Economics

March Employment Report

By Paul Gomme and Peter Rupert According to the Establishment Survey from the Bureau of Labor Statistics , employment increased by 236 thousand in March…

By Paul Gomme and Peter Rupert

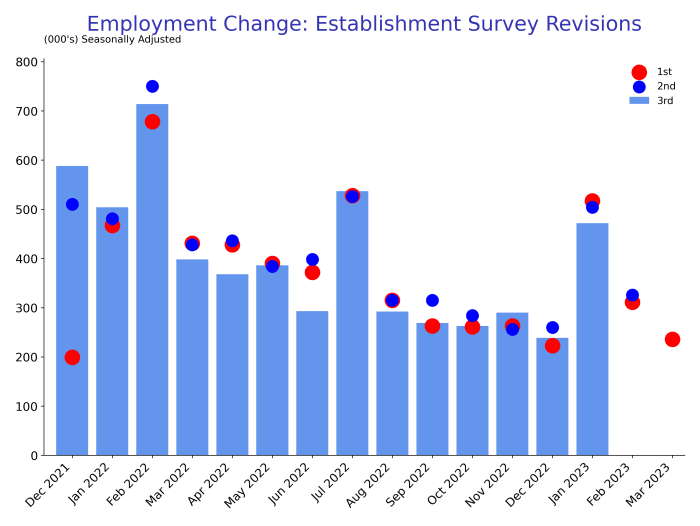

According to the Establishment Survey from the Bureau of Labor Statistics , employment increased by 236 thousand in March 2023. While this increase is the smallest thus far for 2023, it’s close to the average for the second half of 2022. The BLS also revised the change in employment for February up from 311 thousand to 326 thousand, and revised its reading for January down from 504 thousand to 472 thousand.

The BLS also reported that even though employment was up, average weekly hours were down, so that total hours worked fell 6.8 million hours in March which follows on the heels of a 4.1 million hour decline in February. The chart below shows considerable variation in the change in hours worked.

Private sector employment was up 189,000 and the government sector added 47,000 jobs. The private service sector added 196,000 jobs while the goods producing sector shed 7,000 workers. The largest gain in the service sector came from Leisure and Hospitality, adding 72,000 jobs.

Commentators have noted the decline in average hourly earnings, down 4.24% compared to March of 2022. This has been portrayed as a positive development for policymakers. The reason for this positive portrayal is that if higher inflation expectations become entrenched, then workers will want higher wages (to compensate for the higher inflation) which may lead to wage-price spiral in which wage increases feed to price increases which, in turn, feed into further wage increases, and so on. However, as with our commentary on inflation, year-over-year wage changes (the ones discussed by commentators) are slow to pick up changes in trend. And, as with annualized monthly inflation rates, month-to-month changes in average hourly earnings can be quite noisy; indeed, the annualized percentage change over the month actually rose 3.3% compared to 2.5% for the previous month. A 3 month average of monthly earnings growth smooths out some of the monthly fluctuations while, at the same time, picking up changes in trend in a timely fashion.

Readers of this blog know that inflation has generally been running higher than earnings growth. In previous posts, we have plotted average hourly earnings along side various price levels. Here, instead, we present real average hourly earnings: earnings divided by measures of the general price level. So that these measures are all comparable, we divide the consumer price index (CPI) by its average for 2012. The choice of 2012 is motivated by the fact the personal consumption expenditures (PCE) price index is already set to equal 100 in 2012. The chart below expresses average hourly earnings in 2012 dollars. Both CPI measures exhibit declines since 2021: For the overall CPI, average hourly earnings have declined by roughly $1 per hour, while core CPI records a decline of $0.42 per hour. Alternatively, using the PCE price index, earnings fell by $0.36 per hour; using the Fed’s favorite price index, core PCE, earnings have been essentially flat since the start of 2021.

The Household Survey from the BLS showed a 577,000 increase in employment. Moreover, the labor force, the participation rate and the employment to population ratio all increased. The unemployment rate fell from 3.57% to 3.50%. The Jobs Opening and Labor Turnover Survey still shows significant job openings even though they have come down some over the last few months.

Overall, the employment report shows a still-strong labor market, albeit there are signs of slowing in some areas. The Fed seems to have calmed inflation at this point and, depending on what unfolds over the next month or two, there may be a pause in raising rates since monetary policy tends to work with a lag.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…