Economics

More Bearish Market Action Before The Bull Can Run

Following the weaker-than-expected October inflation report, stocks surged on hopes the Fed will "pivot" sooner than later. As we discussed recently, a…

Following the weaker-than-expected October inflation report, stocks surged on hopes the Fed will “pivot” sooner than later. As we discussed recently, a “policy pivot” is not necessarily bullish but instead suggests more bearish market action will come first. To wit:

“Such leaves only two trajectories for monetary policy. The first option is for central banks to pause rates and allow inflation to run its course. Such would potentially lead to a softer landing in the economy but theoretically anchor inflation at higher levels. The second option, and the one chosen, is to hike rates until the economy slips into a deeper recession. Both trajectories are bad for equities. The latter is substantially riskier as it creates an economic or financial “event” with more severe outcomes.

While the U.S. economy has absorbed tighter financial conditions so far, it doesn’t mean it will continue to do so. History is pretty clear about the outcomes of higher rates, combined with a surging dollar and inflationary pressures.”

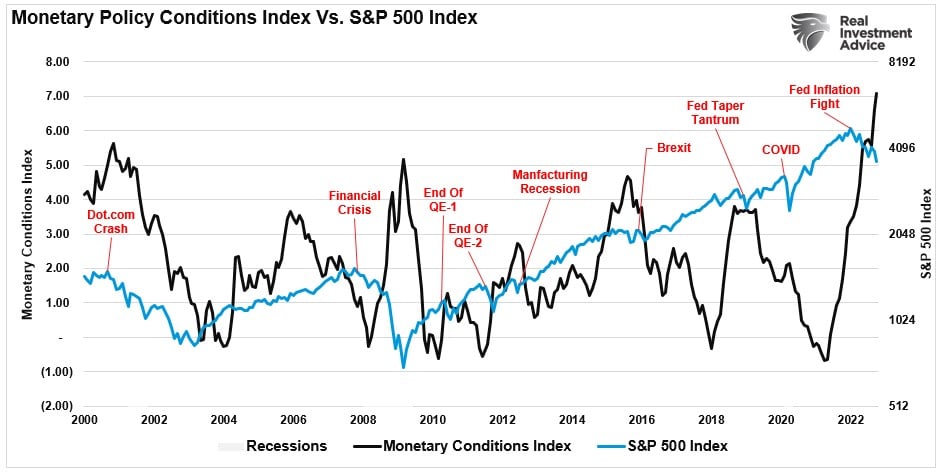

The “monetary policy conditions index” measures the 2-year Treasury rate, which impacts short-term loans; the 10-year rate, which affects longer-term loans; inflation which impacts the consumer; and the dollar, which impacts foreign consumption. Historically, when the index has reached higher levels, it has preceded economic downturns, recessions, and bear markets.

Not surprisingly, the tighter monetary policy conditions become, the slower economic growth tends to be.

The bullish expectation is that when the Fed finally makes a “policy pivot,” such will end the bear market. However, while that expectation is not wrong, it may not occur as quickly as the bulls expect.

Notably, the monetary policy conditions index suggests that more bearish action is likely before the next bull market cycle can begin.

Outlook Remains Bearish For Now

Investors are dealing with a bearish market for the first time in over a decade. Such is something that many investors in the stock market today have never witnessed firsthand. Nonetheless, it has been a challenging year on many fronts, given the enormous number of negative days and increases in daily volatility.

However, we warned this could be the case in 2021 when we discussed that “low volatility begets high volatility.”

“Hyman Minsky argued that financial markets have inherent instability. As we saw in 2020-2021, asymmetric risks rise in market speculation during an abnormally long bullish cycle. That speculation eventually results in market instability and collapse.

We can visualize these periods of ‘instability’ by examining the daily price swings of the S&P 500 index. Note that long periods of “stability” with regularity lead to “instability.”

(I have updated the chart to the present.)

While periods of high volatility eventually subside, the bearish period for stocks is ultimately tied to the monetary conditions present in the economy at the time. If we invert our monetary conditions index and compare it to the annual changes in the price of the S&P 500 index, the correlation becomes apparent.

As should be expected, with the Federal Reserve aggressively hiking rates and the US dollar index surging in 2022, monetary conditions are extremely tight. Such suggests that until those monetary conditions reverse, the market will continue to trade within a bearish trend. Such is because, as should be apparent, tighter monetary conditions reduce corporate earnings and profit margins.

The strong dollar alone is problematic for companies with foreign sales, which account for nearly 40% of corporate revenue. However, adding to that risk, higher borrowing costs, wages, input prices, and the ability to maintain margins in a slower economic environment becomes exceedingly difficult.

Therefore, it should be unsurprising that stocks will need to reprice lower in the coming year to adjust for slower earnings growth.

7-Rules To Navigate The Final Leg Of A Bearish Market

While anything is possible in the near term, complacency has quickly returned to the market. Investors are very optimistic that the Fed will pivot and the next bull market will start. However, there are numerous reasons to remain mindful of the risks.

- Earnings and profit growth estimates are too high.

- Deflation will become more prevalent

- The Fed will continue to hike rates.

- Economic data will surprise on the downside.

- Consumer spending will slow.

- Inventory overhang will impact manufacturing.

- Valuations remain high by many measures.

- The risk of a credit-related event is rising.

So what do you do?

We remain optimistic about the markets due to share buybacks, seasonality, and bullish sentiment. As we have repeatedly stated, the market could rise to between 4000 and 4100 by year-end. However, as we enter 2023, we remain concerned about the broader macro risks and the risk the Federal Reserve will “break something” by hiking rates too much. Such keeps us cautious, so we continue reiterating the importance of remaining unemotional and focusing on managing portfolio risks.

- Move slowly. There is no rush to make dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

- If you are overweight equities, DO NOT try and fully adjust your portfolio to your target allocation in one move. Again, after significant declines, individuals feel like they “must” do something. Think logically about where you want to be and use the rally to adjust to that level.

- Begin by selling laggards and losers. These positions were dragging on performance as the market rose, and they led on the way down.

- Add to sectors, or positions, that are performing with or outperforming the broader market if you need risk exposure.

- Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

- Be prepared to sell into the rally and reduce overall portfolio risk. You will sell many positions at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake.

- If none of this makes sense to you, please consider hiring someone to manage your portfolio. It will be worth the additional expense over the long term.

Everyone approaches money management differently. Our process isn’t perfect, but it works more often than not.

The important message is that this bearish cycle will end, and the next bull cycle will begin.

Remember, if you “run out of chips” beforehand, you are out of the game.

The post More Bearish Market Action Before The Bull Can Run appeared first on RIA.

dollar

inflation

deflation

monetary

markets

reserve

policy

fed

correlation

us dollar

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…