Economics

Morgan Stanley: Why Inflation Is Likely To Fall Faster Than Most Expect Based On M2 Growth

Morgan Stanley: Why Inflation Is Likely To Fall Faster Than Most Expect Based On M2 Growth

By Michael Wilson, chief US equity strategist at…

Morgan Stanley: Why Inflation Is Likely To Fall Faster Than Most Expect Based On M2 Growth

By Michael Wilson, chief US equity strategist at Morgan Stanley

Two weeks ago, we turned tactically bullish on US equities. Some investors felt this call came out of left field, given our well-established bearish view on the fundamentals. To be clear, this call is based almost entirely on technicals rather than fundamentals, which remain unsupportive of many equity prices and the S&P 500 [ZH; similar to what Goldman said on Saturday]. The technical picture became more supportive, in our view, after the historic reversal two weeks ago on another higher-than-expected CPI reading for September. More specifically, the S&P 500 gapped lower that Thursday morning, only to reverse 6% and close at the highs. Then, on Friday, stocks had a terrible day, with the S&P 500 trading down 2.4% and closing on the lows. When we studied this price action over the following weekend, we found that Friday’s pullback was a 61.8% Fibonacci retracement of Thursday’s rally that stopped right at the 200-week moving average. The combination of these technical oddities was too much to ignore. Hence, our tactical/technical rally call.

From a fundamental standpoint there are some supportive factors too.

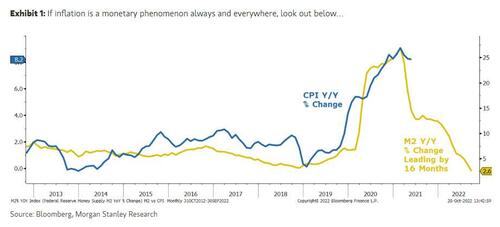

First, CPI is coming down. Granted, it is one of the most backward-looking data series; it says very little about the future and can be misleading about present conditions. Think back to what CPI was telling us at the end of March 2021. The index sat at 2.6%Y after the government had delivered more than $3 trillion in fiscal stimulus during 1Q21. As a result, the money supply (M2) was growing by 27%Y. Never in the history of these data (70+ years) had M2 grown at even half that rate. Given that inflation is always and everywhere a monetary phenomenon, it was crystal clear that 2.6%Y inflation was likely to explode higher. Fast forward to today and CPI stands at 8.2%Y, a 40-year high and marginally below its peak of 9.1%Y in June. However, M2 is now growing at just 2.5%Y and falling fast. Given the leading properties of M2 for inflation, the seeds have been sown for a sharp fall next year. The implied fall in CPI outlined in Exhibit 1 would be highly out of consensus, and while it won’t necessarily play out exactly as in our chart, we believe it’s directionally correct. This has implications for Fed policy and rates. Indeed, part of our call for a rally assumes we are closer to a pause/pivot in the Fed’s tightening campaign, and while we don’t expect to see a dramatic shift at next week’s meeting, the markets have a way of getting in front of Fed shifts. In short, investors may be as offside on inflation today as they were in March 2021, just in the opposite direction. One of the reasons why we did not try to trade the summer rally was that we felt it was much too early to be thinking about a Fed pivot. We turned out to be right as the Fed shift proved to be too far in the future to make the summer rally last. We’re closer today because M2 growth is fast approaching zero and the 3-month-10-year yield curve finally inverted last week, something Chair Powell has noted is important in determining if the Fed has done enough.

Second, while we have been vocal bears on growth all year (calling for fire AND ice), that view is no longer out of consensus. In fact, part of the big sell-off in stocks in September reflected growing concern about 3Q earnings. But, as with 2Q results, earnings have been weak but not bad enough to get the kind of drop in 2023 EPS forecasts necessary for the final leg of this bear market. Instead, we think that management teams have/will remain mostly silent on 2023, which means estimates will stay elevated until it becomes obvious just how negative the operating leverage has become and/or companies are forced to discuss 2023 forecasts during 4Q earnings results in January/February. As an aside, falling inflation is the reason why we think margins will disappoint more than investors have modeled. For most of the year we have had pushback against our lower growth call, with investors arguing that higher inflation leads to higher nominal GDP, even in a recession, so earnings can hold up. We disagree because higher inflation leads to higher operating leverage all else equal and operating leverage cuts both ways. As end-price inflation falls faster than costs, operating leverage turns negative. That’s where we are today with PPI above CPI. That means lower lows for the S&P 500 are still ahead after this rally is over.

Bottom line, inflation has peaked and is likely to fall faster than most expect, based on M2 growth. This could provide some relief to stocks in the short term as rates fall in anticipation of the change. Combining this with the compelling technicals, we think the current rally in the S&P 500 has legs to 4000-4150 before reality sets in on how far 2023 EPS estimates need to come down. We realize that going against one’s core view in the short term can be dangerous (and maybe wrong-headed), but that’s part of our job. It’s like a double-breaking putt in golf – hard to make, but you still gotta try.

More in the full note available to pro subs at the usual place.

Tyler Durden

Sun, 10/30/2022 – 16:00

inflation

monetary

markets

policy

money supply

fed

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…