Today the Fed released the M2 statistics for the month of March ’23, and they were very encouraging. The decline in M2 which began about a year ago is accelerating, with the result that M2 has fallen by almost $900 billion (-4.1%) since its peak. Considering the ongoing growth in the economy and incomes, the ratio of M2 to GDP is now on track to return to pre-Covid levels by the end of this year. This is occurring despite a significant increase in federal deficit spending in the past 9 months (i.e., deficits are no longer being monetized). In short, the monetary inflation wave that flooded the US economy in recent years has receded significantly; as a result, inflation should return to some semblance of normal by the end of this year.

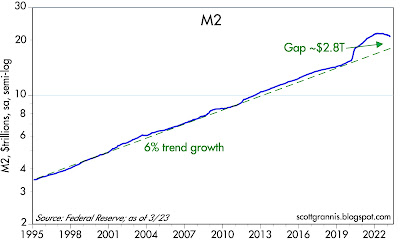

Chart #1

Chart #1 shows the growth of the M2 money supply, which mainly consists of currency in circulation, bank savings and deposit accounts, and retail money market funds. From 1995 through early 2020, M2 growth averaged about 6% per year. It then surged by some $6 trillion as the government began showering consumers with Covid emergency money, most of which ended up in bank savings and deposit accounts. Once the public began spending all this extra money, in early 2021, inflation began to rise.

M2 growth started decelerating early last year and has since turned decidedly negative. As the chart suggests, the “gap” between actual M2 and where it would likely have been under normal conditions has narrowed by over 40%. At the current rate of M2 decline, the gap will be closed around January or February of next year.

Chart #2

Chart #2 compares the growth of M2 to the size of the federal budget deficit. This is strong evidence that the outsized growth of M2 which ultimately fueled the big increase in inflation in recent years was the direct result of monetized federal deficit spending. It’s VERY reassuring to see that although the federal deficit has been rising for the past 9 months, M2 growth has continued to decline.

Conclusion #1: federal deficits are no longer being monetized. Thus, the monetary source of rising inflation has dried up.

Chart #4

Chart #4 shows that there is about a one-year lag between growth in the money supply and the rate of inflation. (The CPI line has been shifted one year to the left so as to make this easier to appreciate.) The big acceleration in M2 growth which began in March ’20 was followed by a big acceleration in inflation which began about a year later. Now the tables have turned: The sharp deceleration in M2 growth which began about two years ago was followed about one year later by a deceleration of the CPI. This strongly suggests that we are likely to see a further—and significant—decline in inflation over the course of the next 6-9 months.

Conclusion #2: there is no longer any need for the Fed to tighten monetary policy any further. Excess money dumped into the economy during the Covid crisis is being absorbed, and federal deficits are no longer being monetized. Without monetary fuel, and given that interest rates have been hiked significantly, the odds of a return to “normal” levels of inflation have improved dramatically. Instead of hiking rates next month, the Fed could, and probably should, lower rates, especially in view of increasing signs of economic weakness (e.g., disappointing corporate profits, lower confidence, a housing market on the skids).

Chart #5

Chart #5 is one I’ve been following for decades. It’s very important because it sheds light on the all-important issue of the demand for money. As Milton Friedman taught us, inflation happens when the supply of money exceeds the demand for money. M2 is the best measure of the supply of money, but we lack any direct measure of the demand for money. As I explained in a long

post early last year, Chart #5 is a good approximation for the demand for money.

The initial surge in deficit spending (Q1, Q2, and Q3 of 2020) was effectively neutralized by an equivalent surge in money demand, with the result that inflation remained low throughout 2020 despite an enormous increase in M2. But then money demand weakened even as M2 continued to grow, and that imbalance fueled the rise in inflation that began in early 2021. The recent plunge in money demand (which began in earnest about a year ago) was offset somewhat by flat to falling growth in M2, with the result that inflation began cooling. Sharply higher interest rates, courtesy of the Fed (belatedly) also helped offset the inflationary potential of M2 by increasing the attractiveness of holding money and creating disincentives for borrowing—thus contributing to a slowing in the money supply.

At the current rate of decline in money demand, it should return to pre-Covid levels by the end of this year—at about the same time as the M2 money supply returns to its pre-Covid long-term trend. As Milton Friedman might observe, money supply and money demand are coming back into balance, and that means inflation is

yesterday’s news.