Economics

Mooners and Shakers: Crypto market eyes China’s economic wildcard as Conflux and Filecoin surge again

Bitcoin and the crypto market is awash in a turbulent sea of macroeconomic data. Is China’s economic narrative something … Read More

The post Mooners…

Morning (just), Coinheads. Bitcoin and the crypto market is awash in a turbulent sea of macroeconomic data and narratives flip-flopping about unconvincingly – like Jim Cramer jogging in a pair thongs. And it has been for some time.

January was a great month for the Cryptoverse. And February was okay, with Bitcoin only just closing out a green month. Which way will the tide take us in March? Difficult to say.

Chinese economic data gives markets a boost

We’re able to observe one thing for sure, though, and that’s rising hopium around the idea of China re-introducing liquidity into markets, including crypto. Er, yep, despite the ongoing ban on crypto trading and mining over there. There’s also no small amount of hopium, too, for the concept of Hong Kong developing into a China-backed crypto-trading hub.

The founder of cryptocurrency Tron and a leading stakeholder with the Hubi exchange, Justin Sun is certainly encouraged by Hong Kong’s new licensing rules, which are set to boost institutional crypto trading and open up retail crypto trading in the region, as of June.

.@trondao founder @justinsuntron says Hong Kong’s new licensing regime could lead to a shift in mainland China’s crypto policy. His Huobi exchange is ready to apply for a license to operate once the rules go into effect in June. @_franvela reportshttps://t.co/xmWUIIR9VW

— CoinDesk (@CoinDesk) March 1, 2023

Meanwhile, the idea of more liquidity in global finance from a zero-COVID-policy-relaxed China could well mean a price rise in volatile, risk assets… in theory.

In any case, Bitcoin and the crypto market had a little pump overnight. And, while the market is still widely seen as correlating with the daily, weekly and monthly fortunes of US stocks and inversely correlated to the US Dollar Index, Chinese economic data and stocks performance is throwing a wildcard into the mix.

As Stockhead’s Eddy Sunarto reported earlier today in his excellent Market Highlights round-up, which you should definitely clock into every single morning, China recorded quite impressive manufacturing purchasing managers’ index (PMI) data overnight.

The index reportedly rose to 52.6 in February – the highest level in more than a decade, and indicating expanded economic activity within the eastern superpower. This is potentially easing global financial growth concerns and giving certain commodities (oil, gold) a boost, as well as increasing risk appetite in markets.

Iit’s increased risk appetite slightly in Bitcoin and some of the crypto majors over the past 24 hours, but more so in “Chinese cryptos”, such as Filecoin and Conflux. Let’s take a gander…

