshold potentially depriving the world of million in barrels of daily supply.

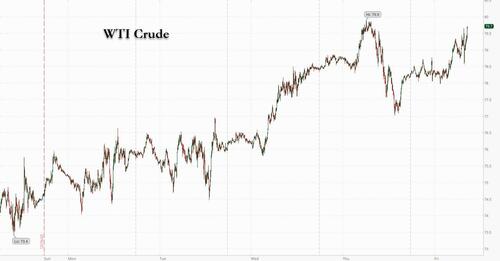

And speaking of prices, WTI rose more than $2 on the news, while Brent was above $83 despite pervasive global recession fears. The gains meant WTI was set to post its second consecutive weekly gain.

As reported earlier this week, there already had been early signs the cap is impeding Russian oil flows, an impact that would run counter to its stated aims. In the first full week after the limit came into effect on Dec. 5 — in tandem with a European Union ban on seaborne Russian imports and curbs on insurance — total volumes shipped from the nation sank by 54%, tanker tracking compiled by Bloomberg showed.

The threat of Russian output cuts comes as China’s rapid shift from Covid Zero has bolstered the demand outlook next year, even though the swift shedding of curbs has been disruptive. With cases spiking, several measures of mobility including traffic congestion in major cities, subway usage and the number of domestic flights have slumped. That said, the country is also easing quarantine rules for air travel, which should boost consumption and oil demand should surge in a few weeks when China builds up natural immunity to the disease even it admits is no riskier than the common cold.

Meanwhile, with Biden’s politically-mandated SPR drain ending, data this week showed a drop in commercial crude inventories, with nationwide holdings at their lowest for this time of year since 2014. Traders are also watching for any fallout for energy markets from a vicious winter storm that’s pummeling parts of the country.

“There is now a high likelihood that the Biden administration will gear up oil purchases heading into the new year,” said Ole Hvalbye, an analyst at SEB AB. Good luck keeping the price of oil below $95 which is the blended average sale price from the SPR.

In the physical market, the prompt time spread in WTI futures was 13 cents a barrel in backwardation, a bullish pattern in which near-term prices are higher than later-dated ones. A week ago, it was 17 cents a barrel in an opposite bearish contango. In other words, the bottom for the oil market is now in the rearview mirror, just as we expected.

Cramer: “I think oil goes to 65”

— zerohedge (@zerohedge) December 12, 2022

Tyler Durden

Fri, 12/23/2022 – 08:44

dollar

commodities

markets

policy

us dollar

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…