Economics

Massive Hawkish Reversal In Rate-Hike Odds Sparks Greenback Gains, Bond Bloodbath

Massive Hawkish Reversal In Rate-Hike Odds Sparks Greenback Gains, Bond Bloodbath

Friday’s payrolls print started the panic, but the weekend’s…

Massive Hawkish Reversal In Rate-Hike Odds Sparks Greenback Gains, Bond Bloodbath

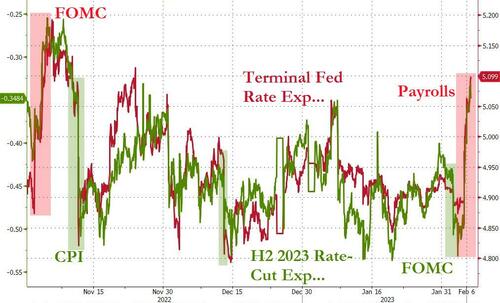

Friday’s payrolls print started the panic, but the weekend’s reality-checks on what Powell said and what the market wanted to hear has sparked a massive resurgence in the short-term interest-rate market’s perceptions of The Fed’s rate-trajectory. The terminal rate expectations has exploded to its highest of this cycle and expectations for rate-cuts in the second-half of 2023 have plunged…

Source: Bloomberg

In fact, all of the 45bps of rate-cuts priced in from now to the end of January 2024 after the FOMC presser has now been erased…

Source: Bloomberg

And rate-hike odds for the next 3 meetings have soared (March is a lock, May is now around 75bps, and even June is now at around 40% for a 25bps hike)…

Source: Bloomberg

All of which has sent Treasury yields roaring higher (the short-end is underperforming with 2Y +17bps today, 30Y +6bps)…

Source: Bloomberg

And while stocks slipped, they still remain massively decoupled from bonds…

Source: Bloomberg

On the day, all the majors were significantly red with Small Caps the biggest losers. The last few minutes saw The Dow desperately try to get back to unch…

Since Powell’s presser, Nasdaq remains up over 3% while The Dow has fallen back to almost unch…

And then there’s BBBY – up 110% today!!??

Meanwhile, the equity market’s exuberance has ‘loosened’ financial conditions dramatically – now massively decoupled from monetary policy (even on a leading basis – i.e. expecting significant rate-cuts)…

Source: Bloomberg

The only way that financial conditions are right would mean The Fed cutting drastically… and that will only happen in the case of a sudden, unexpected recession (or some other exogenous event – cough China?). Does that seem like the kind of environment where equity valuations should be soaring again?

Source: Bloomberg

…and as a reminder, valuations remain extreme by other measures…

Source: Bloomberg

The dollar rallied for the 3rd straight day, up 2.7% (the biggest jump since Sept 2022)…

Source: Bloomberg

Bitcoin tumbled back below $23,000, erasing the post-Powell spike gains…

Source: Bloomberg

Gold ended the day unchanged (impressive given the surge in the dollar) but futs remains below $1900…

Oil prices rallied (after an ugly plunge early on) on the back of various geopolitical headlines, with WTI bouncing back up to a $74 handle…

Finally, as traders anxiously await tomorrow’s words from Fed Chair Powell, it is this scenario that has many worried… The Fed’s seeming comfort with allowing financial conditions to loosen dramatically will lead to a reignition of inflation…

Source: Bloomberg

And of course, then there’s the question of whether China’s reopening will be inflationary… and trigger the re-emergence of a hawkish Fed.

Tyler Durden

Mon, 02/06/2023 – 16:01

dollar

gold

inflation

monetary

policy

fed

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…