Top 10 overview

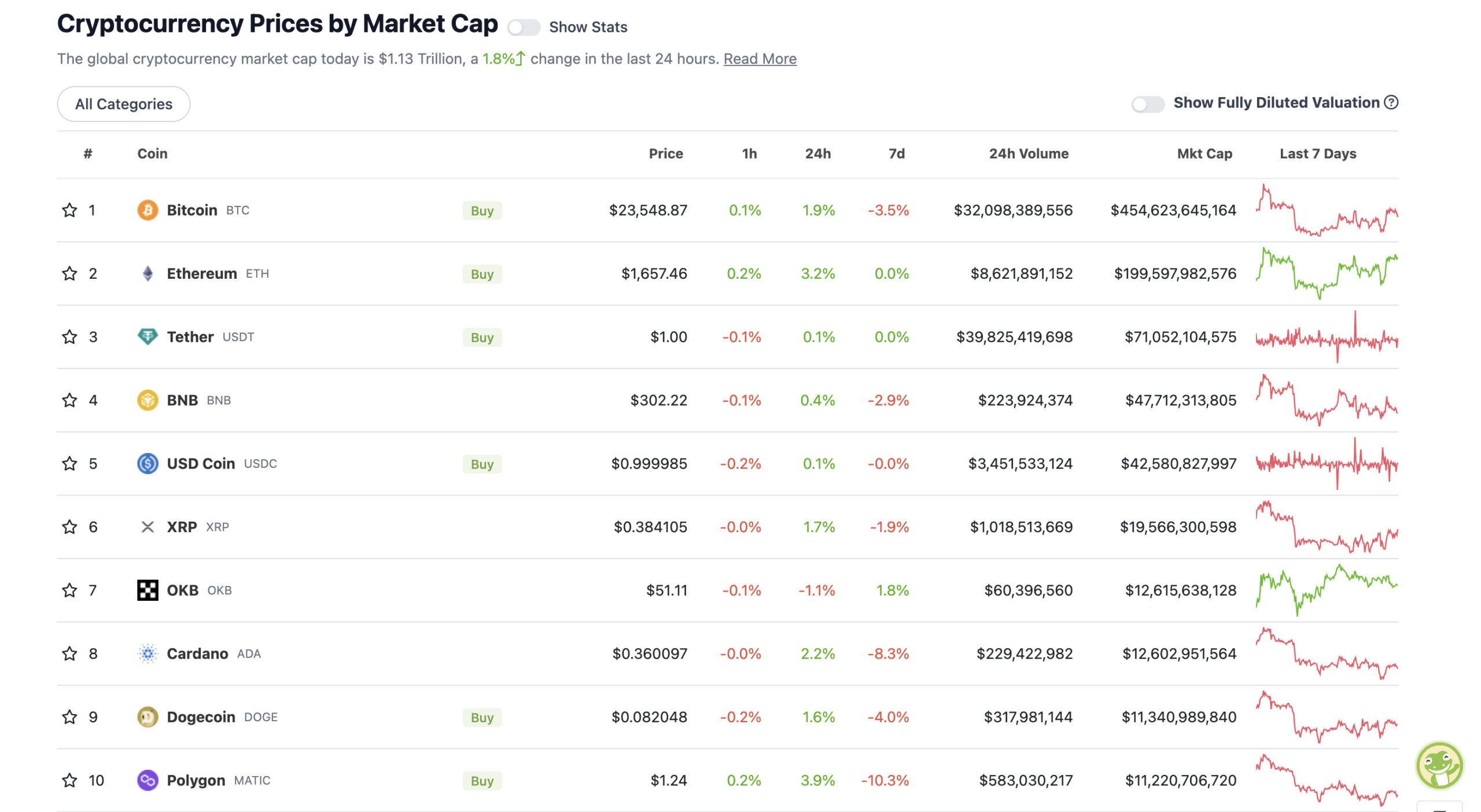

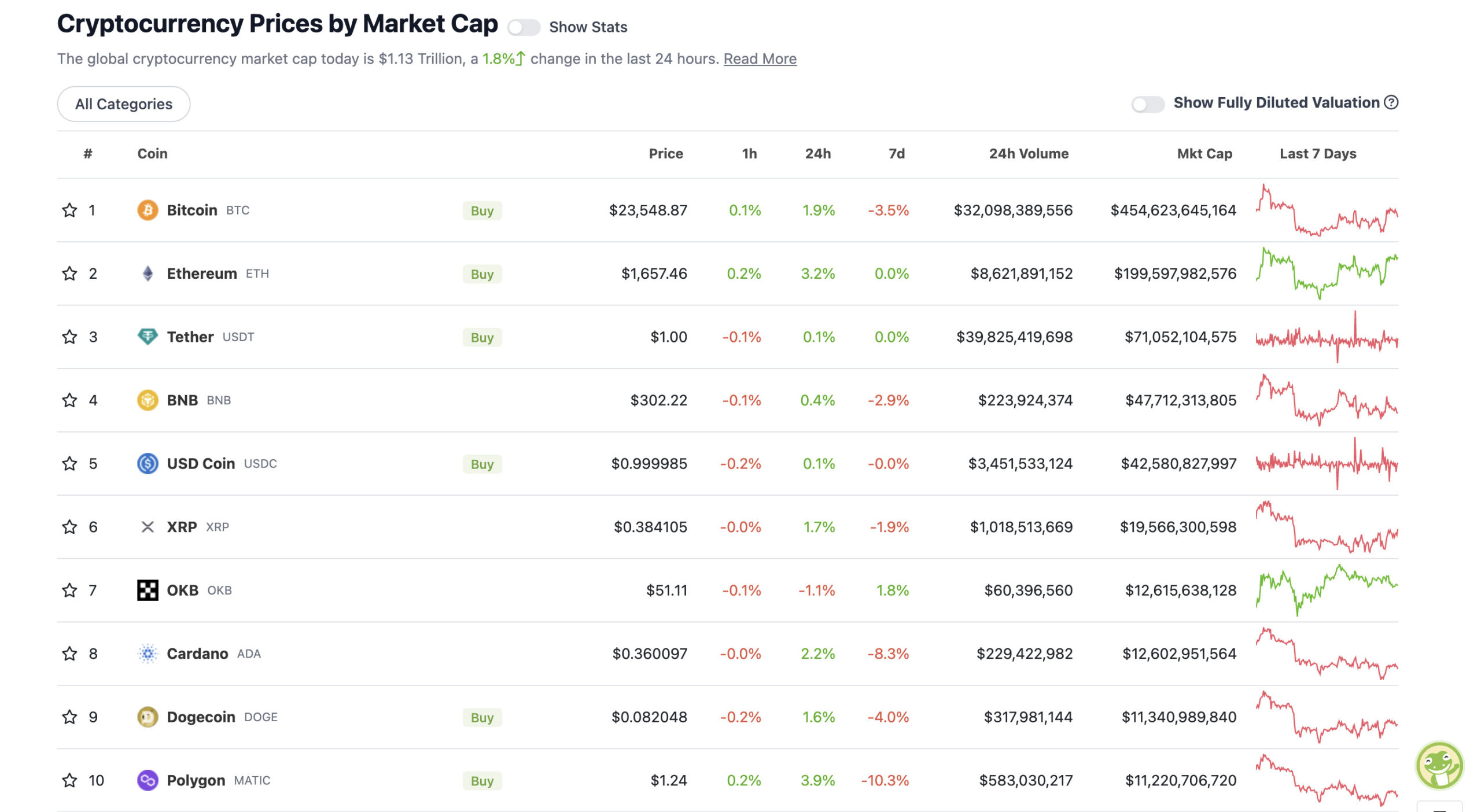

With the overall crypto market cap at US$1.13 trillion, up about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Amid the overall green scene on the daily timeframe in the majors, there a couple of standouts – Ethereum (ETH) and Polygon (MATIC).

Ethereum (ETH) might be one of the better-performing cryptos in the top 10 today on the back of news its blockchain has already deployed its “account abstraction” feature, often touted by co-founder Vitalik Buterin as a positive enhancement for the network.

As CoinDesk reports, the upgrade, known as ERC-4337, is designed to make it easier for users to recover their crypto if they lose private keys to an online wallet.

“Account Abstraction is a concept that turns users’ wallets into smart contract accounts, in order to make Ethereum wallets more user-friendly and to prevent any loss of crypto keys,” reads the report.

The big really valuable and necessary thing that ERC-4337 provides for account abstraction is a *decentralized fee market* for user operations going into smart contract wallets.https://t.co/JUigSO5OtW

— vitalik.eth (@VitalikButerin) October 1, 2022

Meanwhile, Polygon’ MATIC token price has lifted out of its early-week doldrums. Guess you can’t keep a good “zk-rollups” Ethereum scaling-solution narrative down for too long.

Polygon’s zkEVM Mainnet is launching soon.

Time to explore the most interesting projects on Polygon and find the best plays for the Polygon narrative pic.twitter.com/QhYPb53fMU

— Rekt Fencer (@rektfencer) February 28, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.2 billion to about US$480 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Conflux (CFX), (market cap: US$503 million) +23%

• Maker (MKR), (mc: US$839 million) +17%

• Filecoin (FIL), (mc: US$2.9 billion) +12%

• SingularityNET (AGIX), (mc: US$656 million) +12%

• Fetch.ai (FET), (mc: US$462 million) +2%

Conflux and Filecoin. We’ve convered both a little bit recently.

