Economics

Oh Deer! Housing in the Headlights

It’s handy to imagine the housing market as a living organism. Various active systems perform their own, specific functions while

The post Oh Deer! Housing…

It’s handy to imagine the housing market as a living organism. Various active systems perform their own, specific functions while enabling each others’ operation without even knowing it. The circulatory system gets blood to the digestive organs, which metabolize the food and make it into energy that runs the respiratory system, which oxygenates the blood being pumped around to feed the nervous systems, lymphatic system, etc.

In the housing economy, home owners earn money to service mortgage loans made by the banking system, secured against equity sold by the real estate industry, and insured by government and private insurance entities. All the systems and their components depend on each other and hold each other together in a beautiful, living harmony. The organisms even have built-in healing mechanisms, to make sure they keep functioning when there’s a problem, and are able to get better as long as they’re getting enough of the basic inputs (food, water, air / money, homes, credit).

If the metaphor animal were a deer, then rising interest rates wouldn’t be a virus or a parasite making it sick, not even a bad one that it might not recover from. The rising rates are more like a set of headlights that it’s caught in.

The Housing Deer and all its vital organs are staring at those rates, frozen in the middle of the road, unsure of whether to bolt forward or just play dead. It can tell something isn’t right, but the poor confused dummy wasn’t built for this. It’s loud and bright and whether it’s a Honda or a fully loaded eighteen wheeler barreling towards it doesn’t even register. In the moment, all it knows is terror.

Perhaps, in the blind shock that consumes what may be the last moments of its life, under the deafening blare of an approaching horn, its mind becomes untethered from linear time. Pivotal moments of its existence flash before its eyes, each one carrying insight about the creature’s own mortality and its place in eternity. The moments and their meaning occur with startling, cinematic clarity.

The National Housing Act…

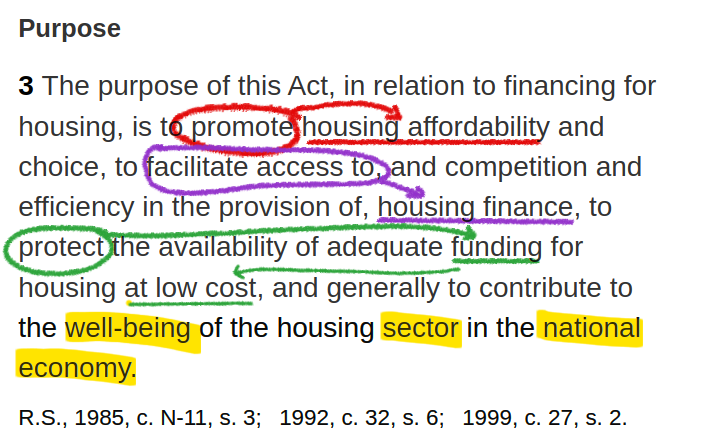

Following the Great Depression, the Canadian government struck a bargain between the fundamental necessity of housing and its utility as a banking instrument by passing the The National Housing Act in 1938, “…to protect the availability of adequate funding for housing at low cost, and generally to contribute to the well-being of the housing sector in the national economy.” It replaced the Dominion Housing Act of 1934, and was amended in 1944 and 1954, with versions that all tried to do the same thing: use the banking system to make residential housing stable financial assets that people could afford.

The NHA is administered by the Canadian Mortgage and Housing Corporation (CMHC), a Crown corporation that insures eligible Canadian residential mortgages so that lenders don’t have to worry about getting wiped out by massive defaults that might come about from an economic downturn. The idea is that giving lenders security allows them to make more capital available so that more Canadians could own their own homes, benefiting from them as investments, and that more demand from more homeowners would give builders an incentive to create new housing stock, enabling strong, steady economic and social growth in a country where people have places to live.

…and the contradiction at its core.

