Economics

Mastering Technical Analysis Of The Financial Markets

Challenges in Technical Analysis of The Financial Markets Sept 7, 2023 Looking at the monthly chart of the Dow via DIA, it is evident that from late…

Challenges in Technical Analysis of The Financial Markets

Sept 7, 2023

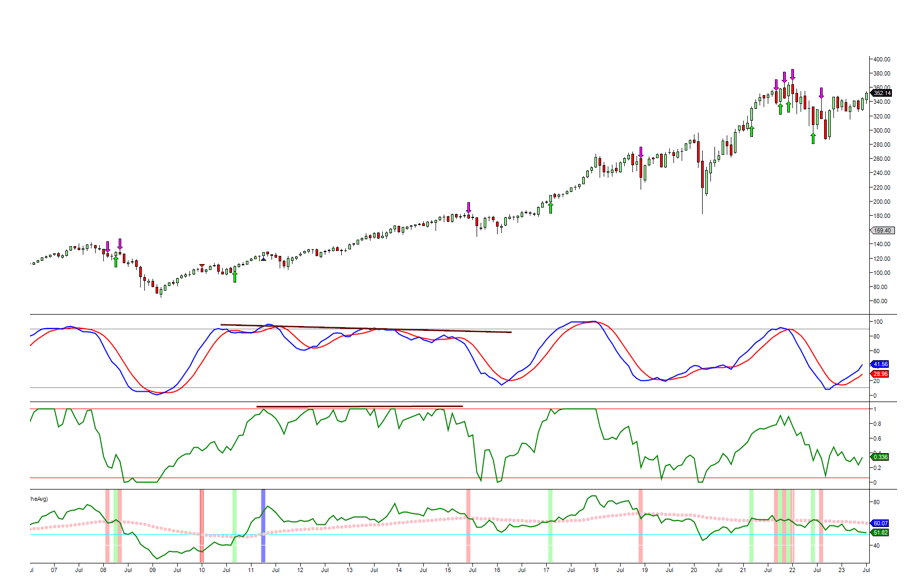

Looking at the monthly chart of the Dow via DIA, it is evident that from late 2009 to at least the middle of 2015, those relying on technical analysis (TA) would have stayed out of the markets and waited for a substantial pullback.

Even in 2015, many TA experts would have hesitated to enter as the pullback was minor. In contrast, we embraced every withdrawal, including the COVID crash, because Mass Psychology (MP), sentiment readings, trend indicators, and more supported this stance. Until recently, the sentiment patterns exhibited an abnormal trend, prompting us to exercise caution. Despite the times when TA seems to work exceptionally well on its own, we will never rely solely on it as a standalone tool. Even if we face some challenging moments in the short to intermediate timelines, we firmly believe that MP reigns supreme in the long run.

As we previously mentioned, the big players can manipulate short-term trends but lack the power to alter long-term trends. Consequently, markets, sentiment, or controlled factors will always revert to the mean in the long run.

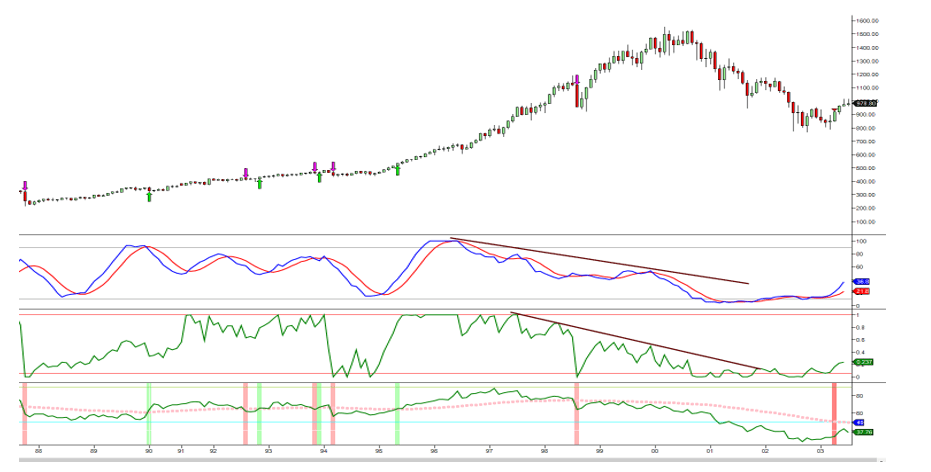

Although we focused on one specific period, there were other periods in the 70s, 80s, 90s, and so on where relying solely on technical analysis (TA) or fundamentals would have led to poor results. The yearly SP500 chart below provides evidence of such unpredictable market behaviour.

