Economics

Morgan Stanley Slams The Fed’s “Inconsistent”, Contradictory Message

Morgan Stanley Slams The Fed’s "Inconsistent", Contradictory Message

It wasn’t just us who read between the lines in the latest Fed statement…

Morgan Stanley Slams The Fed’s “Inconsistent”, Contradictory Message

It wasn’t just us who read between the lines in the latest Fed statement and SEP and said that it’s a complete mess:

Fed projections see weaker economy in 2023; higher unemployment rates, more inflation and 50bps higher Fed funds rate. Powell is taking full responsibility for pushing the US into recession pic.twitter.com/n2DLpHXMak

— zerohedge (@zerohedge) December 14, 2022

Overnight, Morgan Stanley’s chief US economist Ellen Zentner agreed, writing in her FOMC post-mortem (full note available to pro subscribers) that the Fed’s message was “inconsistent” (a polite Wall Street euphemism for total bullshit). As Zentner put it:

The December FOMC decision included the delivery of a 50bp hike to a range of 4.25-4.50%, and a decidedly hawkish Summary of Economic Projections (SEP). The Committee has been frustrated by the lack of progress toward its goals and now sees the need for even more restrictive policy in order to sufficiently weaken the economy, labor market, and inflation.

How is this inconsistent?

Well, starting at the top, we already pointed out that the statement contained almost no changes from the previous meeting, which to Morgan Stanley was, “in itself a hawkish outcome compared to expectations” that the phrase “ongoing increases” could be dropped, to wit: “The Committee still sees “ongoing increases” as appropriate, though comments from Chair Powell appeared open to another step down in pace to 25bp at the February meeting – in line with our expectation.” Additionally, the Committee will continue to take into account the lagged effect of “cumulative tightening” on economic activity and inflation, which keeps the flexibility to move at a slower pace if warranted, and limit or extend the amount of further tightening.

What about the Fed forecasts? Compared with the Fed’s SEP, Morgan Stanley expects a peak rate of 4.50-4.75% in February vs. the median in the SEP at 5.10% in 2023, which means just one more 25bps hike. Additionally, MS sees the first 25bp cut coming in December 2023 vs. the Fed continuing to see the first cut in 2024.

And here the first open friction between MS and the Fed’s own forecast: according to Zentner, it is most at odds with the Fed’s core inflation forecast “where we previously downwardly revised core PCE inflation to 2.9% 4Q/4Q from 3.1% in 2023 v.s the Fed now revising higher from 3.1% to 3.5%. Alongside the upward revision to core inflation, Fed participants also see risks to the upside – even though when asked about the latest downside surprises in the core inflation data Powell replied that it gave the Committee more confidence in their forecasts for falling inflation.“

Morgan Stanley also notes that despite an unexpectedly hawkish statement and press conference, financial conditions barely budged on the day – tighter by a miniscule 0.82bp as of 4:30pm ET, according to the bank’s FCI index. Zentner chalk it up to recency bias in the data (though its rates strategists note there tends to be a lag in market response post-December FOMC). Namely, the two consecutive downside surprises in inflation is hard for investors to ignore. Given the significant upgrade of inflation projections in the face of the realized data trending the other way, markets have likely discounted the hawkish shift in the dots, given that they appear to be based on a less optimistic view of inflation in the SEP despite a weaker growth and employment picture.

What does it all mean?

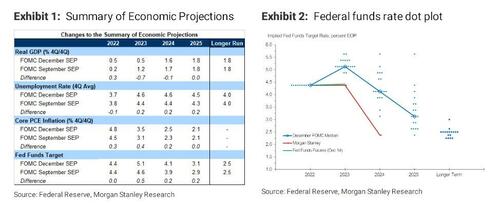

Based on the Fed’s views expressed in the SEP, the central bank is intending to raise rates more to get growth lower and the unemployment rate higher as it faces the prospects of higher inflation for longer. (Exhibit 1). The median dot for the fed funds rate moved higher in 2023, from 4.6% to 5.1%, with only two dots below 5.0% for 2023 (Exhibit 2). The median dots for 2024 and 2025 also moved up 20bp. The Committee still sees a first cut in 2024 as the most likely outcome.