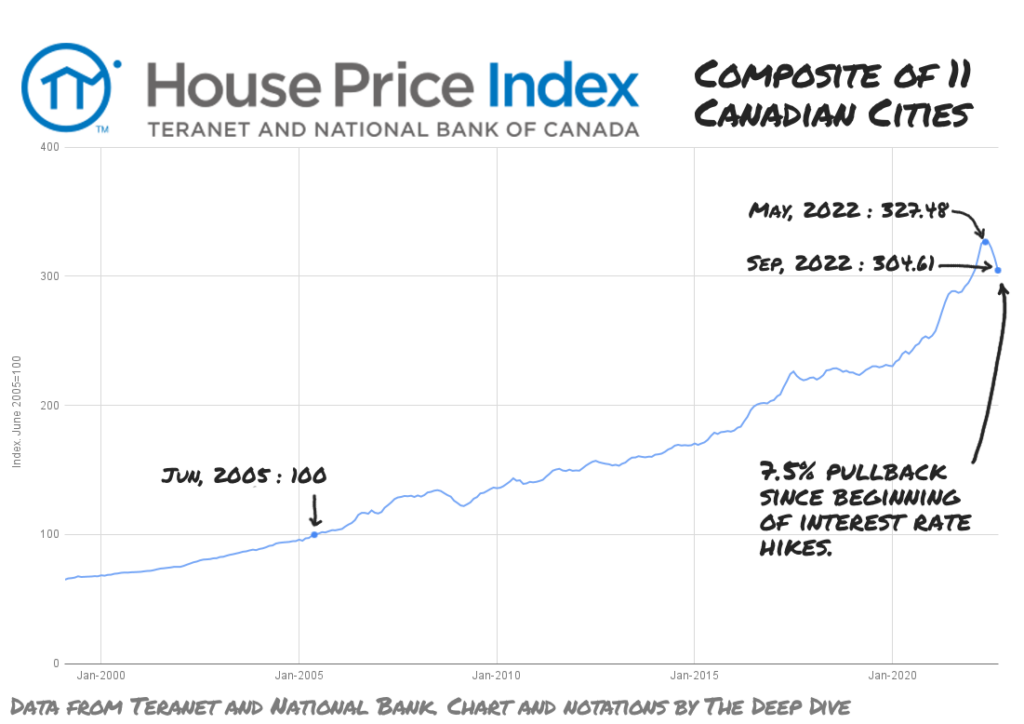

In the clarity of oncoming traffic, the housing deer is perhaps dwelling on the fatal flaw in all of this: nothing can be affordable and a good investment. At least not for any length of time. It’s the kind of thing that’s easy enough to miss in a mad rush to commodify a basic need, and build banking infrastructure that keeps its growth stable.

The affordability part was supposed to work itself out eventually, somehow… But the stability part worked great! The social stability that comes with home security went straight into the value of the houses without slowing down because, from an investor’s perspective, housing is a sure thing. It’s either a guarantee that a person won’t end up on the street, or a way to squeeze money out of someone else by threatening to put them out on the street. Investments don’t get much safer than that, so capital piled in, the lenders obliged it with the foreknowledge of government security, and house prices went up.

The lending supports the equity, which supports the lending, which supports the equity…