The former is apparently China’s only fully regulated, government-backed public blockchain. And it’s making a few partnership and investment waves just lately, including a deal to build blockchain-based SIM cards with China’s second-biggest wireless carrier – China Telecom.

Also, this, a hefty chunk of funding from Singaporean investment firm DWF Labs:

Conflux raises $10 million from DWF Labs in token round https://t.co/bBohgSO85O

— The Block (@TheBlock__) March 1, 2023

Meanwhile, like Ethereum and its suite of impending upgrades, Filecoin is making some waves over at the ETHDenver “innovation festival” as it gears up to launch its Filecoin Virtual Machine (FVM) – which will bring smart-contract user programmability to the Filecoin network, much like Ethereum.

“Filecoin is the world’s largest decentralized storage network! Amassing that quantity of hardware around the world is no small task.” @colinevran kicks off the Countdown to FVM event at #ETHDenver.

Watch live: https://t.co/hVwETX3zYP pic.twitter.com/Z7EXGBV5Qo

— Filecoin (@Filecoin) March 1, 2023

DAILY SLUMPERS

• Osmosis (OSMO), (market cap: US$510 million) -1%

• ImmutableX (IMX), (mc: US$895 million) -1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Feel like we’re not giving bearish views enough of a say here? Okay, here’s impartial trader/analyst Justin Bennett with something negative for traders and investors to consider…

The US 10-year yield just closed above that level.

Terrible look for risk assets if this holds.

Be careful out there. #stocks #crypto https://t.co/zdKA4cK6cI pic.twitter.com/DRQyInuf6A

— Justin Bennett (@JustinBennettFX) March 1, 2023

But then there’s this, from another popular analyst, Rekt Capital:

The time to accumulate #BTC at sensibly low levels is slowly running out

Macro Downtrend breakout isn’t too far off$BTC #Crypto #Bitcoin pic.twitter.com/lK4X7roO4W

— Rekt Capital (@rektcapital) March 2, 2023

#Bitcoin pic.twitter.com/yk2CNiAJck

— naiive (@naiivememe) February 26, 2023

The post Mooners and Shakers: Crypto market eyes China’s economic wildcard as Conflux and Filecoin surge again appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…