At the same time, there was a significant markdown to GDP in 2023 and 2024, reflecting the impact of higher interest rates, while the Committee also increased expectations for core PCE inflation and the unemployment rate in 2023 and 2024, which means that “On balance, participants still see risks to the upside for inflation and downside for growth.”

During the press conference, Powell pointed in particular to the pace of non-shelter core services as a key concern for the inflation trajectory. He argued that this part of the core inflation basket is where persistent labor market tightness would be most inflationary. While this reasoning is sound, relative to MS’ micro level inflation forecasts, non-shelter core services inflation would need to run consistently near the peaks of sequential increases for all of next year to achieve the 3.5% SEP forecast. To Zentner, this outcome looks like a tall order, given that some wage measures such as the ECI are already trending lower, and most importantly, especially difficult against the backdrop of the rest of the SEP’s forecast.

Which brings us to the biggest inconsistency in the Fed forecast:

Growth falls to 0.5% next year and unemployment increases to 4.6%. Given the Chair’s downbeat assessment of the participation rate, this increase would require significant job losses, which is hard if not impossible to reconcile with an environment of continued record wage gains driving services inflation higher.

Here is another way of putting it, courtesy of Jefferies, in 2023 the Fed forecasts 1.6 million job losses and no rate cuts:

The next exhibit provides a roadmap of Morgan Stanley’s data release forecasts through April 2023, alongside the bank’s subjective view on the Fed’s data-dependent action. The table shows potential thresholds around the incoming data that could move the extent and pace of the Fed’s tightening path. Between now and the February meeting, there will be one more inflation print, which should be roughly in line with the November print. As such, the strength of the labor market will be key – expect a step down in the December payroll print (released January 6), to below 200k. But if payrolls continue to run at their September pace (300k+), combined with stronger inflation, managing the step down will be difficult for the Committee and another 50bp rate hike in February could become more likely. The state of the labor market also holds the key for the March meeting. So while a slowdown in job gains in line with Zentner’s forecasts should see the Fed not raise rates further beyond February, persistent payroll prints above 200k could see the tightening cycle extend with additional 25bp steps.

This also begs the question if the BLS is intentionally rigging the jobs data, and mucking up US monetary policy just to make Biden’s policies look better than they are in reality (the gaping chasm between the Household and Establishment survey answers a resounding yes), but we will leave this debate for another time.

Finally, Powell noted during the press conference that “over the course of the year, financial conditions have tightened significantly in response to our policy actions” which is paradoxical because as we showed yesterday, financial conditions are now back to June levels when rates were below 2%.

In any case, year to date, net tightening in the Morgan Stanley FCI has been led by US Treasury yields (152bp), followed by FX (68bp), and to a much lesser extent equities (37bp) and credit (34bp)

It is no secret that tighter conditions have been the explicit goal of Fed officials, as Powell noted it is important that over time they reflect the policy restraint that the Fed is putting in place to return inflation back to its 2% target. Still, the easing in financial conditions since the October peak has been significant (-161bp) as the end of the tightening cycle has come into focus, the step down was embraced, along with the prospect for the soft landing we expect. That amount of easing provided a stronger backdrop for the December policy projections and no doubt fueled an observation on the Committee that rates are not yet in restrictive territory.

As a bonus, here is a take from Goldman trader Mike Cahill who like Morgan Stanley’s economists is confused by what the Fed is trying to achieve: “Powell clearly doesn’t want to explicitly guide towards 25bp, but his comments clearly cut in that direction. His comparison to moving around in a dark room is the same analogy he used in the last cycle, and suggests overall that he thinks policy should move towards more ‘normal’ increments. He adds an important caveat that he wants to see financial conditions reflect the restrictive policy they’re trying to put in place. However, we disagree with his view that the pace of hikes is much less relevant than the level they’re trying to move to…. Powell also reiterated that the Fed believes there is still a lot of tightening ‘in the pipeline’ and policy is in restrictive territory now (just not quite ‘sufficiently restrictive’). That’s counter to the GS FCI framework, where we believe that the bulk of the negative impulse on growth is already behind us.”

More in the full Morgan Stanley note, available to pro subs.

Tyler Durden

Thu, 12/15/2022 – 10:57

inflation

monetary

markets

policy

interest rates

fed

central bank

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…