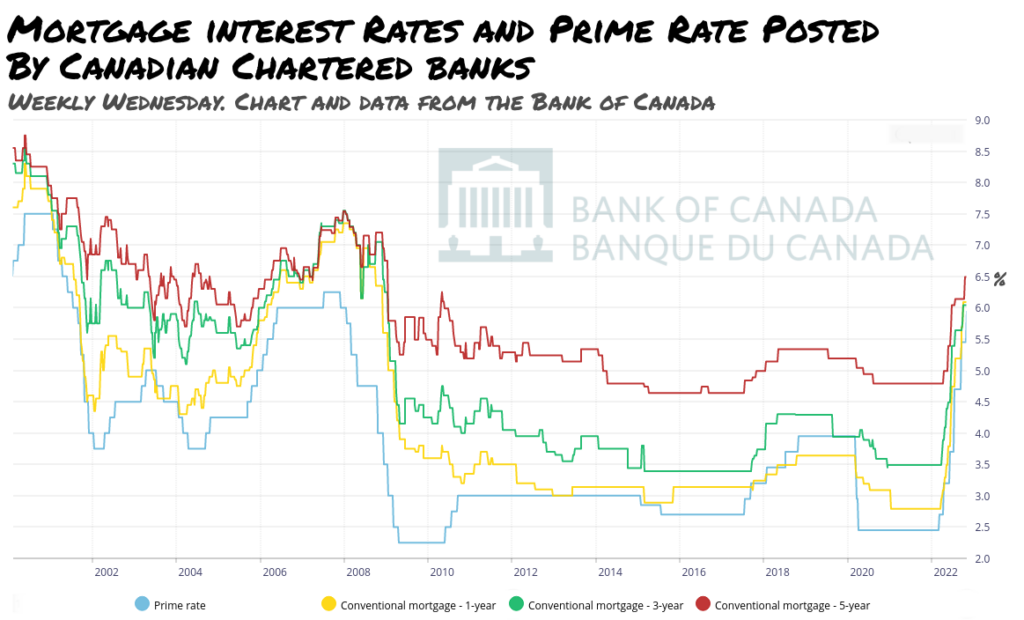

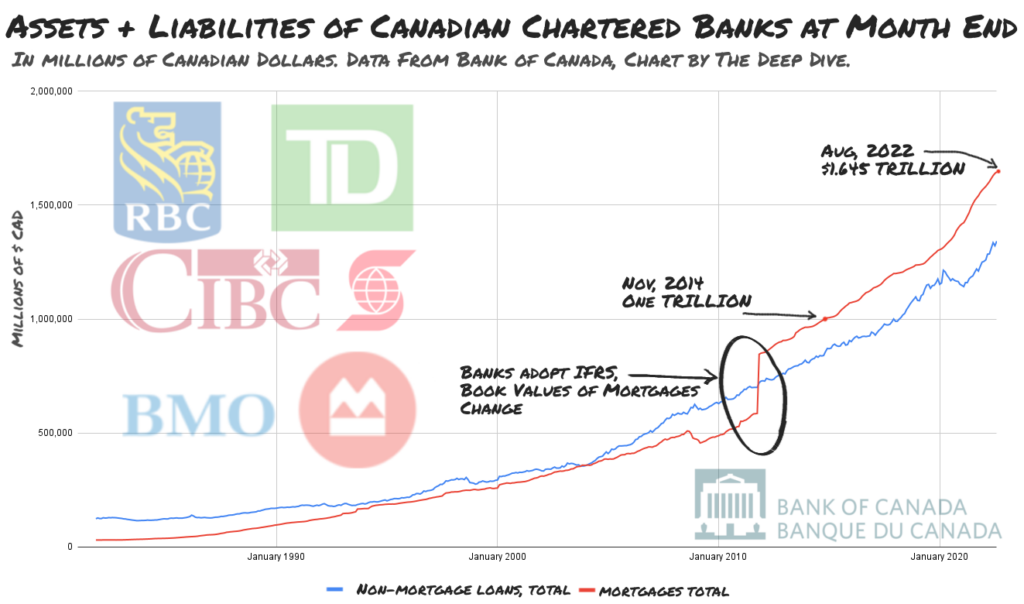

An ever-growing property market needs financing, and the Canadian institutions that financed it (backstopped by government-sponsored insurance) have today grown into some of the largest and most powerful financial institutions in the world. Those banks lent borrowed money to all the successive buyers of Canadian homes at a mark-up, because that’s what banks do, and the value of those homes went up, and went up some more, accelerating the boom as they went.

… and a growing portion of our domestic economy is built on that foundation

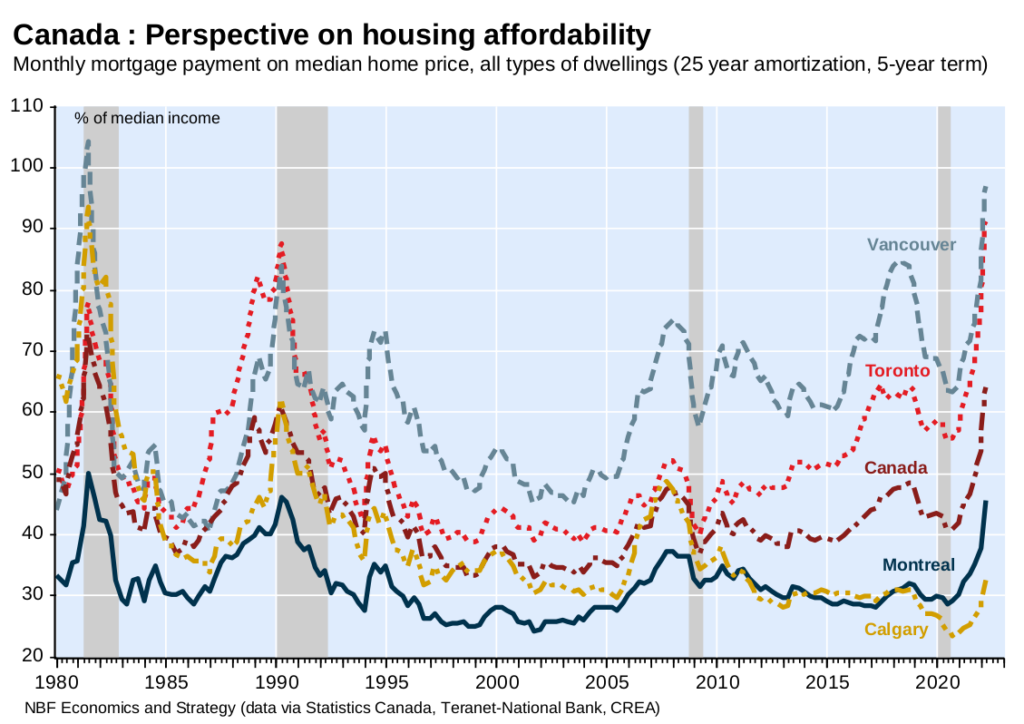

The upward spiral of residential real-estate prices is commonly blamed on ultra-low interest rates, which sure didn’t hurt, but the fundamentals of this bubble’s medium can’t be overlooked. Literally everyone needs housing, and the burning desire to not make monthly payments on someone else’s asset is the energy that powers a whole sector of mortgage lenders, all served by an army of mortgage brokers and real estate agents, who team up to get anyone who qualifies into a home they can afford with borrowed money.