Technical Analysis Trials: The Perils of Misleading Signals

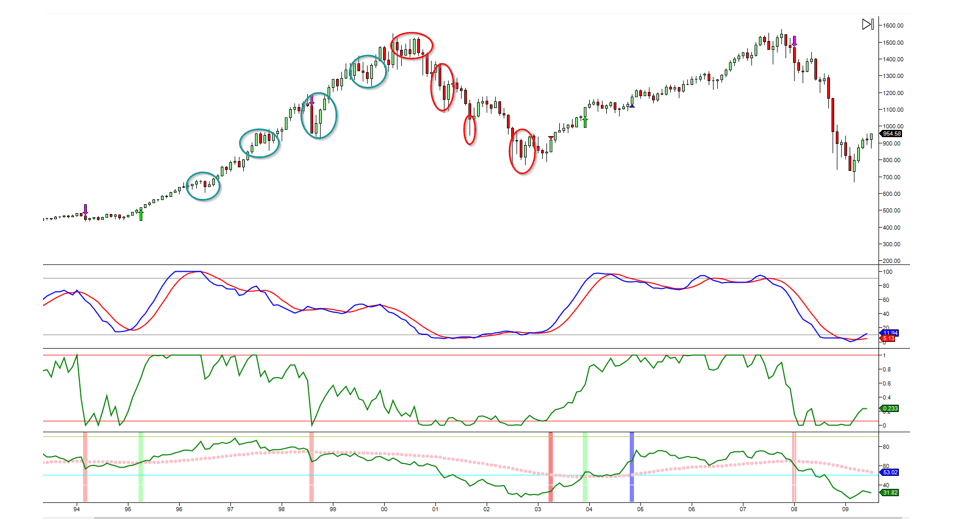

From June 1996 to nearly the end of 2001, technical analysis (TA) specialists might have strongly considered shorting the markets due to indicators displaying multiple negative divergence signals. However, they would have lost a significant fortune if they pursued this path. From a TA perspective, the chart below seems to almost implore one to take a short position. Indeed, adhering to that line of thought would have resulted in a highly unfavourable outcome.

Then, in late 2001, a glimmer of hope appeared, only to be swiftly snuffed out: The Market presented a deceptive buy signal. Despite hitting lows in September 2001, the SPX plummeted an additional 20% before finally reaching its bottom. Imagine spending five years figuring out the trend, only to get a false buy signal and endure another 20% loss. Many investors today would find it challenging to muster the confidence to reinvest after such a setback.

Let’s zoom out and examine the bigger picture. It wasn’t until March 2003 that technical analysis (TA) started to work well again. So, ask yourself this question: Would you have the courage to jump back into the Market after enduring losses for close to 7 years?

Moreover, even when TA started to work again, it began giving many false sell signals as the SP500 traded in the exceptionally overbought range from 2004 to 2008, issuing numerous misleading sell signals.

In contrast, Mass Psychology (MP) would have prevented this dangerous dance of death, which is precisely why we have unwavering confidence in it.

Exercising Caution: The Confluence of Factors Impacting Market Prudence

“The following contents have been excerpted from the July 23, 2023 market update.”

– Bullish sentiment is almost at 55.

A concerning trend persists as 34 world economies exhibit inverted yield curves, signalling underlying issues. This, coupled with the reflection seen in the Baltic Dry Index, suggests that all is not well. In the short term, this situation implies increased volatility and the potential for chaos. However, in the long term, it puts pressure on the Federal Reserve to adopt the “Print baby Print” approach or face dire consequences.

– The hype around LLM models is dying as they are not as infallible as previously portrayed.

– Michigan consumer sentiment reading for July is 72.6, the highest since Sept 2021.

– The CNN Fear Greed index is in the extreme greed section.

– The Anxiety gauge is in the middle of the “moderate zone” and may move to the mild zone.

– The McClellan Summation index reading is close to 2000, indicating extreme greed.

– Market Momentum for Nasdaq and SP500 indicates extreme greed.

– Smart money is moving from Tech to Industrials, commodities, and healthcare.

The put-call ratio is meagre.

While these factors may not appear significant individually, it is crucial to exercise caution when considering their combined impact alongside Mass Psychology. If you are heavily invested in the few stocks that powered the AI mania, it would be prudent to consider scaling back on many of these plays.

Concluding thoughts on Technical Analysis of the Financial markets

In the realm of financial markets, where precision and foresight are paramount, the marriage of Technical Analysis and Mass Psychology has proven to be a formidable strategy. As we’ve seen through the years, relying solely on Technical Analysis (TA) can sometimes be risky.

From June 1996 to the end of 2001, those heavily invested in TA may have contemplated shorting the markets due to apparent negative divergence signals. However, this path would have led to significant losses. The deceptive buy signal in late 2001, which ultimately resulted in another 20% loss, exemplifies the challenges faced when solely relying on TA.

Zooming out and examining the bigger picture, it wasn’t until March 2003 that TA exhibited more reliable results. Imagine the courage required to re-enter the market after nearly seven years of losses. TA continued to provide false signals in the exceptionally overbought market from 2004 to 2008.

Enter Mass Psychology (MP), the guiding force that could have averted this dangerous dance of death. The integrated approach of MP alongside Technical Analysis of the Financial Markets has emerged as a powerful strategy. MP recognizes the role of human emotions, biases, and beliefs in driving market sentiment. It understands that the big players can manipulate short-term trends but lack the power to alter long-term ones. Thus, the confluence of factors, including inverted yield curves, Baltic Dry Index reflections, and volatile sentiment patterns, is best addressed through this dynamic combination.

While Technical Analysis plays a pivotal role in understanding market trends and patterns, Mass Psychology reigns supreme in the long run. The unwavering confidence in this synergy guides us through the complex terrain of financial markets, providing a more holistic and reliable perspective. In conclusion, the journey through the labyrinth of Technical Analysis of the Financial Markets finds its true north in the wisdom of Mass Psychology, offering a resilient and balanced approach to navigating the unpredictable world of finance.

Other Interesting articles

Mastering Technical Analysis Of The Financial Markets

What is Inflation? Unveiling Effects and Strategies for Mastery

Investor Sentiment Data Manipulation: Unveiling Intriguing Insights

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

How the Hive Mind Mentality Influences Stock Market Losses

Stock Books For Beginners: Investing Beyond the Pages

Unlock the Secrets: Learn How to Trade Options like a Pro!

Psychological Manipulation Techniques: Directed Perception

Tomorrow’s Stock Market Prediction: A Silly Pursuit?

When is the Best Time to Buy Stocks: Key Insights

Stock Market Forecast For Next 3 months: Buckle Up

False Information and Its Consequences

Mass Psychology & Financial Success: An Overlooked Connection

The post Mastering Technical Analysis Of The Financial Markets appeared first on Tactical Investor.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…