Economics

Mooners and Shakers: Bitcoin hits $28k-shaped wall but flashes bullish signal

Bitcoin has hit a US$28k-shaped wall again as resistance at that level appears to be impenetrable. For now. … Read More

The post Mooners and Shakers:…

Bitcoin has hit a US$28k-shaped wall again as resistance at that level appears to be impenetrable. For now.

The escalating war between Hamas and Israel may well continue to see a flock to gold as a safe haven asset but that narrative isn’t in play at this stage for BTC, despite its perception as a store of value within the crypto market.

Still, there could be some coattail-riding effect there, and, while we’re on the gold-v-Bitcoin comparison, just a reminder that YTD, Bitcoin performance is still up about 60%, whereas the yellow metal is tracking around +2.4% for 2023 at the time of writing, up from negative territory last week.

BTC is currently changing hands just shy of the US$27.6k mark.

Meanwhile, here’s some analysis from a Bloomberg crypto strategist, Jamie Coutts, who believes the no.1 crypto asset is flashing a somewhat unexpected bullish signal amid US Treasury bonds selling off and the complicated macro landscape …

Isn’t this interesting….our #Bitcoin trend model pops off a bullish signal at a time when USTs are cratering

For #technicalanlysis buffs, we know trend models are great unless we are in the chop of a sideways trading range, which we have been in since Q2. So for now, this… pic.twitter.com/4o7NH7xZlv

— Jamie Coutts CMT (@Jamie1Coutts) October 8, 2023

He does caveat, however, with:

“We know trend models are great unless we are in the chop of a sideways trading range, which we have been in since Q2. So for now, this signal is noise. However, the $31,000 resistance remains a crystal clear threshold that, once broken, would ignite the bull cycle.”

Roll on a US$31k BTC then. Still seems like a long way off for the moment, though.