The list price might seem like a lot of money at first, but that’s what the owner of this house said three years ago, when this house was 20% cheaper. If the trend in property value continues, a starter home will do a lot more for a buyer than just let them bank their rent payments! By the time the kids are old enough to move out, there could easily be enough accumulated equity to pay for college. And what other kind of investment gain can be banked tax free?

It might be that the downside risk of housing was glossed over by the pros in real estate and banking who made their living pushing loans and property, but there are two sides to every deal. A mortgage broker patiently explaining the particulars of an adjustable rate mortgage, however diligently, isn’t someone that anyone wants to listen to. Buyers whose eyes don’t gloss over are likely to steamroll the guy. “Yeah, yeah… adjustable. I’m approved, right? Just… where do I sign? I’ve got to get out of here, because I’ve got a lot of houses to look at before they go up some more.”

Pushed into it or not, the borrower made a personal guarantee to pay the mortgage, personally!, and it all comes down to the apparently out-dated notion of personal responsibility! Anyone who signed on the dotted line to borrow the money, owes it to the bank. Being pushed into something is a flimsy excuse, and if they didn’t fully understand what they were getting into, then they should have been more careful before they borrowed several dozen times their gross annual income to throw away making a high-risk bet on luxury commodities like a roof over their head!

“House money.”

The buyers might have understood what they were getting into a lot better than the people inclined to lecture them about their lack of due diligence. A buyer whose house is worth more than the money borrowed against it can sell, re-finance, keep making payments and live there… whatever they like.

But if rising rates drive the value of the home down far enough that the mortgage is underwater, why bother continuing to pay? Sure, they’re out the down payment. But the mortgage payments they made towards the equity would have otherwise been flushed down the toilet into the rent pipe the landlord feeds on anyhow, and there’s definitely another landlord around, ready to suck up any future monthly payments they’d like to make to stay dry.

From a purely financial perspective, the leveraged homeowners aren’t in all that bad a spot. They’ll lose some credit rating and might have to move, but they can ultimately make a house that turns into a drowning albatross the problem of whatever bank loaned them the money to buy it.

But what about the banks?

“Be careful what you demand as collateral, you might just get it.”

Since there’s a whole National Housing Act dedicated to providing a stable environment in which the banks can thrive, they aren’t built to worry about loan defaults. Those loans are insured. The premiums are all paid up and if a massive, rapid change in valuation turns their balance sheets into loose guts smeared across half a mile of the interstate… well… that’s… insurance will fix it. Somehow.

And, somehow, it likely will. Mortgage insurers (mostly the CMHC) and their shareholders (mostly the federal government) have all types of “somehow” to work with. Some of it borders on the divine, and we’re going to have a closer look at it in the second part of this series. But just as the Housing Deer starts to entertain the notion that any of that financial alchemy might make housing cost any less for the people whose monthly payments give it value, it has a violent flash back to its first insight.

Careful readers will notice that it doesn’t actually say anything about creating affordable housing, just promoting affordable housing. It’s the financing that the act has been built to keep low-cost and efficient. It’s the housing sector and its place in the national economy that the act and the CMHC are there to protect. The affordability of actual houses, as far as the NHA is concerned, is a promotion.

Nothing can be affordable and a good investment.

A financialized housing system isn’t built to make life easy for the people living in the houses. Those people are the renewable resource from which the investors’ yield is drawn. They’re the ultimate customers, because they have nowhere else to go. Their monthly housing payments are coming back into this system one way or another, and there’s no sense trying to soak them for a penny less than they’re able to pay. The market will eventually figure out where that level is, just like it’s supposed to. The CMHC and the Bank of Canada aren’t here to keep anyone in their house or even limit the damage to equity holders in a crash. Their job is to minimize the turbulence and let the market find its level.

Information for this briefing was found via the CMHC, Bank of Canada, National Bank of Canada, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The post Oh Deer! Housing in the Headlights appeared first on the deep dive.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…