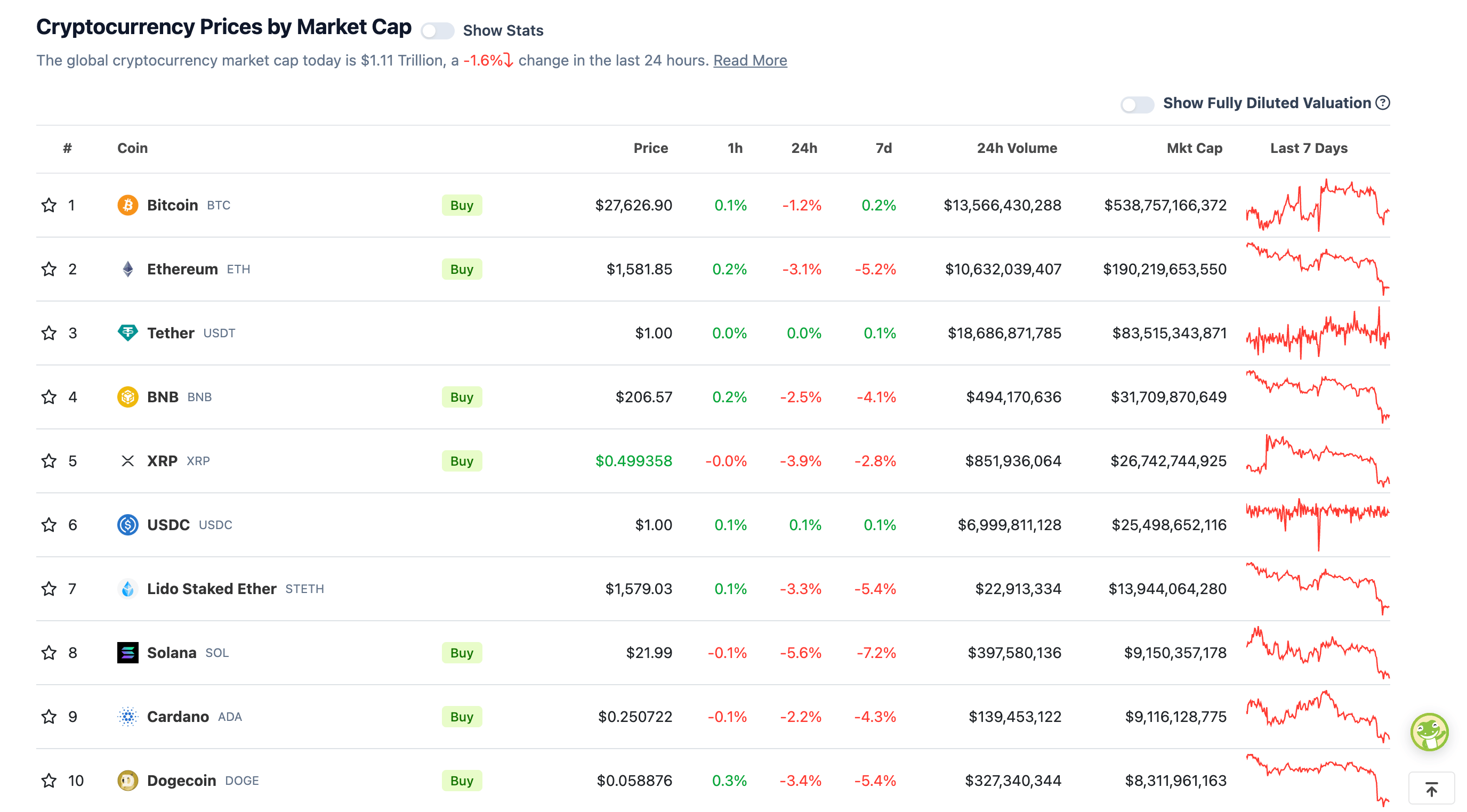

Top 10 overview

With the overall crypto market cap at US$1.11 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Here’s one full-time crypto chart watcher, Michaël van de Poppe, who believes the path for BTC is up from around here, based on the following:

#Bitcoin holding crucial level of support.

Most likely the path towards $30K is going to start from here.

Gold is up, uncertainties rise, Yields are down, so Bitcoin should follow. pic.twitter.com/9CoAPqK6dU

— Michaël van de Poppe (@CryptoMichNL) October 9, 2023

Those yields he references are US Treasury yields, which have recently been falling back from 16-year highs.

Traders often closely track the US Treasury market because of its relationship to all other markets and global liquidity. Falling bonds and rising yields have hurt risk asset markets over the past 18 months or so. Could Treasury yields be topping out now, though? Some say yes.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Tezos (XTZ), (market cap: US$692 million) +8%

• XDC Network (XDC), (market cap: US$681 million) +1%

SLUMPERS

• Kaspa (KAS), (market cap: US$956 million) -9%

• GALA (GALA), (market cap: US$358 million) -7%

• Radix (XRD), (market cap: US$453 million) -7%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Here’s something for Solana (SOL) investors. The Ethereum rival last week saw its largest seven days of institutional investment inflows in more than a year, according to new data from CoinShares.

NEW: SOLANA SEES THE LARGEST WEEK OF INFLOWS IN OVER 1 YEAR. pic.twitter.com/P4RCSzN8XX

— Step Data Insights (@StepDataInsight) October 9, 2023

Feelings aside,

Records show that War is bullish for financial markets/economy.

The beginning of war has marked the bottom for several periods of economic decline as it stimulates the economy greatly.

Calling for a crash isn’t the way to go.#bitcoin #stocks #cryptocurrency

— Roman (@Roman_Trading) October 9, 2023

#XRPLedger is seeing less whale activity this year compared to 2021 & 2022. However, this hasn’t stopped the key shark & whale addresses from accumulating more of the supply. Wallets with 100K-100M $XRP hold $7.89B in coins vs. $7.16B a year ago. https://t.co/NMnrTCTMUw pic.twitter.com/DSShcoFa8G

— Santiment (@santimentfeed) October 9, 2023

The post Mooners and Shakers: Bitcoin hits $28k-shaped wall but flashes bullish signal appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…